During the launch of the University Pension Plan, Barbara Zvan, its president and chief executive officer, knew getting to know the plan’s members was vital to its goal of providing a strong, resilient fund that secured benefits for generations to come. To find out what was important to plan members, the UPP engaged them to find out […]

As sustainable investing continues to gain widespread acceptance among institutional investors, full integration is projected to surge in the next five years, according to a new study conducted by Coalition Greenwich and commissioned by AGF Investments. It found nine in 10 institutional investors in North America and Europe expect to be investing sustainably or working […]

Investments in low-carbon activities leading to positive environmental impacts make up 16.2 per cent of the Public Sector Pension Investment Board’s total assets under management, according to a new report by PSP Investments. A report reviewing the investment organization’s sustainability progress found its current green assets represent $48.9 billion. It credits its ‘green asset taxonomy’ […]

An article on the Ontario Court of Appeal upholding its decision in the Brewers Retail Inc. pension case was the most-read story on BenefitsCanada.com over the last week. Here are the five most popular news stories of the week: 1. Court of Appeal upholds decision in Brewers Retail pension case 2. Are insurers updating their benefits policies to include […]

A majority (98 per cent) of Canadian institutional investors consider climate change a top environmental, social and governance focus area, according to a new survey by consultancy Millani. The survey, which polled 40 institutional investors with more than $5.8 trillion in assets under management, found they also ranked diversity, equity and inclusion (45 per cent) and […]

Institutional investors in Asia and Europe are at the forefront of adopting environmental, social and governance investment strategies, while North America lags behind, according to a survey by Coalition Greenwich. Globally, the survey found 75 per cent of investors incorporate ESG strategies, with Europe leading at 92 per cent followed by Asia at 76 per […]

An article on how Yellow Corp.’s bankruptcy will impact Canadian workers’ pensions was the most-read story on BenefitsCanada.com over the last week. Here are the five most popular news stories of the week: 1. Yellow bankruptcy will have little impact on Canadian workers’ pensions: union 2. FSRA appoints Andrew Fung as EVP of pensions 3. Wildfires crystallizing threats of catastrophic […]

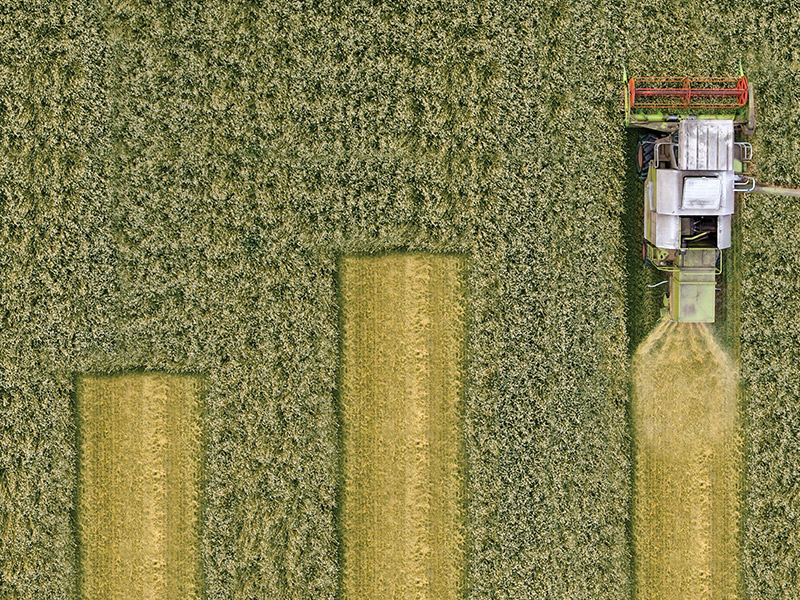

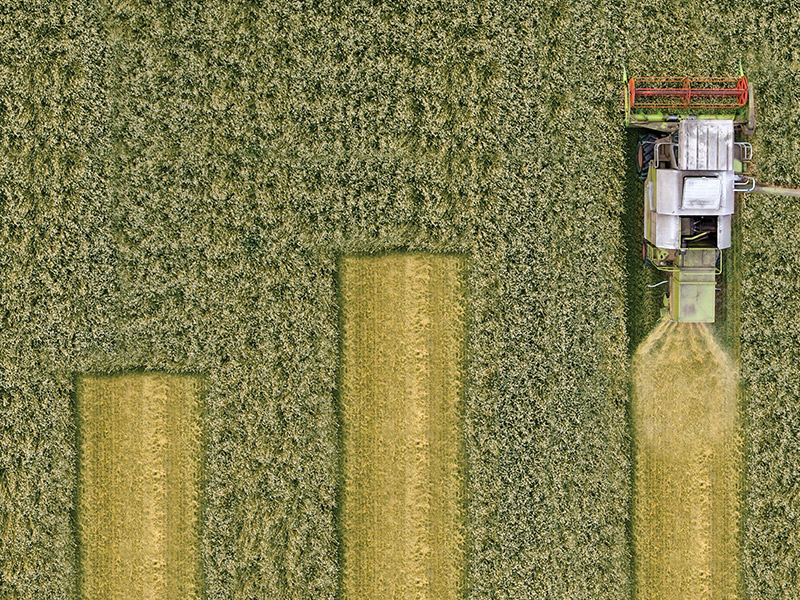

Despite the prevalence of farming in its home province, the Alberta Investment Management Corp.’s agricultural portfolio is just 13 years old, the product of a 2010 investment in converted farmland held by Australian timber producer Great Southern Group. The properties proved too arid for tree growth and were converted back to croplands for canola, wheat […]

British Columbia’s wildfires have crystallized the threats pension plan administrators across that province face from catastrophic climate change events, says Damara Kiceniuk, senior risk analyst of pensions at the B.C. Financial Services Authority. However, these fires are just one catastrophic risk pension funds have to manage. These risks have prompted the organization to release a discussion […]

Approaches to climate scenario analysis are currently based on “implausible” assumptions that could delay action and create fiduciary duty challenges for investors, according to a new study by the Institute & Faculty of Actuaries. Sandy Trust, head of organizational risk at M&G, a global investment manager headquartered in London, England and one of the authors […]