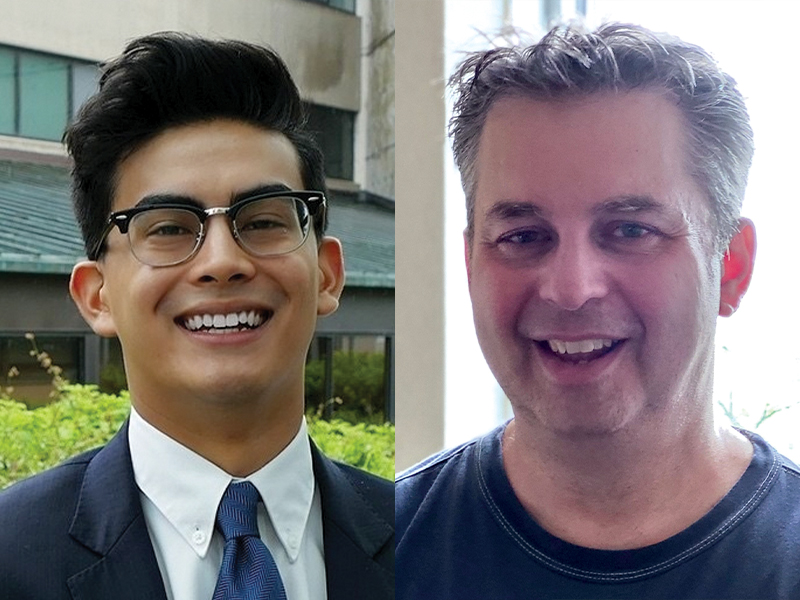

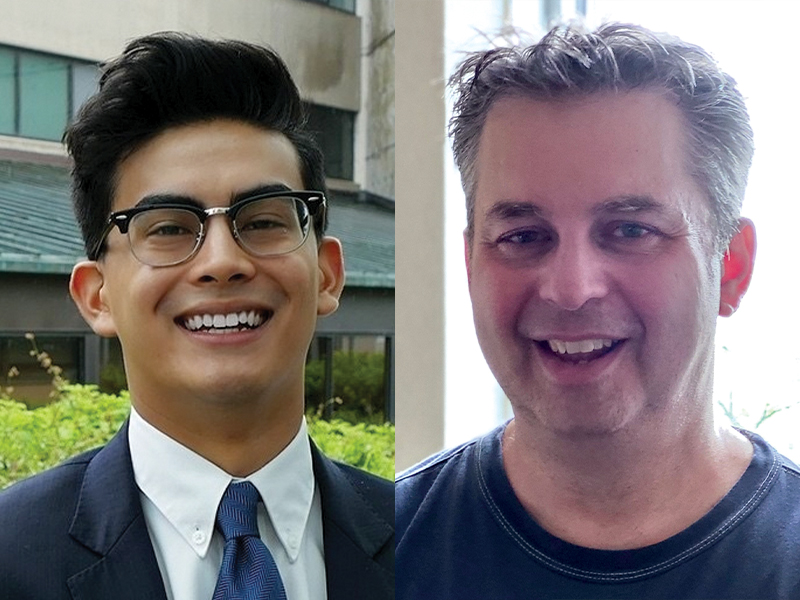

Head to head: Should employees be saving for retirement or focusing on other financial priorities?

As Canadians face continued economic uncertainty, a recent university graduate and a long-time teacher share their views on balancing different financial priorities. Sul Mahmood, age…

- By: Leah Golob

- October 14, 2022 October 14, 2022

- 08:59