Regime change in markets may signal the end of U.S. dominance.

| Justin Thomson CIO, International Equities |

KEY INSIGHTS

- We appear to be entering a new era of structurally higher inflation and higher rates, meaning that the gravitational pull of competing income‑generating assets has returned.

- U.S. equities have outperformed international markets for a record 53 consecutive rolling three‑year periods, but we believe this cannot be sustained.

- The comparatively cheap valuations of international equities and the gravitational pull of higher rates broadly favor international equities.

The popular view that we are currently undergoing a “paradigm shift” in markets will only be substantiated with the passage of time and the benefit of hindsight. However, we do indeed seem to be transitioning from the post‑global financial crisis (GFC) era of benign disinflation, ultra‑accommodative monetary policy, negative yields, maximum liquidity, and minimum volatility to a new era of structurally higher inflation and higher nominal (and likely higher real) rates. If this continues and we assume that paradigm shifts usually bring changes in market leadership, this alteration in the macro backdrop will have profound implications for returns across and within asset classes.

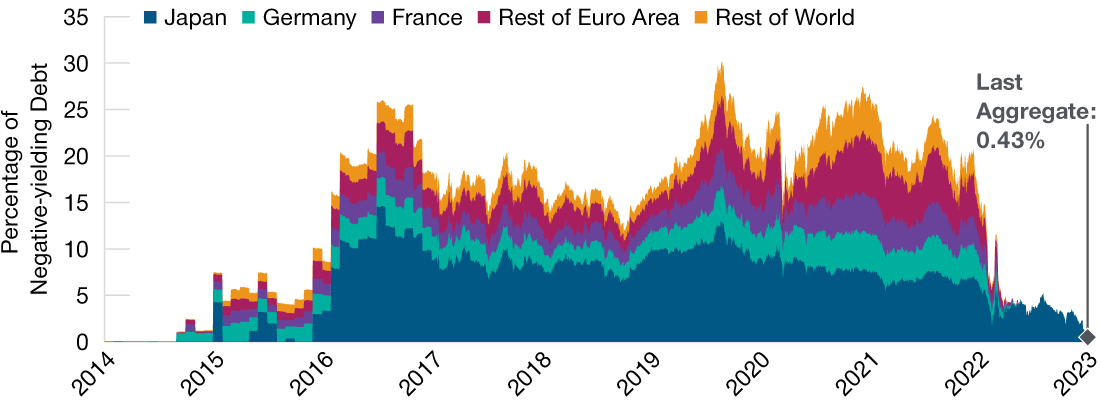

The transition to higher interest rates means that, once again, money has a cost. Last September, the writer Nassim Nicholas Taleb tweeted that “experience in finance with a discount rate near zero is like having studied physics except without gravity.” Well, gravity is back. Or, to put it more precisely, the gravitational pull of competing income‑generating asset classes has returned, and non‑income‑generating assets have a cost of carry1 again (Figure 1). Gravity also affects the way equities are valued, resulting in higher discount rates, lower terminal values, and lower tolerances for business models where profits are all in the future.

Gravity Is Back

(Fig. 1) The global stock of negative‑yielding bonds has fallen to zero

As of January 6, 2023. For illustrative purposes only.

Past performance is not a reliable indicator of future performance.

Source: Bloomberg Finance L.P., Goldman Sachs Investment Research.

We have lived through this during the past 15 months—and it has been a painful experience as the most highly valued sectors of the market retreated at the same time as yields backed up. For a typical 60:40 portfolio, this amounted to something of a black swan event. Markets are great storytellers, and the story of 2022 suggests that we are living through a regime change. And if the most shocking phase of that regime change is behind us but the world in front of us looks very different, what investment conclusions can we draw?

Factor‑wise, it means that valuation now has gravitational pull and that value as a factor will likely continue to do well. If we have indeed entered an era of higher‑trend inflation, sectors that provide some inflation protection (financials, resources, real estate) are likely to be in the ascendency, while sectors that are “long duration” and beneficiaries of low inflation (technology, consumer, and health care) will probably fare less well. Overall, we believe that the combination of a low‑valuation starting point and the likely strong performance of inflation‑hedging sectors points to an era in which international equities may enjoy a period of sustained strong performance.

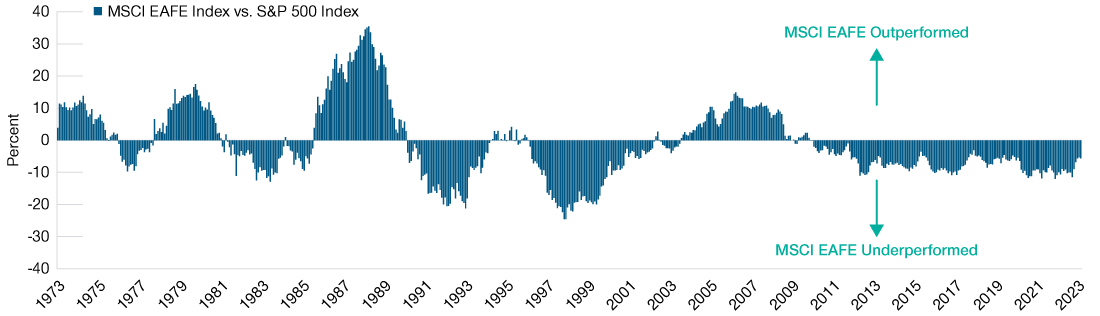

The Era of U.S. Outperformance May Be About to End

After the longest period of U.S. equity outperformance versus international markets, it would be reasonable for U.S. investors to ask: “Why should I go anywhere else?” But the length of time that U.S. equities have dominated should itself serve as a warning sign. U.S. equities have outperformed 80% of the time over the past decade (Figure 2). Or, to put it another way, U.S. equities have now outperformed for 53 consecutive rolling three‑year periods using quarterly observations—the most extended cycle in recorded history. Surely gravity, or mean reversion, dictates that it is time for this to change?

