PARTNER CONTENT

Global cancer diagnoses are rising, compounded by disruptions to early detection during the coronavirus pandemic. It disproportionately affects older people, but many studies are showing a rise in serious cancers among young adults.

Benefits Canada asked six experts about the current state of cancer in Canada and the impact on group benefits plans, looking at prevention, treatment and return to work.

Meet our experts

Q: Let’s start by setting the scene with some current facts.

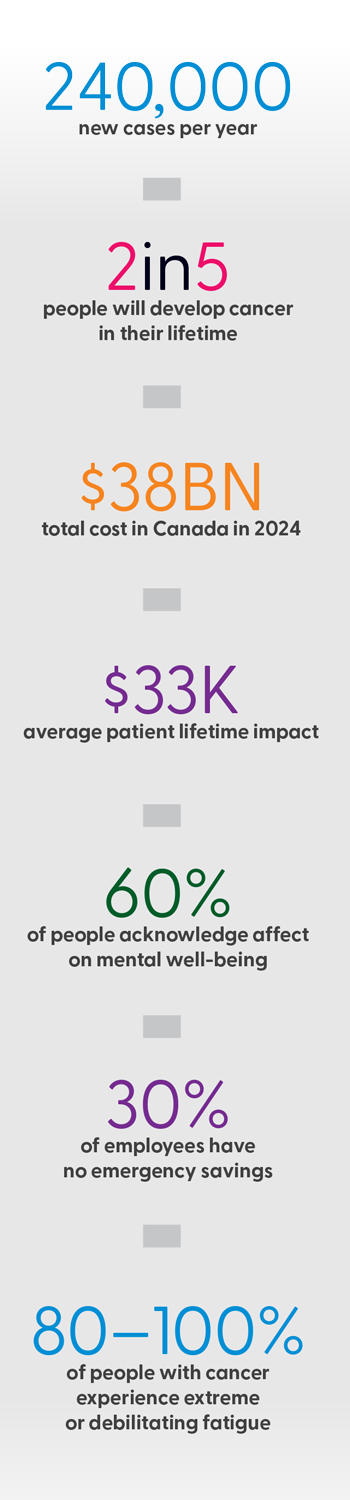

NedA: Cancer remains one of Canada’s most significant health challenges. There are about 240,000 new cases per year and two in five people will develop cancer in their lifetime, of which about a quarter will pass away. The total cost in Canada [in 2024] was about $38 billion, including indirect costs such as presenteeism and absenteeism. And it also includes close to $8 billion in direct costs for patients and caregivers.

Statistics show about 90% of Canadians believe cancer would impact their finances — and that’s probably right. The average lifetime impact per patient is about $33,000, which includes take-home medications, particularly in provinces like Ontario and Atlantic Canada where public coverage is limited to specific populations. In many cases, it includes travel and accommodation, including frequent trips for treatments. And it also includes lost wages, so reduced work hours, the inability to work during treatment and the recovery period.

Around 60% of people acknowledge that, on top of everything else, [a cancer diagnosis] will definitely take a toll on them and affect their mental well-being. We often forget patients and caregivers are human and they should also receive some type of psychological support when they’re confronted with a life-threatening disease. That’s why group benefits are in place.

mantek: One of the things that has really stuck with me was a statement from a medical oncologist I met with several years ago. He said a cancer diagnosis is a medical emergency. In the same way, if you’re at work and someone has a heart attack or a stroke, you’re not going to sit around and wait for medical intervention. The timeline may be a little bit different, but what’s key to maximizing overall survival and other outcomes is early and accurate diagnosis and the initiation of an appropriate treatment or intervention plan. Where private payers can come in to support employees is assisting with things like early diagnosis technologies and navigating that pathway to ensuring intervention is started as soon as possible.

What’s key to maximizing overall survival and other outcomes is early and accurate diagnosis and the initiation of an appropriate treatment or intervention plan.

- MANTEK -

Laura: A recent report found 30% of employees don’t have emergency savings for basic needs, so to Neda’s point, if your costs are going up $33,000 on average if you’re diagnosed with cancer and you have no money or savings, how are you going to pay for that? You’re going into debt and you might not be getting some of the treatment you need because you can’t afford to pay the deductible for those drugs. I think that financial context is important, but there’s also the psychological impact and the stress.

