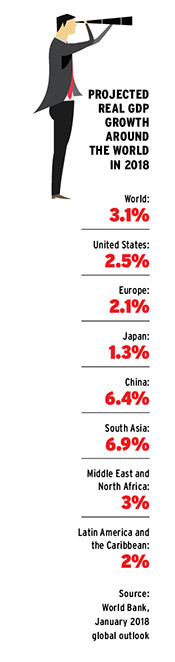

Canada and the world enjoyed a particularly strong economic performance last year. In Canada, the unemployment rate fell to just 5.7 per cent at the end of December, while the World Bank estimates the global economy grew by three per cent last year. So with those positive results in mind, what should institutional investors keep in mind as 2018 gets underway?

“It’s been a long time since the global economy has done better than expected for a full year,” says Doug Porter, chief economist and managing director at the Bank of Montreal, of the particularly strong performance in 2017.

Read: Investors urged to beware of unwelcome surprises in 2018

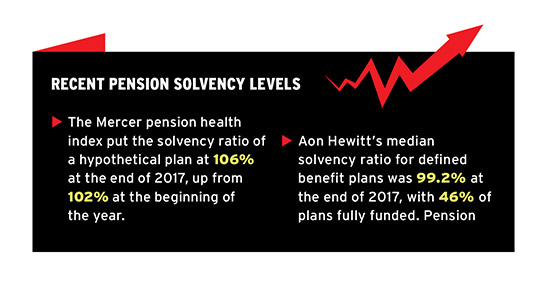

Despite the solid result and the concomitant positive effect on solvency levels, pension plans and other institutional investors are staring at a calendar that’s full of uncertainties. But whether it’s a strained market in traditional asset classes, geopolitical risk, trade tensions or interest rate changes, there’s always a way to turn a shifting environment to an investor’s advantage, says Zev Frishman, chief investment officer at Morneau Shepell Asset and Risk Management Ltd.

“Unless you believe something like this will be the end of the world, typically in the past, these things have been opportunities to buy,” he says, referring to some of the more dramatic points of geopolitical tension, such as North Korea.

Interest rates

Interest rates, of course, are one of the key considerations.

“Life support is definitely being removed by central banks globally,” says Angus Sippe, multi-asset portfolio manager at Schroders.

The consensus that central banks are feeling comfortable with gradually hiking interest rates is a direct result of improving macroeconomic conditions, says Rahul Khasgiwale, senior investment director at Aviva Investors Canada Inc. “We do think global markets are at a crossroads and that investors should embrace those changes, accordingly, as we see more normalization,” he says.

Read: Higher interest rates, monetary policy top issues for global investors in 2018: survey

South of the border, Porter expects the U.S. Federal Reserve to boost interest rates three times next year, widening the gap with Canada even more.

Geopolitical risks

While the fund doesn’t necessarily have direct exposure in a given region suffering from heightened tensions, it’s important to think holistically about how global events can affect investments tangentially, says Brodersen.

Trade protectionism, in particular, has the potential to blunt upward momentum globally and lead to upward pressure on prices since “it can lead to weaker growth and higher inflation insofar as it throws sand into the gears of global trade,” says Porter.

Read: Institutional investors expect volatility spike in 2018

Sanctions also have the power to slow things down, says Brodersen. “Trade sanctions have become the weapon of choice for disputes among countries right now. Russia does things in Crimea or Ukraine that other countries aren’t happy about, and the response is not really a military response; it’s a trade sanction response.”

And then, of course, there are the ongoing negotiations around the North American Free Trade Agreement. “The single biggest risk factor we’re looking at is the uncertainty around NAFTA,” says Porter.

In Porter’s view, shifting the U.S. administration’s priorities away from NAFTA would be the best-case scenario. Much-discussed tax reforms could be a distraction for Republicans that could reduce the pressure on them to make a show of force on trade if they can claim a victory in another area. “Worst-case scenario would be if the talks go completely off the rails, the president does try to terminate the deal and we get into a legal quagmire with Congress,” says Porter.

Porter expects the matter will land somewhere in the middle, with Trump not ripping up NAFTA per se but continuing to create friction that will weigh on business in Canada, the United States and Mexico.

A NAFTA renegotiation could also hurt areas of the U.S. economy, says Sippe. “There are sectors within the U.S. — for example, agriculture — that are also vulnerable.” Managing those types of what-if scenarios is very difficult, so when they come up, investors need to make a conscious decision about whether they want to play that game, he says.

Read: NAFTA’s demise ‘vastly overstated’: economist

In Europe, where the issues have been quite regionally specific, there’s an opportunity to capture the power of rotating acute risk, says Sippe. A strategy for that type of scenario, he says, is to divest from an area prior to a risk-heavy situation, only to pounce once the markets have priced in the maximum pessimism. “Markets move too far, too fast,” says Sippe.

“Tactically, we’re buying Spanish equities and selling Italian equities. We’re buying where markets have overpriced in political risk and we’re fading markets where the upcoming political risks are not being priced yet,” he says. Spain, of course, has faced significant turmoil around the Catalonia independence referendum and elections in recent months.

