By Michael Greenberg

Senior Vice-President, Portfolio Manager

Franklin Templeton Investment Solutions

Back in 1987, the United Nations World Commission on Environment and Development came up with a definition for a bold new concept: sustainable development[1].

“Sustainable development is development that meets the needs of the present without compromising the ability of future generations to meet their own needs.”

It’s taken a few decades to catch on, but as more of the world’s focus turns towards society’s environmental, social and governance (ESG) goals, investing in sustainable development has moved into the mainstream.

Canadian investors want ESG investment options

A 2021 research study sponsored by Franklin Templeton found that ESG is fundamentally important to Canadian investors[2]. In that study, 61% of respondents said it was important that their investment options include ESG integration. Among defined contribution plan participants, the percentage was even higher; 68% wanted ESG-integrated options available when making an investment decision. Our findings provide the opportunity for plan sponsors, consultants, and financial advisors to engage with their clients, including newer ones, on the issues.

Financial industry responds to growing demand

Sustainable investing has become a meaningful business opportunity for the financial industry. According to Morningstar, global sustainable fund assets reached $2.74 trillion USD by the end of December 2021. In the United States alone, over $350 billion is invested in open-end funds and ETFs that claim some type of sustainable investing mandate. The number of sustainable funds is five times greater than a decade ago[3].

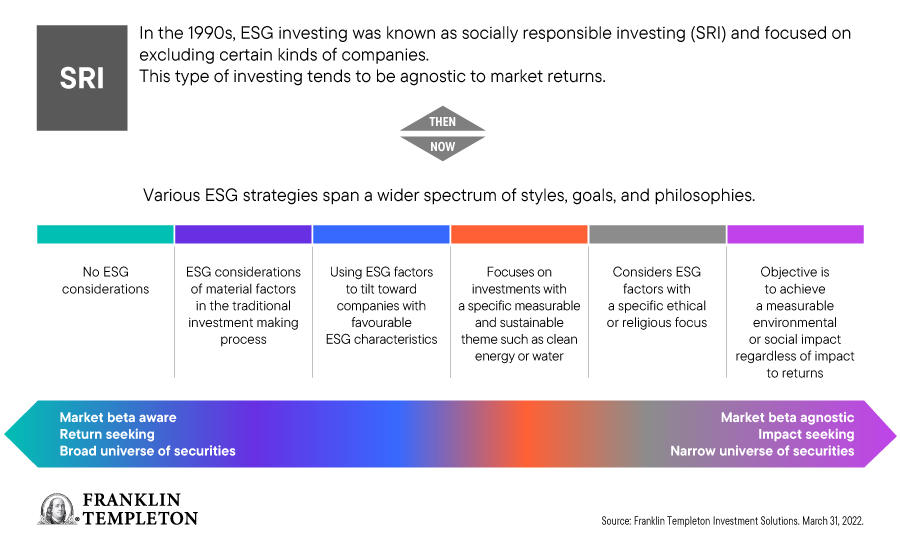

Moreover, sustainable investing has transformed beyond traditional SRI funds to now include various ESG strategies and philosophies across a broader spectrum of goals and constraints. The different styles of sustainable investing prioritize different outcomes, as described in the accompanying illustration.

Various Types of ESG Investing, Then and Now

Meeting the challenges and dispelling myths

ESG investing is a burgeoning field fraught with challenges, including a lack of industry standardization around scoring methodologies and difficulties in manager selection and portfolio construction, among others.

Though the challenges associated with ESG investing are numerous, we believe they can be overcome with sophisticated processes and tools. Proprietary ESG ratings that incorporate an in-depth look into industry materiality are one step in that direction when investing in securities. An exhaustive and continuous review of underlying managers can identify the cream of the crop and weed out those whose processes may not yet be up to par. But without a refined portfolio construction methodology, and the tools needed to implement it, a strategy may drift from its purpose and unintended exposures could abound.

In a recently released paper, we discussed the rise of sustainable investing, key considerations, and obstacles to effectively incorporating sustainable analysis into constructing portfolios and the approach we take to multi-asset portfolios with a sustainable focus.

Integrating sustainability into multi-asset portfolios

Effective management of an ESG-tilted portfolio requires a high level of investment in data, technology, and human resources. To implement a robust sustainable investment process, investors should focus on these areas:

- Supplement rating agency scores with in-depth, customized ESG rating analysis that considers materiality

- Implement a robust investment manager research process to ensure underlying funds create true ESG value, and

- Have sophisticated tools to aid in the portfolio construction process to execute the client’s goals and reduce unintended biases that may appear.

ESG investing is a resource-intensive and complicated effort. Partnering with an asset manager with the experience and expertise necessary to build effective ESG portfolios may be of use in unlocking value. We believe this could allow clients to effectively capture a risk-adjusted return benefit to portfolios brought on by a sustainable investment focus.

We believe that, over the long-term, sustainable investing will continue to gain prominence. Investors will reward companies that act as good corporate citizens and penalize those that do not. As investors, we need to consider material sustainability factors to properly assess value over time.

We think this will drive better risk-adjusted returns over the long run.

[1] United Nations World Commission on Environment and Development, “Report of the World Commission on Environment and Development: Our Common Future”. 1987. Chapter 2, paragraph 1.

[2] The Xcelerant survey was conducted online among a sample of 1,236 Canadian investors 18 years of age or older and was administered between October 28 and November 2, 2021, by Directions Research, which is not affiliated with Franklin Templeton. Data has been statistically weighted by age, gender and geographic region in Canada. The custom-designed weighting program assigns a weighting factor to the data based on current population statistics from Statistics Canada.

[3] Sustainable Funds U.S. Landscape Report – 2021: Another year of broken records. (2022). Morningstar, p. 1

IMPORTANT LEGAL INFORMATION

The material is intended to be of general interest only and should not be construed as investment advice, recommendation or solicitation to buy, sell, hold any security, or adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the author and the comments, opinions and analyses are rendered as of March 31, 2022 and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions, and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton contact for further information on availability of products and services in your jurisdiction.

Franklin Templeton Investment Solutions (FTIS) is a global team dedicated to global portfolio-based solutions, which draws on the expertise of a number of Franklin Templeton affiliates. In Canada, the advisor to the Canadian FTIS mandates is Fiduciary Trust Company of Canada.