The other point is the postal code lottery — the idea that, depending on the province you live in, you’re going to have access to different levels of treatment covered by the provincial government. And people in rural communities, to ManTek’s point, don’t have access to early detection as much as people who live in cities.

NAOMI: To dovetail on what was already said, the piece I’d like to be really explicit about is symptom complexity. We talk about early access to treatment and early access to diagnostics, but it’s important to note that 80% to 100% of people with a cancer diagnosis report some level of extreme or debilitating fatigue, so think about that in a work context. And the other statistic that might be relevant today is that the leading cause of emotional distress for people who have a cancer diagnosis following their treatment is reduced physical ability. So again, thinking about that survive-and-thrive model versus what’s actually happening to someone when they’re reintegrating into the workforce.

Q: Turning to the employers in the group, can you please each share some broad information about how cancer impacts your workplaces and benefits plans?

AARON: Cancer affects workplaces in multiple ways — obviously, absenteeism, which can lead to productivity challenges, and the financial strain that’s placed on benefits plans. More employees are also choosing to work through their treatments or they’re returning to work post-recovery, which means the employer support is really critical. Under-standing these realities helps us shape our benefits pro-grams to better support our employee needs.

At CSA Group, we recognize that supporting employees through the whole journey is about creating a workplace culture that prioritizes health, flexibility and emotional support. One of the programs we offer is access to a [health-care service] specifically for cancer treatment. It provides medical and emotional guidance for our employees and their families from the very first phone call they make, helping them navigate the cancer journey.

FRANCESCA: S&C is over a century old and started as a family business, so we want to lead with compassion and empathy and really reflect that in all we do. It’s important to see that reflected in how we design programs, but also how we engage with employees when they need it. In terms of how the programs are designed, we take a holistic approach.

In our main benefits plans, we have mental health and [para-medicals] separate and then we have the other benefits, so depending on what the treatment requires, there’s support available. The mental-health benefits are there to support the person who has been diagnosed, as well as their family. And it isn’t necessarily during treatment or diagnosis; it’s at any point. We make sure employees are aware of the mental-health facilities available to support them and their family.

In terms of financial support, we have a robust insurance program. If someone is worried about what might happen, there’s robust insurance to support and protect their family. There’s critical illness available. And through our main pension and retirement savings, they have access to a [group registered retirement savings plan] and [tax-free savings account], allowing them to have easy savings. It isn’t really related, but it all helps them save and create that cushion for when life sends curve balls your way.

The mental-health benefits are there to support the person who has been diagnosed, as well as their family — and it isn’t necessarily during treatment or diagnosis; it’s at any point.

- FRANCESCA -

LAURA: We have to make sure our benefits align with our values of being caring and courageous and rigorous and united. But what’s different about our employee population is we attract people to work with us who really care about the cause of cancer, so what you’d expect is a higher incidence of cancer within our workforce. As an organization, I feel we have a higher standard of care in terms of making sure we’re supporting people with cancer because that’s what our organization is all about. That provides a unique perspective. We’re going through a bit of a refresh right now of looking at that philosophy in our total rewards and — in particular — our philosophy around the benefits plan and what that means for cancer care, both during and after.

We have to make sure our benefits align with our values of being caring and courageous and rigorous and united.

- LAURA -

Q: Across workplace benefits and wellness programs, we talk a lot about prevention. How important is prevention when it comes to people developing cancer? What’s the role of employers and the benefits industry here?

Neda: Fitness is super important for prevention, as well as smoking cessation, vaccines and nutrition therapy. Something that’s very popular right now is weight management. We don’t automatically think of weight management and cancer together, but obesity is related to about 13 different types of cancer, so it’s important to have that weight management program in place. As well, having the services of a kinesiologist or physiotherapist covered would be ideal so people can regain movement to go back to doing some physical activities. Recently, there was a publication about human papillomavirus — a large group of women were vaccinated in the fourth grade and cervical cancer has been eradicated in these patients. Perhaps, in the future, there’s going to be even more preventive vaccines for cancer.

