Not everyone can say they’ve spent two decades at the same organization, but Candy Wong, portfolio manager of external managers and international strategies at Manitoba’s Civil Service Superannuation Board, is now in her 21st year at the public sector pension plan.

“I don’t think you can foresee where you’re going to be, especially in finance. . . . I just wanted to learn as much as I [could] and be prepared for whatever doorways would open.”

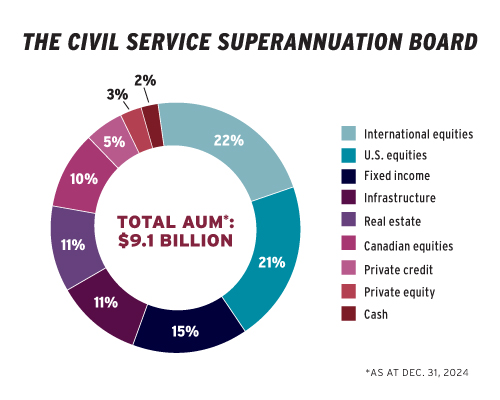

During this time, Wong has learned to apply a curiosity and do anything possible to gain a better context around any investment subject. In her role, no two days are alike, as her list of responsibilities span monitoring international equities, overseeing risk management and reviewing the portfolio through an environmental, social and governance lens. Her work also involves a lot of quarterly manager review preparations, daily holdings analysis and creating reports for the investment committee.

Getting to know

Candy Wong

Job title:

Portfolio manager of external managers and international strategies, Manitoba’s Civil Service Superannuation Board

Joined the CSSB:

2004

Previous role:

Portfolio manager, international equities, the CSSB

What keeps her up at night:

The current state of geopolitics affecting the world

Outside of the office she can be found:

Enjoying great food, planning trips and reading plenty while finding time to lend her expertise by sitting on the Manitoba Public Insurance and Community Financial Counselling Services boards

Read: Canadian institutional investors with U.S. investments facing impact from currency volatility

Throughout her time at the CSSB, she’s witnessed firsthand how an asset like emerging market equities can go from outperforming for little more than a decade following the global financial crisis to now underperforming relative to global markets in the last decade. “It feels like it went by really fast and the investment landscape has changed a lot from then to now.”

Wong has also been fascinated by investors’ reactions over the last few years as the low interest rate landscape that followed the financial crisis shifted to higher rates in the wake of the coronavirus pandemic. “That’s been really interesting.”

Since she joined the CSSB in a role evaluating international equities, she’s seen an uptake of assessment strategies for global operations, thanks in large part to a globalization effect that’s pushed corporations to rely on global integration. “Economies are more globally integrated, so you have to know the bigger macro picture when you’re assessing different investments.”

Read: Public equities account for 42% of global asset owners’ portfolios: report

However, current market dynamics are pointing to instability for a continued globalized effort, with tariff policy and trade showing signs of heading towards deglobalization, she adds. “Is that something that’s [going to last] forever or is that something that’s for the next three years? It has an impact on how we invest and assess the macro environment, because there’s just too much uncertainty and no one knows where to invest, so [companies] just don’t invest.”

At CSSB, which is a longterm investor with an extended time horizon, she favours a free global trade environment from an economics perspective, but she acknowledges the uncertainty of the ongoing disruption to global trade.

Indeed, talk of tariffs and trade has serious implications for investment volatility, but Wong says the plan sponsor always aims to build a resilient portfolio with a focus on longterm capital market assumptions. It’s also set up to take advantage of short term deals if there are tactical opportunities available, she adds.

Read: Emerging markets regions building resiliency amid geopolitical shifts, tariff woes

International equities have shifted from a dominant market for financials and telecommunications to now being more technology based with a preference for companies that are a big part of the benchmark, says Wong. Her own investment compass is guiding her to consider thematic growth opportunities like the rise in the middle class in emerging markets alongside the increase in technology across these jurisdictions.

“Technology is important in emerging markets with exposure to Taiwan and Korea. . . . [We’re] making sure [our asset managers] are good stock pickers, finding quality companies with a sustainable value proposition.”

In her role overseeing ESG at the CSSB, Wong aims to focus on social and governance considerations by assessing different risks within the portfolio. The pension plan doesn’t have a netzero goal, she adds, noting that, instead of counting on what she describes as a rigid process, the team is more focused on broadly understanding and being aware of the material risks associated with using an ESG lens.

Bryan McGovern is an associate editor at Benefits Canada and the Canadian Investment Review.