Originally from our sister publication, Advisor.ca. As risk aversion continues to haunt equity markets, corporate credit risk looks reasonably good. Despite deleveraging and a prolonged economic decline that threatens to take down companies, investing in corporate bonds might be a worthwhile alternative to equities. With about 10,000 issuers and an increasing number of emerging markets […]

Why it's 1979 all over again (hint: it's about volatility, not disco).

Understanding why they do what they do.

Watch this video The global investment landscape has shifted over the past 10 years in four key ways, says Sebastien Page, executive vice-president and head of the client analytics group for Pimco. The four drivers he lists are: A shift from focusing on data and models to macroeconomic forecasting. A switch from diversifying across asset […]

PIMCO's Page on why diversification via assets is out.

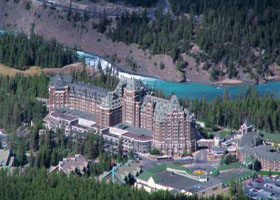

Coverage of the 2011 Global Investment Conference

Coverage of the 2011 Global Investment Conference.

Coverage of the 2011 Global Investment Conference.

When one size doesn't fit all.

Small and medium-size institutional investors are increasingly utilizing exchange-traded funds (ETFs) to efficiently implement investment strategies that used to be the exclusive domain of large institutional investment funds. Most discussions about the use of ETFs tend to focus on the benefits they offer to retail investors. Indeed, most passively managed index tracking ETFs are a […]