A large group of women were vaccinated in the fourth grade and cervical cancer has been eradicated in these patients.

- NEDA -

AARON: I think I saw a statistic recently that 50% of cancer cases are preventable through lifestyle changes. With that in mind, employer-driven initiatives are really crucial at reducing risk. At CSA Group, we understand that prevention is key. We’ve recently implemented a global benefit to help actively support our employees’ health and wellness — it’s a platform or app that encourages and rewards employees for healthy habits, such as tracking their steps every day or their sleep or engaging with daily health and nutrition [resources]. We already have 40% of our population enrolled and consistent engagement. I truly believe in investing in preventative benefits like this; it not only improves the well-being of employees and morale, but it can also reduce the long-term health-care costs on the company, as well as absenteeism.

FRANCESCA: Prevention, education and awareness — we’ve done a lot of work to spotlight and highlight different types of health topics and campaigns. Our population is 80% male, so for Movember, we let them know what signs to look for and what resources are available. We use a digital screen or a biweekly newsletter that shines a light on a topic, like breast cancer, nutrition and skin cancer awareness. We’ve also had biometric screening onsite in the U.S. It provides an opportunity for employees who might not have seen a medical professional in a long time. We’ve enhanced our [employee assistance program] services — we use them for more than just the mental-health and counselling component. It provides coaching and life balance solutions around wellness, fitness, nutrition, smoking cessation and stress management.

LaurA: Aaron spoke about the move to action and Francesca spoke about how her organization is getting the information in front of people. We’ve been trying to do a mixture of both. Everybody knows you should eat well, you should exercise, you should sleep, you should do all these good things for your physical health. But getting people to move to action is the tricky part. To change life behaviours takes a long time — anywhere from eight to 16 weeks to really change that behaviour.

NAOMI: To build on that idea of the multi-level approaches, the research supports that, for primary, secondary and tertiary prevention of cancer, there are benefits to exercise. But particularly, for that secondary prevention, there are better outcomes for chemotherapy and treatment when people are engaged in supervised or supported exercise programming. It’s one thing to be able to offer services, it’s another to recognize the complexity of the people that may need tailored or supported access. The data from groups that are going through cancer and cancer treatment may look a bit different than a general population or other chronic disease populations in terms of the supports that are being requested to make sure it’s catered to fit their needs.

There are better outcomes for chemotherapy and treatment when people are engaged in supervised or supported exercise programming.

- NAOMI -

Q: Turning to treatment now. Given the advances in oncology, can you please speak to why private payers remain crucial to patients with cancer in terms of access to treatments?

MANTEK: For private payers, many provinces like Ontario or the Atlantic provinces go through the private payer first before going into the public system. But the other answer is that private insurance provides an avenue to earlier access to new medical innovations that maximize outcomes. Cancer research is happening at a breakneck speed and it’s really difficult for the health-care system to keep up. The role of private insurance is that it can accelerate access to early medications. In Canada, the timeline to public reimbursement is really slow. And in fact, when we benchmark ourselves against [Organisation for Economic Co-operation and Development] countries, we rank 19 out of 20 out of countries from the time it takes from Health Canada approval to public reimbursement and that’s about 25 months on average. To summarize, the role of private insurance is that ability for patients to navigate and get access to novel treatments sooner. And it allows physicians a bit more flexibility in their toolkits because, often, public reimbursement criteria can be very rigid. Private insurance can supplement that, so the physician can have a very robust conversation with the patient and the family about the goals of the treatment and to personalize that treatment for the patient.

Q: Of course, treatment will depend on the type of cancer and the stage of the diagnosis. Are there any new treatments or innovations to share?

MANTEK: When we look at what constitutes an effective medication, obviously overall survival is the key benchmark. But I think, increasingly what we’re seeing is cancer is being modified into a chronic disease and people are living with cancer so that requires us to look at quality of life. A lot of the new therapies that are coming out are looking at outcomes like overall survival, progression-free survival, but also looking at quality of life because that’s really the measure of how the patient is being impacted.