U.S. Equities Have Dominated for a Decade

(Fig. 2) They have outperformed international stocks 80% of the time

January 1, 1973, through March 31, 2023. For illustrative purposes only.

EAFE = Europe, Australasia and Far East.

Past performance is not a reliable indicator of future performance.

Source: T. Rowe Price calculations using data from FactSet Research Systems Inc. All rights reserved. Please see Additional Disclosures page for information about this MSCI and S&P information.

For those still skeptical, it is worth paying attention to the reasons behind the chart‑busting absolute and relative performance of U.S. equities in the post‑GFC period. The key is to look under the hood at corporate performance. If index levels are driven by valuation multiples and earnings are a function of sales and profit margins, the majority of U.S. stocks’ outperformance can be explained by an extraordinary period of sales growth (albeit concentrated in a fistful of companies) combined with the fact that the U.S. is one of two major economic blocs where profit margins rose following the GFC (the other being Japan). Free cash flow growth was also superior, and much of this was put toward share buybacks, which meant the effect at the earnings per share (EPS) level was supercharged. All this suggests that the outperformance of U.S. equities owed more to growth in EPS than to multiple expansion.

Why is this likely to change? Well, to believe the trend will continue you must make two assumptions: first, that record‑high levels of margin will be sustained, and second, that sales per share growth will continue to exceed growth in nominal gross domestic product (GDP).

Continued higher margins are not impossible, but they are unlikely. U.S. profit margins are unusually concentrated in a handful of large technology firms, and the weight of incoming capital—combined with greater competition and possibly regulation—will likely change that. Indeed, we already know that the mega‑cap tech companies are now facing contestable markets in a way that they were not in the previous decades. Likewise, it seems unlikely that sales per share growth will continue to outstrip in nominal GDP growth. Although companies headquartered in the U.S. are often successful exporters, history tells us that nominal GDP and the sales of U.S.‑listed companies are closely linked. A reversion to the norm therefore seems likely.

Higher‑Trend Inflation Should Favor International Stocks

Sector composition will also be a factor. The old heuristics that Europe outperforms the U.S. when financials outperform technology and that emerging markets outperform when materials outperform may be a little outdated, but they still contain some truth. Sector composition has been positive in the U.S., driven by high index weightings in the three top‑performing sectors of technology, consumer discretionary, and health care. Outside the U.S., sector composition has been negative because of the higher weightings of financials and industrials. The potential unwind of this pattern during a period of higher‑trend inflation favors positioning in international equities.

A longer‑term consequence of paradigm shift is likely to be a new capex cycle. For two decades, capital expenditure (as measured by global capex to GDP) declined as supply chains globalized and capacity accumulated (particularly in China), releasing a sustained deflationary impulse across the world. Higher inflation will likely bring forward spending as capital is substituted for scarce labor and governments increase fiscal spending to support economies.

Deglobalization, resulting in shortening supply chains, will be inflationary as it reduces redundancies in the system, and capex should rise as investment is forced closer to home. Longer term, the green transition will require large‑scale investments over a multiyear period to meet net zero targets.2 The key point here is that index composition means international markets historically have been more levered to that cyclical impulse.

Regime Changes Mean Shifts in Market Leadership

As Jeremy Grantham, co‑founder of investment firm Grantham, Mayo, Van Otterloo & Co. put it: “The one reality you can never change is that a higher‑priced asset will produce a lower return than the lower‑priced asset.” There were times during the bubble conditions of the COVID era when the reverse was true: High valuations and high returns were positively correlated with price performance. A period of antigravity, if you like. Gravity has now returned, and we find that the starting point for valuations in international equities is highly favorable, compared with both history and current U.S. valuations. While the U.S. dollar’s position as the world’s reserve currency is unlikely to be challenged, the sustained period of U.S. dollar strength has contributed to the superior returns of U.S. equities to the extent that most developed market currencies are deeply undervalued relative to the dollar on a purchasing power parity basis.

Regime changes are defined by changes in market leadership. Given that international equities and currencies are much cheaper than U.S. assets and we are entering a period of sustained higher rates, the gravitational pull of valuation broadly favors international, we believe. In a world where energy and supply chain forces are set to drive capex higher, we believe it is time to re‑weight portfolios, as appropriate, to accommodate more international stocks.

1The net cost of holding a position.

2 Net zero refers to a state where greenhouse gas emissions into the atmosphere are balanced by removals (such as through forests or carbon capture and storage).

Sponsored by

![]()

Additional Disclosures

Source: MSCI. MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

Copyright © 2023, S&P Global Market Intelligence (and its affiliates, as applicable). Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice. Credit ratings are statements of opinions and are not statements of fact.

Important Information

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested. The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

All investments are subject to market risk, including the possible loss of principal. International investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. These risks are generally greater for investments in emerging markets.

Canada—Issued in Canada by T. Rowe Price (Canada), Inc. T. Rowe Price (Canada), Inc.’s investment management services are only available to Accredited Investors as defined under National Instrument 45-106. T. Rowe Price (Canada), Inc. enters into written delegation agreements with affiliates to provide investment management services.

© 2023 T. Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

CCON0151519 | 202305‑2928538