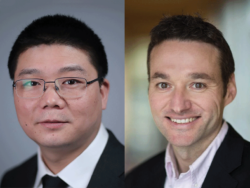

AIMCo appoints Ray Gilmour as CEO

The Alberta Investment Management Corp. is permanently appointing Ray Gilmour as the organization’s chief executive officer, a role he has held on an interim basis…

- By: Staff

- December 16, 2025 December 16, 2025

- 15:00