When it comes to medical innovations, it isn’t necessarily just a new drug. It could be a new route of administration that will impact quality of life. When we think about chemotherapy, for example, we often think about IV or spending a lot of time in the hospital sitting in a chemo chair. But a lot of these innovations and how we deliver cancer therapy are turning these into subcutaneous injections or oral therapies. That takes a lot of time away from needing to be in the hospital and it reduces the burden on the health-care system as well. Innovations like oral therapies provide an opportunity for convenient and effective treatment for patients.

NEDA: The genetic testing that’s done in the cancer world is on tumours, so when a drug is covered, there’s a companion test that’s going to be covered. Of course, there’s a gap between the time when a patient sends their submission and the time it’s actually covered, so the private insurer has a role to play to fill in that gap. And [employers] have to look at their contracts because most contracts with private insurers have an exclusion in terms of genetic testing.

It’s important to remember, as ManTek was saying, our system is very slow. From a tax perspective, right now, those companion tests aren’t considered medical expenses, so there’s a bit of discrepancy there, but eventually the tax law will also get there. All of this to say, it’s important for private insurers to also cover this type of genetic testing because it will allow the patient to go on the drug that will be specific to their tumour. And hopefully, their return to work is going to be quicker.

Q: For the employers, what are the processes in your organizations when an employee is diagnosed with cancer and is undergoing treatment?

Aaron: When an employee is diagnosed, our priority is about ensuring the employee feels supported, both personally and professionally. We do this by focusing on a number of things: providing very flexible work arrangements, providing access to the best mental-health resources and very clear communications about the ben-efits coverage and resources available. We have really good communications in place. We have a mental-health ambassador program globally that steers employees in the right direction and provides them with the resources they need. It’s about making sure employees feel supported and taking away the stress when it comes to having to think about what benefits are available to them.

Our priority is about ensuring the employee feels supported, both personally and professionally.

- AARON -

FRANCESCA: We have a strong short-term disability plan that’s followed by long-term disability, so [employees] know they’re cared for in terms of income loss. But also, where they’re comfortable in sharing things, speaking with their manager — we encourage that. I’ve seen different versions of how people want to be supported. And then, like Aaron said, we ensure they understand what’s available to them while they’re being diagnosed, in treatment and upon return, we well as the resources that are available to support their families, the caregivers.

LaurA: We don’t always know if somebody is going off with cancer and it’s not our right as the employer to know that; it’s only when somebody self-discloses. So we’re making sure people know, at the time they become ill and they’re going off on short-term disability, that they have resources available to them. When we learn it’s cancer, we’d refer them to our 1-800 line, which is available to anybody. It’s a support line a person or caregiver can call and learn about what care is available to the individual outside of the health-care system, to help them maneuver within the system because there are lots of things available and it’s very regionally specific.

Q: As our population ages and people live longer, there’s an impact on most aspects of group benefits plans. Even further, cancer survival rates have improved, which means the impact of cancer in the workplace is changing as people return to work, particularly with a variety of symptoms like cognitive and physical changes or even value changes in how they may prioritize work. Can you please speak to these evolving circumstances, as well as the challenges?

NAOMI: From the health-care research side, our implementation after a pilot is usually up to 17 years in the public system with only about 50% of effective pilot trials actually making it into an implementation status. So just to give a picture of the challenges, when we then talk about a paradigm shift from many cancers being acute to being chronic in nature and that focus on quality of life and rehabilitation, it’s very slow to catch up to when the medical advancements are coming down the pipeline. And, at this point, rehabilitation isn’t part of standard practice; there isn’t typically a targeted person with that credential supporting return to work, even though we know it’s a big issue.

The Cancer and Work website showcases the newest information in the easiest way possible. We’ve created programs like ‘I Can Work,’ which is a pilot program of virtual delivery services. And we created a module through the University of British Columbia that’s tailored to physicians and medical professionals. There are some pieces at work, but overall, there’s a bit of a disconnect when we talk about the quality of life and the importance of physical and functional outcomes and how much we have access to.

As rehab programming is developing in cancer, we also see a lag where often we’re thinking about pre-surgical, but not necessarily that whole picture of life. Some of the big issues I would highlight to keep the conversation going is areas that would be harder or challenging even for the individual to be able to self-identify — cancer-related fatigue and cancer-related cognitive impairment. You don’t have to go through chemo to see these issues with cognition that then impact on mental health. So even in the return-to-work assessments, it’s really challenging because if someone is having cognitive-related issues, we might see a trickledown effect where they aren’t able to follow those instructions, so their physical outcomes look different or their mental wellness is impacted. We have to think of each person with tailored symptom complexity and each job being so different — how do we address that, but in a really efficient resource-related way?

