In a year marked by unpredictability and an unexpected rift between Canada and the U.S., Sophie Leblanc wants to look forward in McGill University’s investment strategy and avoid pitfalls from short-term volatility.

“I’m less concerned with short-term volatility,” says the university’s chief investment officer and treasurer. “There has been a lot of short-term volatility and a lot of unexpected risk this year, more [from] geopolitical risk rather than anything else. . . . The portfolio is resilient and diversified [enough] to make sure that we’ll have long-term good results, even with short-term volatility.”

Getting to know

Sophie Leblanc

Job title:

Chief investment officer and treasurer, McGill University

Joined McGill University:

2014

Previous role:

Director of investments, Bombardier Inc.

What keeps her up at night:

How her team can improve, stay curious and disciplined in the face of risks emerging from unexpected places

Outside of the office she can be found:

Expertly crafting her next vacation destination to avoid all tourist traps

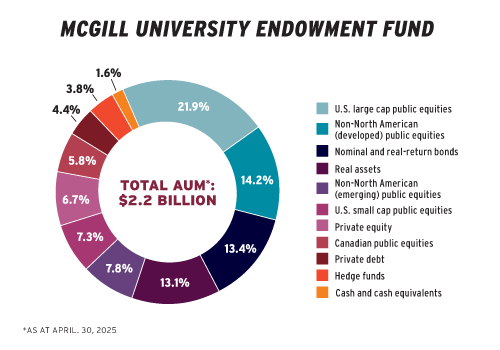

As the leader of a six-person investment team, Leblanc oversees the investment direction of the school’s $2.2-billion endowment fund, a capital preservation vehicle with a diversified portfolio providing dependable income to the university. In the year ended April 30, 2025, the fund beat its benchmark for the second year in a row, due to a 10.2 per cent investment return.

Read: Caisse backing McGill’s sustainable growth initiative

“I’m not really concerned if we beat the benchmark. . . . I’m concerned about long-term performance and [ensuring] the risk and the portfolio are aligned with the return and objective.”

The endowment fund has evolved significantly by gradually introducing exposure to alternative assets in the portfolio mix, she says. “Understanding the portfolio was the first step, . . . I realized that, for the team, it was too complex [and] you need to align the complexity of the portfolio with the size and the experience of the team.”

Nearly 10 years later, Leblanc has found the right balance, with her team pursuing niche investments in alternative markets. The portfolio’s alternative asset mix stands at 28 per cent across a variety of investments. “We slowly but surely want to increase the private assets where there’s more growth [and] more value.”

Over the next three years, she intends to increase exposure to these assets to between 30 and 35 per cent. A large and expensive concentration in U.S. public equities is also aiding the gradual push into alternatives, even though in the last five years, performance was bolstered by successful fund selection in U.S. equity strategies, according to the organization’s latest financial report.

Read: Scaling up private assets at Western University

Leblanc is particularly interested in opportunities attached to energy assets that are fuelling advanced computing solutions amid the current demand for artificial intelligence. “We made some allocations in data centres last year and now we want to go more with the infrastructure around electrification. . . . We believe there’s a lot of space to increase our allocation there.”

In recent years, the university’s investment office has faced questions about divestment as a method to decarbonize the endowment fund’s portfolio. In response, the organization implemented a responsible divestment from segregated holdings in the ‘Carbon Underground 200,’ a list of the world’s top 200 publicly-listed coal, oil and gas reserves owners.

It’s also increasing its active ownership scope to leverage social and governance engagements, as well as including fixed income corporate securities in its carbon footprint calculation.

Leblanc says these decisions reduced the fund’s carbon emissions by more than half. While her team can’t be reactive to every community demand, she welcomes the feedback because the fund is better served by being exposed to sustainable investment assets in the long run.

Bryan McGovern is an associate editor at Benefits Canada and the Canadian Investment Review.