When Loblaw Companies Ltd. purchased annuities to reduce the risk in its defined benefit pension plans in January 2017, the $350-million, inflation-linked buyout kicked off a year of significant activity in the Canadian annuity market.

Group annuity purchases had reached nearly $2.5 billion by the end of the third quarter of 2017, according to Willis Towers Watson’s latest quarterly update. “It will be the fifth year in a row that we beat the previous year,” says Marco Dickner, retirement risk management leader for Canada at Willis Towers Watson.

Read: Year-to-date group annuity purchases rise to $2.5 billion: report

“That trend of risk transfer is something that’s here to stay,” he adds. “It’s a global trend. We saw that in the U.S. and in the U.K., so this is not a temporary thing.”

With that in mind, what are some of the group annuity trends to watch for in 2018?

History in the making

Transactions in Canada’s group annuity market have historically reached about $1 billion a year. In 2012, two large annuity buyouts in the United States — General Motors Co. and Verizon Communications Inc. — opened the eyes of Canadian plan sponsors to the range of possibilities, says Benoit Labrosse, a partner in the asset and risk management practice at Morneau Shepell Ltd.

In the past four years, the market has been closer to $2.5 billion a year. “A few years back, there would have been a call for additional premiums to go for large transactions. That’s one of the interesting things for this year — we can see now what wasn’t a possible or affordable price a couple of years ago,” says Dickner, noting the depth of the market is allowing plan sponsors to entertain larger transactions without really affecting the price.

A report published by Eckler Ltd. in November noted the amount of pension obligations transferred to insurers annually through annuity buyouts or buy-ins has increased by more than 250 per cent over the past eight years. And Willis Towers Watson’s latest report found that while terminating plans once dominated the market, annuity purchases for ongoing plans represented the vast majority of transactions in 2017.

Read: Group annuity market could reach $10B over next three years: report

And there’s still a lot more to come, says Paul Forestell, president and chief executive officer at Brookfield Annuity Co. “Despite the dramatic growth in annuity placements, there’s still a huge amount of pension liabilities sitting on corporations’ balance sheets, which I would expect to move to insurers over the next 10 years.”

Indeed, the insurers surveyed for the Eckler report estimated Canada’s group annuity market could see up to $10 billion in risk transferred over the next three years, with some estimates reaching as high as $15 billion.

Solvency ratios on an upswing

One of the factors behind the growth has been pension solvency ratios, which are enjoying their healthiest levels in years. At the same time, many Canadian jurisdictions have brought in or are considering changes to their pension funding legislation.

“Funded ratios in Canada are at the best that they’ve been for many years,” says Brent Simmons, senior managing director of the defined benefit solutions team at Sun Life Financial. “What that means is plan sponsors finally have enough money in their plans to be able to purchase annuities without having to put in a lot of additional contributions.”

Read: Loblaw buys $350M in annuities for inflation-linked DB obligations

In the case of Loblaws, its pension plans had been relatively well-funded for a number of years, so it was looking for opportunities to transfer risk, says John Poos, group head of pensions and benefits at George Weston Ltd., Loblaws’ parent company. “Having said that, other plans are now approaching the same levels of funding status that we were in and are probably thinking very much along the same lines,” he says.

“I do think there’s going to be greater incentive and greater demand for annuities in the coming years,” he adds.

Annuity buy-ins gain popularity

While the traditional group annuity is a buyout, buy-ins have become much more prevalent in the past five years. In a buyout, a plan sponsor identifies a group of retirees to an insurer, which then estimates how long they’re going to live and, therefore, how much money to set aside to pay their pensions into the future. All of the responsibility for paying those retirees transfers to the insurer.

A buy-in follows the same process as a buyout, except there’s no transfer of responsibility. Instead, the plan sponsor pays a lump sum to the insurer, which then pays that money back into the plan every month. “An annuity buy-in is more of a behind-the-scenes insurance policy or investment that the pension plan can make to better manage its risk,” says Simmons.

Read: Pension longevity swaps and bulk-annuity deals to increase in 2016

One of the reasons for the increasing popularity of buy-ins is they’re an investment into the plan. “If the plan is underfunded, it doesn’t have to put in a top-up contribution,” says Simmons. “So that’s very different than an annuity buyout where, if the plan is 90 per cent funded and it wants to buy an annuity buyout for a group of retirees, it has to top up that piece that it’s buying up to 100 per cent.”