Mantek: The fact that we’re talking about return to work speaks to the success in cancer research and how we treat cancer. And so, obviously, with cancer therapies, there are always side-effects. Where extended benefits can support employees is covering those medications that help manage side-effects as well. Also, when the employee with cancer comes back to work, it’s about having policies that are flexible, that allows the individual to go in for regular monitoring in the clinic or regular treatments if it’s IV, for example. And a lot of cancer treatments can be immunosuppressive, so it’s about creating fairness and equity for employees with cancer who may be susceptible to different things like infections.

Q: What are employers doing to support employees returning to work in these circumstances?

Laura: We have a hybrid workforce where people are required to be in office two days a week minimum, so the accommodation for medical reasons like cancer is one of those reasons we absolutely want people to work from home where they can, so they feel safe. But I think it’s holistic. The return to work includes understanding the needs of the employee and the people leaders, as well as making sure the employee has support systems in place and they know what they can access. This includes the psychological benefit, nutrition support and other paramedical practitioners like physiotherapists and occupational therapists because, while they’re on disability, they have a lot of structure and support, but when they’re coming back to work, they might forget they have all of those benefits in place. It’s just packaging and the way we communicate that’s very structured, so people have the package right at the time they need it when they’re returning to work.

FRANCESCA: At S&C, we have a mainly male environment and they’ve worked here for years, so say there’s a welder coming back to work and he’s worked with his team for 20 years. The HR team really has to have conversations, whether that’s around support or setting the stage. You have those conversations, extend that invitation, have as much touch base and contact [as they want.] At the same time, it’s important to get in to talk with a team before the employee returns, have a conversation and let them know he’s returning and that we’re going to have him lead how he can transition back to the environment in a respectful way that’s right for him. It’s also important to speak to the manager about what they can look for, what they can do and where to go for support — trying to make that environment they’re returning to the best to support sustained success on the return.

Aaron: It’s difficult for employers when it comes to employees returning to work when they may not feel or be quite ready. This is where having a flexible return-to-work policy is really important to ensure we’re being as accommodating as possible. Managers have a role to play in the return to work as well — they need to be having open, ongoing communication with their employees to be able to support and be as accommodating as possible and also promote the different well-being resources that are available.

NEDA: This year, our priority at Desjardins is to work on cancer care and cancer and return to work. And I think this will definitely set the table for the conversation. I’m glad we’re all sharing different perspectives here and I’m happy to say I think we’re on the right path because we’re touching a little bit of everything that everyone said.

Healthy Workplace Roundtable Sponsors

Desjardins Insurance

Desjardins Insurance offers a wide range of flexible life insurance, health insurance and retirement savings products and services. It’s one of the top life insurance companies in Canada and a member of Desjardins Group, the leading cooperative financial group in Canada. Desjardins Insurance has been providing innovative services to individuals, groups and businesses for over a century. These services reflect Desjardins Insurance's commitment to employee well-being, as demonstrated by the initiatives and partnerships it has participated in over the years.

Takeda Canada Inc.

Takeda Canada Inc. is the Canadian organization of Takeda Pharmaceutical Co. Ltd., a global, values-based, R&D-driven biopharmaceutical leader headquartered in Japan, committed to discovering and delivering life-transforming treatments, guided by our commitment to patients, our people and the planet. Takeda focuses its R&D efforts on four therapeutic areas: oncology, rare genetics and hematology, neuroscience and gastroenterology . We also make targeted R&D investments in plasma-derived therapies and vaccines. We are focusing on developing highly innovative medicines that contribute to making a difference in people's lives by advancing the frontier of new treatment options and leveraging our enhanced collaborative R&D engine and capabilities to create a robust, modality-diverse pipeline. Our employees are committed to improving quality of life for patients and to working with our partners in health care in approximately 80 countries and regions. For more information, visit: www.takeda.com/en-ca/.