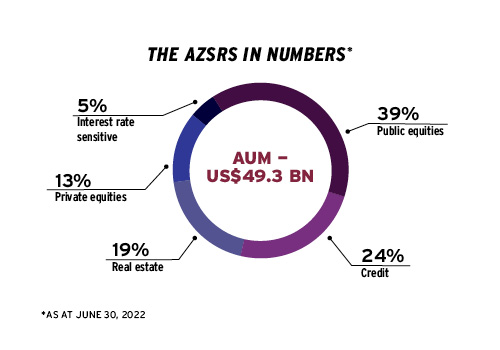

There’s something about the Arizona State Retirement System — a US$49.3-billion defined benefit-like hybrid pension plan for the state’s 600,000 current and former public sector workers — that feels downright Canadian.

The resemblance is intentional. Canadian Paul Matson, executive director of the AZSRS, drew inspiration from his home country when establishing its approach, particularly in the creation of its governance model. “It would be too bold to say it’s substantially Canadian, but we took the best of the U.S. [and] Canadian public and private sector models.”

He first became familiar with the Canadian pension sector in 1989 after being accepted to a financial management training program run by Alberta’s treasury board. After a role as a portfolio analyst there, he joined the Alberta Workers’ Compensation Board as a senior investment advisor.

Getting to know

Paul Matson

Job title:

Executive director, AZSRS

Joined the AZSRS: 1995

Previous role:

Senior investment manager, Alberta department of finance

What keeps him up at night:

How to get people to focus more on their similarities than their differences

Outside the office he can be found:

Running half marathons and exploring Arizona’s abandoned mines and ghost towns in his Jeep

However, after a about a year in the job, he heard about a position he found intriguing — chief investment officer of the AZSRS, with responsibility for creating an internal investment program. “I could have written that job description — it was for a job that I’d love in a city that I love,” says Matson, a half-marathon runner who feels most alive in arid climates.

Read: 2022 IIC coverage: A Canadian view of the Arizona State Retirement System

After an extensive interview process, he clinched the position. “It was great. I was 32 years old and given a mandate to oversee a multi-billion dollar portfolio and create its investment policies from scratch.”

After taking a few months to understand the organization and convince his colleagues he was qualified, Matson altered the sub-governance model so the research staff all reported to the same person — him. He also added U.S. equities to the portfolio through a strategy that was neither passive nor active — referred to instead as enhanced passive. “We didn’t want to rely on company-by-company fundamental research, but also didn’t want to just replicate what other organizations would do. Our mandate was to add small, incremental returns through non-volatile alpha.”

Next, Matson turned his attention to the bond portfolio. “Now, all of our U.S. equities and two-thirds of our bonds are managed in house using enhanced passive strategies.”

Today, up to a third of the AZSRS’ assets are managed internally, with the rest overseen by external firms. While he’s proud of the overall performance of the investment strategies, Matson describes the creation of the organization’s governance model as his crowning achievement. He started working on it in 2003 and it was codified in 2004.

Read: Pension funds saving with in-house asset management: survey

Through the governance model, which was designed to make a clear distinction between the work of the AZSRS’ staff and its board, employees are given documented authority and responsibility to make most decisions. Third-party information about decisions and results are provided to both the trustees and staff, which allows them to focus on important issues related to long-term performance. “It’s hard to make other stuff work throughout time without a strong, clear, effective and documented governance model,” he says. “It lets us do everything more quickly, actively and with better oversight.”

It didn’t take long for the guidelines to attract the attention of peer organizations. Matson soon found himself delivering presentations or responding to questions about the governance model. He also believes the adoption of the model indirectly led to the Arizona Capital Times naming him the 2012 leader of the year for public policy and governance.

Read: Canadian model offers lessons for U.S. public pensions: report

From an operational perspective, the AZSRS may look distinctly American, but its habit of creating house views aligned with its investment values is typical north of the border, he says. “We have a house view on many things. . . . It’s a big deal.”

Many of these views are aligned with Matson’s own belief that there’s a significant difference between industry standard and best standard. “Just because most people do something one way doesn’t mean that’s the best way to do it. People conflate what’s most common with what’s industry practice as its best.”

Gideon Scanlon is the editor of the Canadian Investment Review.