Peter Shaker’s job requires him to stay connected with the financial world, its economic movement and any developing investment trends — mainly, what’s making people nervous these days.

“A lot of it is keeping up to date with what’s going on in the world, economic trends, investment trends, what’s scaring people, what’s keeping people somewhat satisfied and making sure that our invested asset portfolio . . . makes sense,” says the Co-operators Group Ltd.’s assistant vice-president of treasury, investments and pensions.

Getting to know

Peter Shaker

Job title:

Assistant vice-president, treasury, investments and pensions, the Co-operators Group Ltd.

Joined the Co-operators:

2021

Previous role:

Assistant vice-president, corporate financial reporting, Co-operators

What keeps him up at night:

The threat of unpredictable tariff policy from the U.S. and its impact to the Canadian economy

Outside of the office he can be found:

In the summer, at the golf course, but more regularly, just trying to keep up with his two young daughters’ busy dance competition schedules

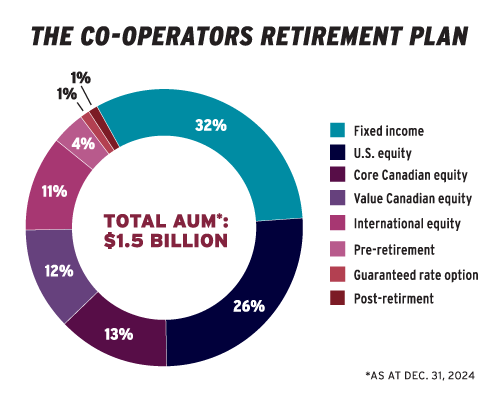

In the role, he’s responsible for managing both the organization’s defined contribution plan and a grandfathered defined benefit plan that was brought in through the acquisition of CUMIS Group Ltd. “It’s a smaller plan. . . . We do have a committee that meets quarterly to make sure the solvency ratios are OK and whether we need to change our asset mix.”

Read: Expert panel: Risk management tips during economic, geopolitical uncertainty

Shaker started his career as a chartered professional accountant, but a technical detour in the investment finance department at Sun Life Financial Inc. created a passion to learn about a variety of investment topics and the process behind it all. He joined the Co-operators in a corporate financial reporting role, but has since been able to transition to fully deploy his newfound investment learnings.

Pension fund administrators have a lot to consider in the modern economic landscape. Severe volatility is starting to impact longterm plans and the trade conflict between Canada and the U.S. is creating uncertainty about the subsequent impact on investors’ portfolios moving forward. However, Shaker doesn’t see any of this causing a significant reconsideration in allocations. “When an economic event or a political event happens, a lot of individuals are quick to react. . . . If you understand your risk appetite well and your investments are within that risk tolerance limit, [you] don’t always react to every little news because, over the long run, the returns always come back.”

However, the ongoing tension between the two countries is causing some plan members to question allocations to U.S. equities, he says, noting he cautions members to consider a long-term lens. In the face of accelerated volatility, particularly in public equities, some investors may end up relying on allocations to cash and shorter-term fixed income, he adds. “I think you’re going to see that trend a little bit more, where you’re allocating more to safer assets that still give you a solid yield, so you don’t have to worry about volatility — and with private assets, the liquidity factor is a big concern.”

Read: Institutional investors turning to diversified portfolios to manage tariff volatility: expert

In the previous low-interest rate environment, private assets played a bigger role in institutional investors’ portfolios, but now, he wonders if the trend will continue to accelerate. “You have to weigh the risk and benefits of private assets. Is the additional yield worth it when you’re giving up liquidity?”

As an insurance firm, the Co-operators is in a unique position when it comes to climate transition risks and the ongoing dialogue on the use of sustainability investment metrics. In its most recent annual results, Rob Wesseling, the organization’s president and chief executive officer, highlighted significant challenges from a series of record-breaking climate-related weather events.

At the end of 2024, more than half (52.6 per cent) of the Co-operators’ investments were directed to climate transition and impact investments with an overall target of investing 60 per cent to these causes by 2030. The organization is committed to sustainability and resiliency investing, says Shaker.

Bryan McGovern is an associate editor at Benefits Canada and the Canadian Investment Review.