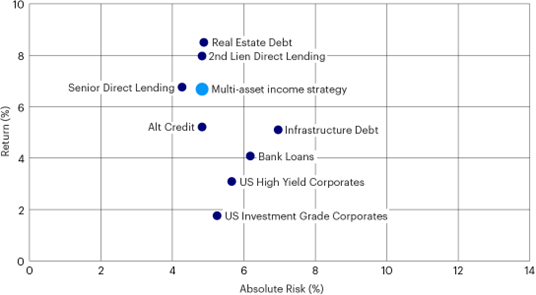

Private debt is increasingly playing an important role in institutional portfolios by offering attractive sources of yield, typically for the same volatility as their liquid counterparts.

As return dispersion increases, so does the risk of single-strategy concentration.

Capturing higher returns and cash flow through investing in private debt can be idealistic in that actual outcomes may be significantly more dispersed than their public counterparts.

The benefits of private debt may be enhanced through diversification.

Invesco Investment Solutions believes that harnessing consistent benefit from your private debt allocation means taking a multi-dimensional approach and diversifying risk from concentration in:

- Managers

- Asset Types

- Asset Classes

- Sectors

- Regions

- Vintages

Diversification through a multi-asset private credit allocation may help avoid concentrated risks and performance dispersion

For illustrative purposes only

Source: IIS as of 3/31/22

There can be no assurance that these results can be achieved in the future.

Learn more about Invesco’s diversified multi-alternative solutions.