Nine in 10 (89 per cent) U.S. defined benefit pension plan sponsors say they’re expecting to completely divest their plan liabilities in roughly four years, according to a new survey by MetLife Inc. The survey, which polled 250 DB plan sponsors, found nearly all (94 per cent) said the financial impacts of volatility and related risks […]

The Alberta Investment Management Corp. is opening its first Asian office, but the Edmonton-based investment organization says it will steer well clear of China to focus instead on markets with less geopolitical risk. The official opening of the AIMCo’s new Singapore office marks the first foray into the Asia-Pacific region for one of Canada’s largest institutional investors, with $158 billion of assets under management as of 2022. Evan Siddall, chief executive officer of the AIMCo, […]

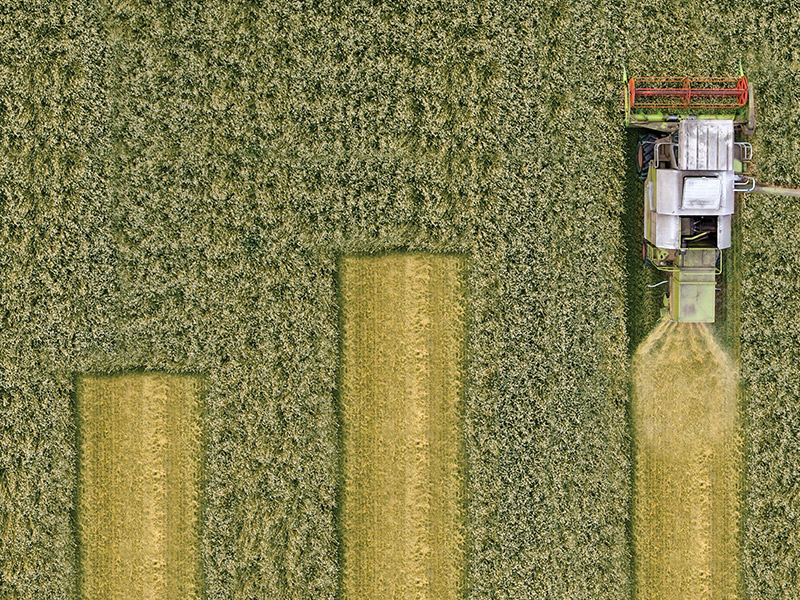

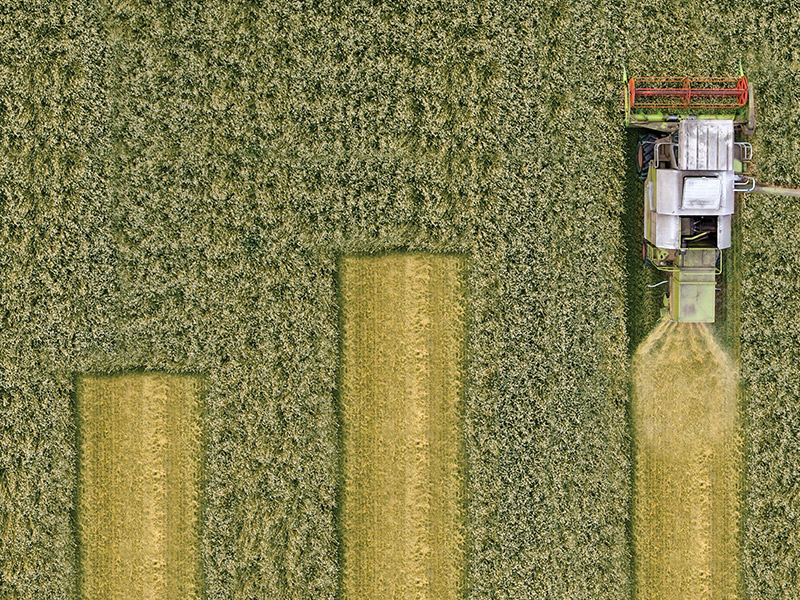

Despite the prevalence of farming in its home province, the Alberta Investment Management Corp.’s agricultural portfolio is just 13 years old, the product of a 2010 investment in converted farmland held by Australian timber producer Great Southern Group. The properties proved too arid for tree growth and were converted back to croplands for canola, wheat […]

Environmental, social and governance investing is a powerful tool that can reveal systemic issues impacting all parts of institutional investors’ portfolios, said Aaron Bennett, chief investment officer of the University Pension Plan, during the 2023 Responsible Investment Association conference last week. Some of these issues can accrue over time — and, when they finally manifest, they can […]

While China’s presence on emerging market indexes may be shrinking, the case for investing in it remains compelling, said Vivian Lin Thurston, a partner and portfolio manager for emerging markets growth at William Blair Investment Management, during a session at the Canadian Investment Review’s 2023 Global Investment Conference. “China now accounts for approximately 31 per […]

At the best of times, selecting an optimal asset mix for a defined benefit pension plan is challenging. The times of today are downright turbulent. Last year, inflation reached 8.1 per cent in Canada as a result of a prolonged period of government stimulus spending to manage the fallout of the coronavirus pandemic. In response […]

Factors such as population demographics, productivity and geopolitics impact economic growth and, by extension, the retirement outcomes of defined contribution pension plan members over longer-term time horizons, said Jon Knowles, senior investment analyst at Fidelity Canada Institutional, during a session at Benefits Canada‘s 2023 DC Plan Summit. Ageing populations have traditionally been viewed as a dis-inflationary force due […]

Representatives from six of Canada’s largest public sector pension investment organizations addressed a special parliamentary committee on Monday. The special committee on the Canada–People’s Republic of China Relations called on the British Columbia Investment Management Corp., the Canada Pension Plan Investment Board, the Caisse de dépôt et placement du Québec, the Ontario Teachers’ Pension Plan […]

Amid the unprecedented events of the last three years, the Colleges of Applied Arts and Technology pension plan has remained on course with its investment strategies, according to Asif Haque, the plan’s chief investment officer. “We held our focus on the key goal of the CAAT’s investment program. . . . The plan’s diversified asset […]

Despite the challenging economic environment, Canadian defined benefit pension plans saw a median return of 4.27 per cent in the fourth quarter of 2022, according to BNY Mellon’s Canadian master trust universe. The universe, which is based on $290.3 billion worth of assets under management across 84 corporate, public and university pension plans, found the one-year median […]