As private market assets become more widely adopted by institutional investors, they open up new, unexpected opportunities.

Tom Keenleyside, associate director of investments at Western University, is ready to meet the moment. “We are in the process of scaling up; I think private market investments have become more mainstream among institutional investors. . . . It’s a growing market. That’s making it easier for institutional investors of all sizes to get access to private markets.”

From private equity, private debt and even music royalties, the investment team overseeing the university’s operating and endowment fund is open to exploring all types of available alternative assets. Keenleyside is also interested in agriculture, litigation and finance assets. “We’re looking for opportunities that are substantially uncorrelated to public markets.”

Read: Growing risk concerns pushing institutional investors to private markets: report

Getting to know

Tom Keenleyside

Job title:

Associate director, investments, Western University

Joined the CSSB:

2013

Previous role:

Manager, retirement services, Canada Life

What keeps him up at night:

The amount of political unrest in Canada leading to uncertainty and a lack of harmony within the political domain

Outside of the office he can be found:

Enjoying life as a hockey dad for two active athlete kids and imparting his own expertise after reaching varsity as a hockey player himself

For Western University, the adoption of private assets started in earnest in 2013 as a plan to increase complex investments that could enhance the existing portfolio, he says. The portfolio’s evolution from a traditionally large component in public equities to more prominently incorporating private assets has been a long time coming, he notes, with meaningful changes starting more than a decade ago when he joined the university.

Keenleyside’s focus on private equity is typically centred on U.S. and Western Europe-based assets that are small- to medium-sized with positive earnings before interest, taxes, depreciation and amortization. He also has a specific focus on the buyout segment with some opportunistic interest in growth segment assets.

“Private markets start to become more attractive as your size increases. The opportunity set increases alongside some more non-traditional investments that we could explore, that would be enhancers to our existing portfolio.”

Read: Calgary Foundation finding a groove through alternative assets

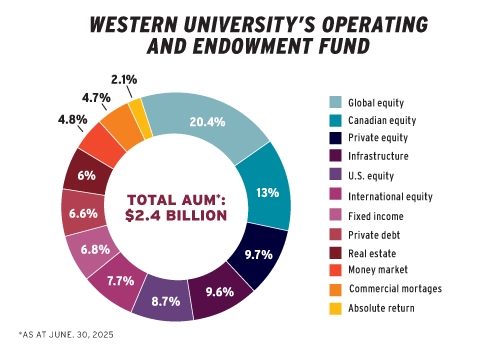

The university maintains three endowment funds with different timeline goals, but its operating and endowment fund, which is its largest portfolio, with $2.4 billion in assets as at June 30, 2025, is a long-term horizon vehicle.

While responsible investment is another relatively new lens adopted by the university, Keenleyside says elements of this approach were always present in the traditional investment review process. To date, 10 per cent of its operating and endowment fund is invested in sustainable strategies through five allocations totalling US$155 million.

It also intends to decarbonize its portfolio by 45 per cent by 2030 based on a 2020 baseline. This focus on responsible investments has been present since the start, he adds, but the investment team is now taking a ramped up, formalized approach. “We’ve certainly put more rigour around [responsible investments]. . . . It’s been a very prominent part of our operation.”

The operating and endowment fund allows Western University to invest in an asset mix navigating a long-term horizon and to earn additional returns over time that exceed the returns from short-term money market instruments, while also securing the university’s daily cash needs, says Keenleyside.

“It’s rewarding to have that long-term view for an investor. You can really take time and collaboratively come up with ideas that do work over the long run.”

With the current investment volatility forcing institutional investors to be ready for the unexpected every single day, Keenleyside says good governance is the foundation of balancing long-term decision-making with trying to absorb shockwaves from the market.

“We have layers of very experienced individuals and groups that we work with . . . and having that depth of support is essential to help keep the focus where it should be.”

Bryan McGovern is an associate editor at Benefits Canada and the Canadian Investment Review.