Halifax Port ILA/HEA assessing past, future of DB pension plans

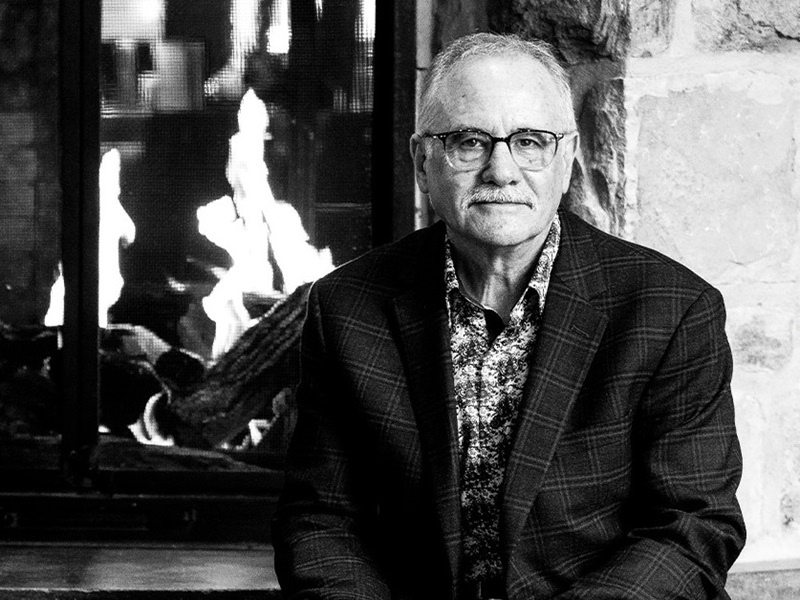

While Blair Richards understands why the industry is moving away from defined benefit pension plans, he worries about what may be lost in the process.…

- By: Bryan McGovern

- February 9, 2024 February 8, 2024

- 08:55