The last decade has seen seismic shifts in geopolitical, macroeconomic, capital market and technological trends. Today, uncertainty abounds: U.S. policy has become increasingly erratic, and artificial intelligence is advancing at a pace that promises massive productivity gains as well as disruption. How can investors navigate so much change and ongoing uncertainty? Here are some lessons […]

The Caisse de dépôt et placement du Québec returned 9.3 per cent for 2025, below its benchmark portfolio’s 10.9 per cent return, according to the investment organization’s latest financial report. The investment organization’s five-year and 10-year annualized returns were 6.5 per cent and 7.2 per cent, compared to benchmarks of 6.2 per cent and 6.9 […]

CPP Investments says it had a net return of 0.5 per cent in its third quarter for a growth rate well below its longer-term track record. The independent investment manager for the Canada Pension Plan says it ended the third quarter with $780.7 billion in net assets, up from $777.5 billion in the previous quarter. Read: CPPIB […]

After a record-setting 2024, the Canadian group annuity purchase market experienced a moderate slowdown in 2025, according to a new report by Normandin Beaudry. It found transaction volume reached nearly $6.9 billion, a decline of nearly 40 per cent compared with the $11 billion recorded last year and roughly 10 per cent below the average […]

The funded status of a typical Canadian defined benefit pension plan increased on both a solvency and accounting basis during the month of December, according to a new report by Telus Health. The monthly pension index revealed the typical DB plan grew slightly from 107.4 per cent in November to 109 per cent on the […]

Over the last 80 years, the TTC Pension Plan has grown from a contribution of $250,000 and a small team within the Toronto Transit Commission to a Maple Middle pension fund with close to $10 billion and a team of 42 people serving 28,000 members. “We’ve built a model where we’ve tried to learn from […]

The median solvency ratio among Canadian defined benefit pension plans was 132 per cent as of Dec. 31, 2025, an increase of seven per cent during the year, including three per cent in the final quarter, according to a new report by Mercer Canada. The report, which analyzed more than 470 plan sponsors, found Canadian […]

After a year of steady performance, fixed income markets could kick off 2026 with concerns from a macroeconomic standpoint, says Steve Locke, chief investment officer of fixed income and multi-asset strategies at Mackenzie Investments. “We’re seeing some fiscal and GDP tailwinds that are going to start to form fairly early in the new year. In […]

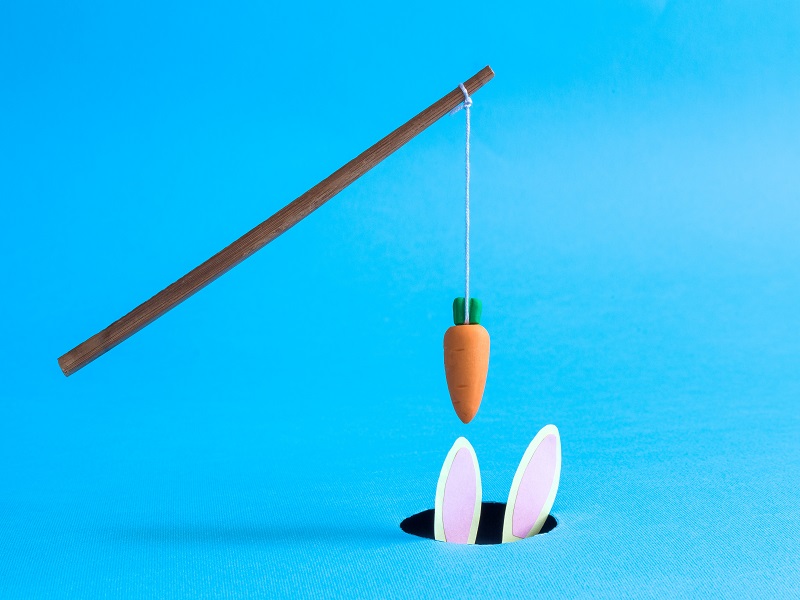

Economic headwinds, cost pressures and shifting employee expectations are forcing organizations to rethink performance compensation. Traditional pay-for-performance models, built for more predictable business cycles, are showing signs of strain. Many leaders are now asking a difficult but necessary question: are salary increases and incentive awards still tied to performance, or have they evolved into entitlements? […]

As institutional investors navigate complex markets and demanding governance requirements, Grace Uniacke, director of alternatives solutions at Russell Investments, suggests they move their portfolios from disconnected compartments towards integrated, connected systems. “This can be done in incremental tweaks, but more so as a structural upgrade to how we design, construct and manage institutional portfolios,” she said during […]