War is also an unfortunate possibility investors will need to consider this year, says Frishman. A conflict on the Korean peninsula could trigger panic in the markets, he notes. “Frankly, we deal with a very belligerent and perhaps irrational leader. And you have now a situation where you have somewhat of an irrational leader in the U.S. as well. So it can end up badly,” he says.

“People are not just going to look and say, ‘The U.S. is expensive, so sell there and keep the rest.’ When panic sets in, it affects everything,” he adds, noting that in that scenario, government bonds are the only thing that would do well as investors flee to safety.

Read: Catalonia turbulence puts damper on regional investment prospects

Investors have also been watching as China’s economy has “quietly done quite well,” says Porter. “It’s one of the reasons why the global economy has done better than expected.”

He also believes the trade imbalance between the United States and China will become a point of tension over the next year. “We’re dealing with a very protectionist administration. Half the U.S. trade debt is with China. I think that’s where the friction is going to arise,” he says.

For his part, Khasgiwale doesn’t take China’s relative economic health, as it moves towards a more consumer-driven scenario, as a given for the future. “As we know, smooth transitions are rare in economic development,” he says.

Equities

In light of the broader trends, what’s the outlook for equities?

“European and emerging market equities no longer look especially cheap. But relative to the U.S., we believe they’re more attractive in terms of valuation,” says Khasgiwale.

Indeed, with benchmark indices hitting new highs throughout 2017, investors have to wonder how much more room equities could possibly have to rise before they see some kind of correction, says Porter.

The United States represents about half of the world’s equity market capitalization, says Frishman, adding that, based on almost every valuation criteria, U.S. equities are pricey. “If there is something that causes it to go back to fundamental valuations, this is a market that I would argue is vulnerable more than others,” says Frishman. As for Canada, a big reversal looks unlikely, he adds.

In terms of sector specifics, Sippe likes banks since they “should become more profitable with higher interest rates and steeper curves globally.”

Investors should watch for a decoupling of energy equities and commodity prices, specifically for oil, says Sippe. “Energy price appreciation is not going to be as beneficial for energy equities going forward, and there are other asset classes where you might be rewarded better for that,” he says, pointing to oil-sensitive currencies like the Canadian dollar and the Norwegian krone, as well as the commodities themselves.

Read: Canadian pension funds like energy stocks despite potential rejection in Norway

Consumer discretionary goods are another area where it’s wise to exercise caution, according to Porter. Despite low savings rates in the United States and high household debt levels in Canada, “we still think consumer spending can grow. I just don’t think we can continue to see it grow at the kind of pace we’ve been seeing in recent years,” he says.

The often-painful practice of value investing isn’t without risk but it looks more attractive in the current environment, says Sippe. “We continue to have a value tilt in our equity allocations globally and we believe that’s the right way to be.”

Fixed income

A lot of factors are stacking up against the bond market, says Porter. The market is at a point in the investment cycle where bonds tend to begin to weaken, he says. At the moment, bonds are also contending with the U.S. Federal Reserve winding down quantitative easing and the European Central Bank starting to reduce its purchases as well, he adds.

Investment-grade corporate and high-yield credit spreads are also close to their lowest levels since 2008, says Frishman. “In that respect, we remain moderately optimistic on the outlook for credit, with the risk that increased volatility could lead to a widening in spread,” he says.

In the ongoing quest for yield, however, Frishman says he has seen an increased interest in riskier types of credit, such as covenant-like bonds and leveraged loans.

Read: Fixed-income investors expecting modest global growth, eyeing alternative credit: survey

Typically, pension plans severely restrict non-investment-grade fixed-income securities to a specific percentage of the portfolio, says Frishman. However, in today’s environment, he classifies investment-grade bonds as a terrible option since the yield barely keeps up with inflation. As such, riskier fixed-income options, which require further due diligence, are in greater demand these days, he says.

Brodersen predicts the near desperation could lead to some questionable choices in the credit markets. “In past credit cycles, we’ve always gotten to the point where, after the credit bubble bursts, people look back and go, ‘What were we thinking?’ So I am worried that we’re going to end up in that situation again.”

Alternatives

The demand for good-quality alternative investments outweighs the supply, making valuations for assets like infrastructure and private equity very expensive right now, says Sippe.

Indeed, alternatives are the place to be for “very sophisticated pension plans with huge resources,” says Frishman. “They can go into call it funky areas, like aviation finance and private debt or some private debt in Asia and so on. And they can find the good value there because they have very deep resources to go and do the very deep due diligence.”

Frishman says he’s going to be watching out for what the fledgling Investment Management Corp. of Ontario does.

“They’re trying to encourage a lot of smaller public plans to join, because that will allow them again to leverage the far larger resources of the larger plans and be able to participate in these,” he says.

Read: Options for small plans to invest like the big pension funds

Investors will have to wait and see if the political noise surrounding infrastructure spending in North America will translate into actual growth, says Porter. “I do think North America’s got tremendous opportunities in the midterm,” he says, noting it’s unclear whether activity will take off on the scale U.S. and Canadian politicians have promised.

For pension plans, the stakes are high. “There’s this ongoing search for yield, especially among pension plans,” says Brodersen. Dramatically low bond yields, he notes, have “brought them to things like infrastructure, and we’ve seen those valuations climb quite significantly over the last number of years. We’re still targeting those asset classes, but it’s not easy.”