The COVID-19 pandemic has been a disruptive force in so many ways – but it has not changed the methodology of Patrick Blais and his team at Manulife Investment Management. The senior managing director, senior portfolio manager and head of the Canadian Fundamental Equity Team explains that the events of the past few months have strengthened his commitment to an approach that blends disciplined analysis, human insight and collegial portfolio construction.

THE COVID-19 PANDEMIC HAS IN MANY WAYS BEEN UNPRECEDENTED FOR GLOBAL SOCIETY AND THE GLOBAL ECONOMY. WHAT HAS IT TAUGHT YOU ABOUT INVESTMENT MANAGEMENT?

Our experience with COVID-19 has reinforced the importance of analyzing risks and understanding the downside in every name we own, including the potential fundamental impact of unexpected tail risk events. This extends beyond traditional risk measures and includes factors captured in our environmental, social and governance (ESG) analysis. If a company has a framework to address ESG factors as part of its strategic imperative, that says a lot about that company’s culture, ability to mitigate risk and potential resilience. We were already strong believers in understanding the risk profile of every one of our investments, but the pandemic underscored that it is essential to build portfolios that can maintain their value irrespective of emerging risk, especially tail risk.

HOW DOES YOUR INVESTMENT PROCESS GUIDE YOUR TEAM THROUGH VOLATILE MARKETS SUCH AS THOSE WE’VE HAD THIS YEAR?

