State-owned institutional investors reached a combined US$60 trillion in assets and foreign reserves in December 2025, according to a new report by Global SWF. The total includes assets managed by sovereign wealth funds, public pension funds and central banks, all of which expanded their balance sheets during the year. Sovereign wealth funds surpassed $15 trillion […]

In its 2025 budget, the federal government announced several initiatives to incentivize institutional investors to back domestic infrastructure and business ventures. The budget proposed $1 billion on a cash basis over three years, starting in 2026-27, for the Business Development Bank of Canada to launch a venture and growth capital catalyst initiative, a fund-of-funds that […]

It’s a generally recognized fact that institutional investors in the Nordic region pioneered the approach to sustainable investing, including incorporating environmental, social and governance factors. Sweden’s large public pension funds — AP1, AP2, AP3, AP4, AP6 and AP7 — are regulated by a law introduced in the early 2000s stipulating that sustainability needs to be […]

The Canada Pension Plan Investment Board and the Caisse de dépôt et placement du Québec were ranked No. 3 and No. 8, respectively, among the top 10 global institutional investors with the highest total deal values in 2024, according to a new report by data platform Global SWF. Last year, the CPPIB invested US$21.1 billion while […]

According to Statistics Canada, 80 per cent of Canadian public sector workers benefit from a respectable, life-long pension. However, for many private sector employees the quality of the pension plan available to them leaves much to be desired. The typical private sector pension is a defined contribution plan, which means employees bear the risk of […]

Evolving expectations, a shifting interest rate environment and the need to manage increasingly large asset bases for performance and for national and societal impact are transforming how and where institutional investors allocate capital, according to a new report by the Boston Consulting Group. It found in 2024, sovereign wealth funds and public pension funds accounted […]

The federal government’s recent decision to transfer a $1.9 billion surplus from the Public Service Pension Plan to its general revenue is within its purview, says Mitch Frazer, a pension lawyer and managing partner at Mintz, Levin, Cohn, Ferris, Glovsky and Popeo. “[This situation is] slightly different because this plan is made by a statute and, […]

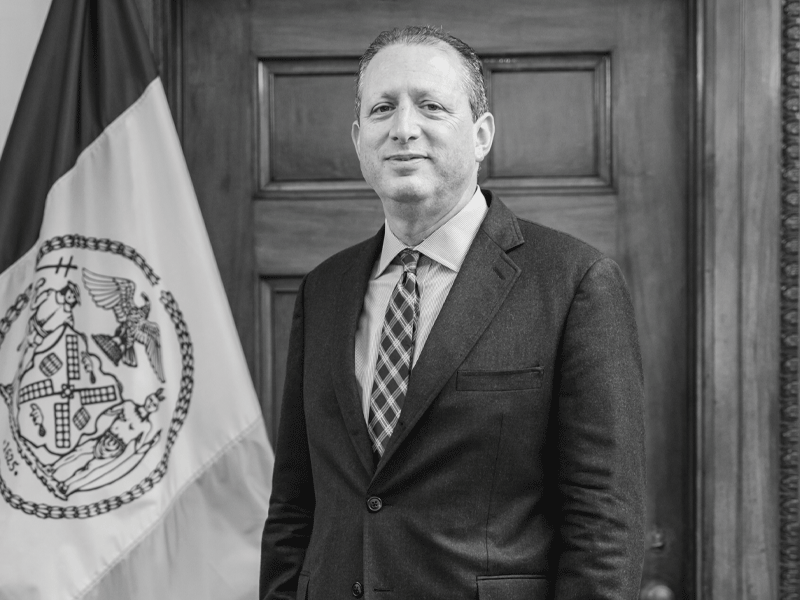

Brad Lander is advocating for public pension funds to enforce their responsible investment mandates even if that pits them against their partners. As New York City comptroller and chief financial officer, he’s the investment advisor and custodian for the city’s five public pension funds. In the role, he oversees the investment guidelines and allocations strategy […]

Canadian institutional investors are allocating only three per cent of their funds to domestic equities, according to a new study from London-based think thank New Financial LLP. The report, which analyzed 13 countries’ pension systems, found the U.S. had the highest allocation to domestic equities (44 per cent), while Norway had the lowest (0.5 per cent). […]

U.K. Chancellor Rachel Reeves met with some of Canada’s biggest public sector pension plans this month, as the country looks to reform its public pension system, according to a report by the Financial Times. Reeves is pursuing the creation of a pension model that would allow the U.K.’s local government pension scheme — worth about […]