The Canadian Institutional Investment Network 2024 Overview is an essential source of information on Canadian registered pension and group retirement funds, foundations and endowments, investment managers and other providers serving the institutional market.

The annual report is the only publication of its kind in Canada. For retirement savings program plan sponsors, it serves as an important tool to manage the ever-changing relationship with suppliers and such partners as investment managers, consultants, custodians, and pension lawyers.

The Canadian Institutional Investment Network is a key component within Contex Group, a media organization that also publishes Benefits Canada, Avantages and Canadian Investment Review—Canada’s essential sources of industry information for pension, benefits and investment executives. The data provided by our members illustrates an accurate picture of the pension landscape, which benefits everyone in the industry.

KEY HIGHLIGHTS

- REGISTERED RETIREMENT SAVINGS PLAN OVERVIEW

- FOUNDATIONS & ENDOWMENTS

- INVESTMENT MANAGERS

- GLOBAL EQUITY MANAGERS

- REAL ESTATE MANAGERS

- INFRASTRUCTURE MANAGERS

- FIXED INCOME MANAGERS

- OCIO

- INVESTMENT CONSULTANTS AND CUSTODIANS

- PENSION LAWYERS

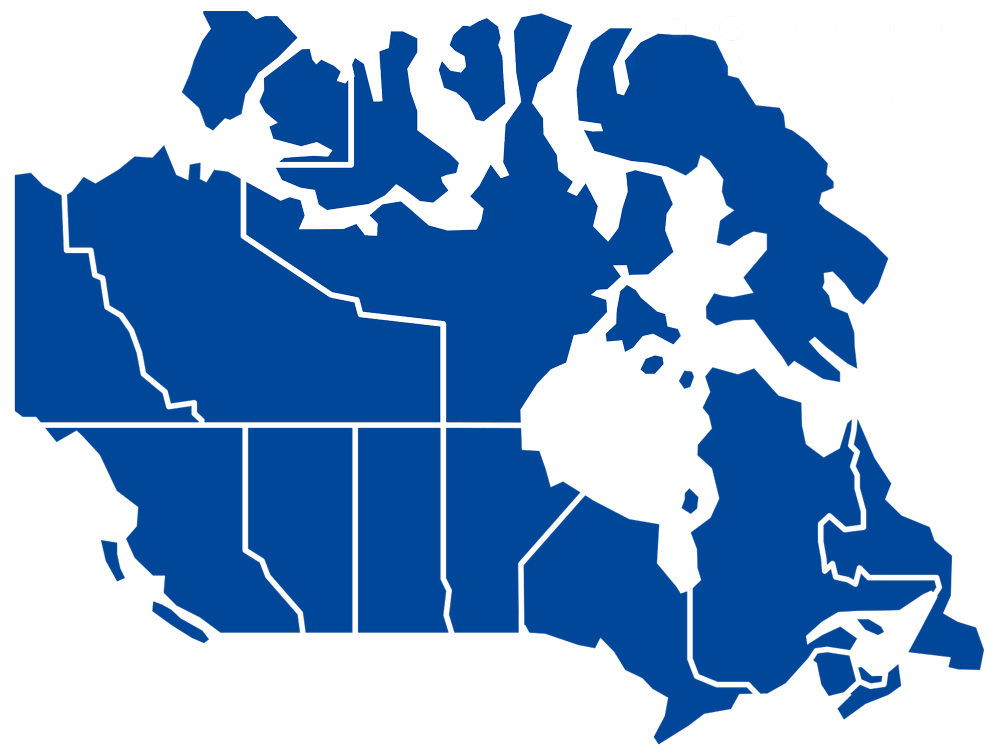

ASSETS BY PROVINCE/TERRITORY

Registered pension and workplace retirement savings plans covered by the Canadian Institutional Investment Network (CIIN) database reported assets totalling $2.764 trillion at the end of 2023, a slight increase of 2.9%, which is a rebound to where things stood in 2022. Removing the assets managed by the Canada Pension Plan Investment Board and Fonds du régime de base du régime de rentes du Québec, which are not linked to a specific employer or sector, workplace registered pension and retirement plan assets in the CIIN database totalled $2.082 trillion.

Download OverviewACTIVE MEMBERS

The CIIN database represents the registered pension and retirement savings plans for approximately 9.8 million plan members across the country, with active members representing just over half (5.1 million) of the total. There are approximately 2.1 million deferred members (21.3%), and 2.6 million retired members (26.7%).

Download Overview

Copyright © 2025 Contex Group Inc. Terms and Conditions Privacy

Contex Group Inc.

355, Sainte-Catherine West, suite 501

Montréal, QC H3B 1A5

(514) 392-2009