Buy-ins also don’t accelerate the payment of a plan deficit and they have a more favourable accounting treatment, says Dickner.

Eliminating the boomerang

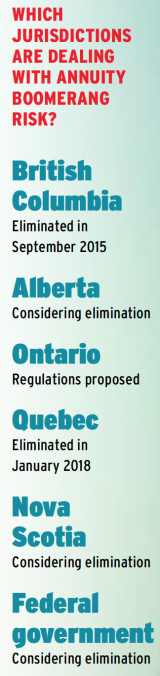

Quebec’s regulations, which took effect in January 2018, will fully eliminate boomerang risk after a three-year period. “So if the plan sponsor becomes insolvent five years after the annuity purchase, there’s no chance that any of the participants affected by the purchase will see their benefit being revised lower,” says Labrosse.

Ontario also intends to eliminate boomerang risk and, in December, announced proposed regulations related to discharges for obligations related to former and retired members. In Alberta, the pension regulator holds the view that a discharge of liability exists on annuity buyouts, but the government hasn’t formalized the issue in legislation, according to a spokesperson, who noted the province is aiming to amend its rules. On the other side of the country, Nova Scotia has published a consultation asking for feedback on the removal of the boomerang risk, but it’s still early days in that province. And on the federal side, the Office of the Superintendent of Financial Institutions is considering removing the boomerang risk. The details, however, are in Bill C-27, which has been slow to move forward due to opposition to its provisions around target-benefit pension plans.

Read: New DB pension proposals in Quebec, Ontario tackle annuity purchases

“Boomerang risk is a concern and it’s certainly one that, as it gets eliminated, will incent plan sponsors to be a little bit more proactive in this area,” says Poos.

Tailored transactions

Despite the threat of boomerang risk, Canada’s annuity market has seen a number of interesting transactions in the past year. Loblaws’ inflation-linked deal was an unusual opportunity, says Poos, noting indexed plans are never easy to annuitize. “There’s no magic in this. We don’t try to time the market but we do assess the likelihood that the market is receptive to certain liabilities and we go to market when we think it’s appropriate. It was one where the timing worked, the pricing worked and we executed it.”

Inflation-linked deals are a trend to watch, says Forestell, noting it used to be difficult to get good pricing for indexed pensions. “As insurers have got more comfortable with that, they’re able to give prices that make sense for a pension plan to transact, and I think that will continue to happen going forward.”

Another innovative transaction in 2017 was a combination buyout and buy-in annuity that benefited both inactive and active pension members. Simmons admits the circumstances of that transaction were unique. “It was a pension plan that was thinking of winding up in the next couple of years and so was looking for a risk transfer solution for its active members,” he says, noting one of the challenges in purchasing annuities for active members is the plan sponsor doesn’t know exactly what it’s buying.

Read: Annuities, funding policies among Quebec pension changes

“But because it was within the next couple of years, we were able to . . . come up with a mechanism to estimate what those pensions would be and then eventually true up those pensions when the annuities are actually purchased,” says Simmons.

“I don’t think it will be the last deal we’ll see, and it could translate into something completely different as well,” he adds.

Another potential development in the future is the rise of reinsurers in the market, says Forestell. “The reinsurance companies typically won’t transact directly with a pension plan, so they’ll partner with a direct insurer, and that adds capacity to the market. It would allow bigger deals to get placed, through the support of a reinsurer.”

And many industry participants agree there will be larger deals ahead. “We’ve seen a couple of very large transactions, so that’s something that will likely happen more often as we go forward, as insurers get more comfortable with the big transactions,” says Forestell, noting that even a $900-million deal in 2017 involved a number of insurers.

“The biggest we’ve seen with one insurer is about $500 million, so far,” he adds.

Read: Brookfield launches group annuity solutions company

While some of the developments reflect one-off transactions, they at least show the industry is getting creative, says Labrosse. “Most organizations are at least thinking about it, and a good chunk of these organizations have done some feasibility studies to establish what would be the advantages. . . . So this is a leading indicator that, one day, there will be a massive amount of transactions,” he says.

“We’re really just scratching the surface in terms of how much transactions and how much volume will be considered in the future,” he adds.

Jennifer Paterson is the managing editor of Benefits Canada.

Download exclusive annuities research by the Canadian Institutional Investment Network.