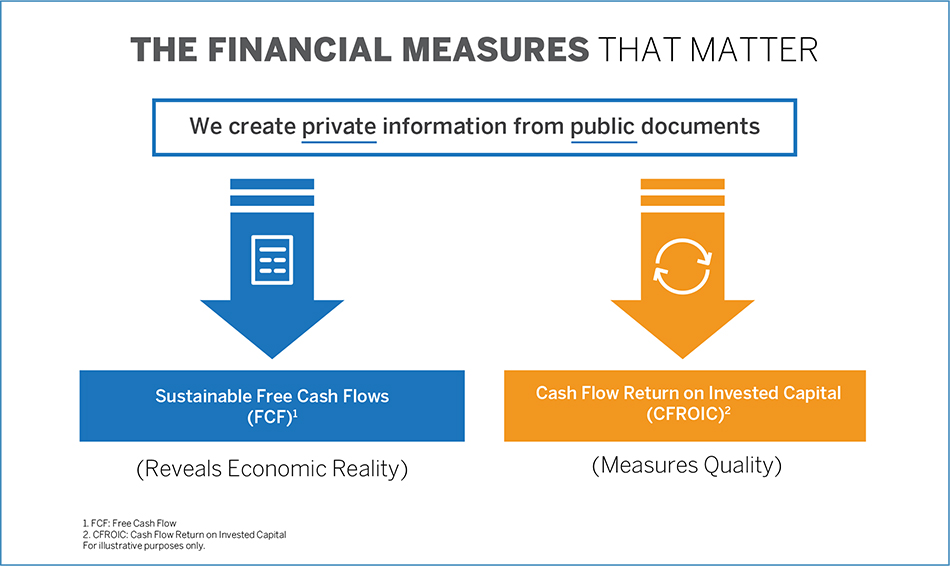

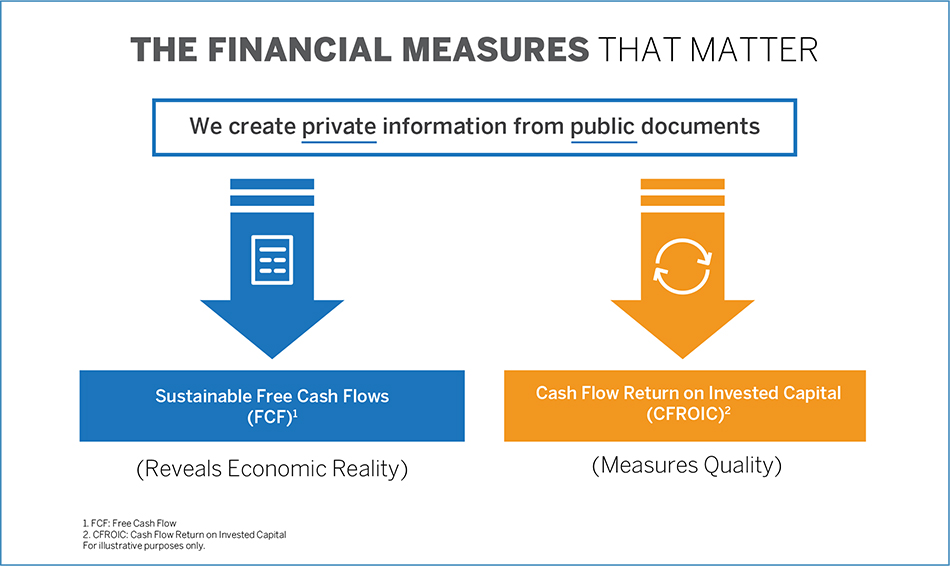

Our process focuses on key metrics, in particular free cash flow and cash returns, and also on understanding the volatility of those metrics. We typically evaluate this by performing scenario analysis, and we have minimum requirements for quality and valuation. We believe our approach produces a more resilient portfolio as we analyze the potential volatility of those free cash flows and cash returns under a range of scenarios to better understand the resilience of the business. Instead of focusing on only one fair valuation, we analyze a range of outcomes to determine the risk-return profile of each name. We aim to put together a portfolio composed of good alpha ideas, which should also prove to be resilient in markets where there’s volatility or dislocation. Many Canadian equity investors say a differentiated active fundamental investment approach sets them apart from their peers.

WHAT’S THE CASE YOU CAN MAKE FOR BEING TRULY DIFFERENTIATED?

Like everybody else, we perform fundamental analysis, but our fundamental analysis is based on two proprietary metrics that are unique to our team. Specifically, we undertake an extensive, non-mechanical process to restate 10 years of historical financial statements to get to a sustainable free cash flow measure, which in our view is the driver of value creation at a company. Line by line, we think through how a company generates that free cash flow. Then we link that metric to cash returns, which gives us a clear indication of quality. Together, our proprietary metrics allow us to look at the market through a different lens and give us a competitive advantage relative to our peers.

IN YOUR OPINION, WHAT’S THE KEY LINK BETWEEN CORPORATE PERFORMANCE AND STOCK PERFORMANCE?

Understanding the history of, progression of and consistency in cash returns tells you a lot about the quality of a company. It provides information about much more than the operations of a company. It tells you about management action, and whether management is effectively allocating capital by reinvesting appropriately in the business, making acquisitions at the right price and managing the balance sheet. When you have a real understanding of what’s happening at the company, you’re better able to gauge the probable way forward and direction of that company, and you get a clearer picture of the fundamental value of a company toward which stock prices will converge over time.

WHAT ARE THE ROLES OF QUANTITATIVE AND QUALITATIVE ANALYSIS WHEN IT COMES TO CANADIAN EQUITIES? ARE THEY BOTH IMPORTANT?

We like to say, “People think. Models do not.” So, it’s important to have the rigorous quantitative analysis of free cash flow and cash returns, but you need to combine that with the experience and insight of an analyst. There’s always a piece of judgment that comes into the equation when assessing a company, so the qualitative part is important as well. Successful investment management is a mix of science and art.

IS INVESTMENT STYLE AN IMPORTANT CONSIDERATION IN YOUR PORTFOLIO CONSTRUCTION PROCESS?

We’re style agnostic. Our process is about consistency across the investment universe, meaning that we look at every company in an identical fashion, and we believe that leads us to the best opportunities in the market. We do hold some value names and we do hold some growth names; however, we don’t consider ourselves to be growth investors or value investors. Rather, we consider ourselves to be core investors with conviction. That means we can deviate significantly from the index, and we’re not afraid to take advantage of the opportunities in the market.

WHAT ARE THE ATTRIBUTES OF AN EFFECTIVE INVESTMENT TEAM?

It’s about the people and the working dynamics. We have a team of eight professionals who are experienced, intellectually curious and passionate, and who come from diverse backgrounds. That helps in terms of leveraging our proprietary framework and making the right decisions. In terms of how we work together, we want to empower every individual on the team, and we do that within a framework of what we call a collegial partnership. It’s a very flat structure and everybody contributes both as an analyst and in the portfolio construction process. There are no sector specialists on our team; everybody analyzes companies across every sector to ensure that everybody develops as a portfolio manager. In addition, no idea goes unchallenged and we encourage people to speak up when they disagree with the prevailing group opinion. Empowering every member of the team ensures the repeatability and scalability of our process. It’s about eight people, a jury of peers, coming together, checking each other’s inevitable behavioural biases and putting all their efforts into building the right portfolio.

Sponsored by Manulife Investment Management.

Source: Manulife Investment Management, as of August 2020. Individual portfolio management teams may have different views and opinions that are

subject to change without notice. The historical success, or Manulife Investment Management’s belief in the future success of any of the strategies is not

indicative of, and has no bearing on, future results. No investment strategy or risk management technique can guarantee returns or eliminate risk in any

market environment. Manulife Investment Management does not provide investment, legal or tax advice, and you are encouraged to consult your own lawyer,

accountant, or other advisor before making any financial decision.