While workplace savings programs have traditionally focused on retirement, there has been a shift in recent years to facilitate employees’ changing financial priorities and savings journeys.

Benefits Canada’s 2025 Employee Savings Survey (formerly known as the CAP Member Survey) found three-quarters (73 per cent) of Canadian employees ranked paying for day-to-day expenses among their top three financial priorities, followed by mortgage or rent (60 per cent), personal non-mortgage debt such as credit cards (50 per cent), saving for retirement through personal or workplace savings plans (42 per cent), personal emergency funds (39 per cent) and savings for a specific purpose (36 per cent). Just 13 per cent said they’re very confident in their employer-sponsored capital accumulation plan.

Finances in good shape

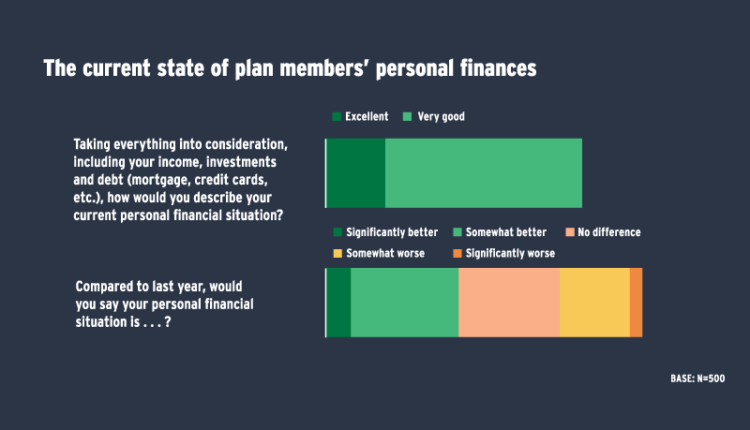

Despite the economic backdrop, the survey also found nearly half (46 per cent) of respondents described their personal finances as excellent and a similar percentage (42 per cent) said their financial situation is better than the previous year, up slightly from 40 per cent in 2024.

Read: 25% of divorced, widowed women have less than one month of retirement savings: survey

While these findings are partly attributable to strong investment returns and minimal impacts of the U.S. trade war when the survey was fielded, inflation remains volatile, particularly when it comes to food and housing, said Jason Vary, president of Actuarial Solutions Inc., during a discussion of the results at the 2025 Employee Savings Summit. “[These findings] are good news [and] my sense is that people are definitely on edge, but no one’s in a full-blown panic quite yet.”

Also speaking during the event, Crystal Arnold, senior manager of workplace benefits and human resources projects at LifeLabs Inc., said this financial outlook may also have been shaped by Canadian employers’ increased focus on financial wellness resources during the coronavirus pandemic.

“Employees are saying they really place value on well-being offerings, which includes financial well-being, and employers are stepping up to really meet those expectations.

“It’s becoming more of a priority as well for employers to invest in these areas for [talent] attraction and retention. I think a key takeaway for plan sponsors would be to continue thinking creatively about how to support employees with these varied offerings that fulfill more of an immediate financial need in tandem with long-term retirement savings plans.”

Indeed, retirement (85 per cent) continued to top the list of Canadian employees’ financial goals for their workplace registered savings plan, but emergency funds (81 per cent) weren’t far behind, followed by life projects such as travel or a sabbatical (56 per cent), a home purchase (38 per cent), student loan repayment (13 per cent) and returning to school (seven per cent).

Kate Nazar, vice-president of group retirement services at the Canada Life Assurance Co., said she wasn’t surprised to see retirement and emergency savings ranked as the top goals for workplace savings plans, citing the impact of the pandemic on Canadians’ finances.

“The topic of emergency savings became top of mind as many Canadians were faced with terminations, layoffs and decreases in salaries. . . . We see today, many plan members are now using group [tax-free savings accounts] for short-term emergency savings, giving them the flexibility to withdraw. “The TFSA might be one solution, but we’ll need to continue to monitor where new or additional financial pressures impact Canadians and how we can support with innovative solutions.”

Different priorities, different plans

According to the survey, many employees expressed interest in savings plans geared toward specific financial goals: nearly half (47 per cent) said they’d likely participate in a registered education savings plan, followed by a first-home savings account (41 per cent) and a student loan repayment program (26 per cent).

“Employees are clearly saying they want and need help saving for the future and they’re turning to their employers for help, but their future is not necessarily retirement,” said Vary. “In my view, employees actually want to be forced to save, like [auto]-enrolment and [auto]-contributions, but they need access to different types of savings vehicles because they all have very different goals.”

Among survey respondents who said they’re enrolled in different types of savings plans, satisfaction was very high, with 93 per cent of group RESP members expressing satisfaction with their plan, as well as 85 per cent of members enrolled in a student loan repayment program and 84 per cent who are saving into a FHSA.

Read: How the coronavirus pandemic shifted employees’ retirement planning strategies

As different types of savings plans become more popular, plan sponsors will have to take different approaches depending on their size, said Jimmy Carbonneau, national director of group retirement, group insurance and group annuity plans at AGA Benefit Solutions.

“Larger [plan sponsors] tend to have additional budgets, meaning the retirement savings [plan] is one budget and the additional [plans] are another budget. That makes it easier to explain to the plan members and it avoids conflicts in decision-making as well. . . . For smaller [employers], it will be more of an arbitrage.It will be like, ‘I’ll match you in the [deferred profit-sharing plan] but you get to choose where I put my five or six per cent’ and every time someone has to make an arbitrage, it becomes incumbent [for the plan sponsor] to provide decision-making tools. It’s a bit of a challenge, but a challenge that we can easily overcome.”

For its part, LifeLabs saw very little uptake of a group RESP it rolled out during a pilot project, but Arnold said the company is revisiting the possibility of offering a group TFSA or non-registered savings plan to support employees’ financial wellness.

Confidence in the future

Overall, Canadians’ confidence in their retirement planning remains steady: two-thirds (66 per cent) of respondents said they’re very or somewhat confident their employer-sponsored workplace registered savings plan(s) will provide the amount of money they expect from it in order to meet their financial objectives, similar to previous years.

Read: Canpotex adds FHSA to savings options to support employee financial well-being

When asked how much money they’ll need to maintain their desired standard of living in retirement, half (50 per cent) said they’ll need more than $1 million, a gradual increase from when the question was posed in 2015 (23 per cent), 2023 (38 per cent) and 2024 (46 per cent).

However, Nazar cautioned the increased confidence around workplace retirement savings plans may indicate employees — some of whom have already decided to postpone or continue working in retirement — are using these funds to meet short-term financial goals amid the rising cost of living.

“Generation Z is withdrawing from their [registered retirement savings plans] at a greater rate than previous generations — 12 per cent more than millennials and 42 per cent more than gen X. So while they may see their workplace [retirement] plans supporting their financial objectives, these are tending to be more short-term objectives versus retirement planning. . . . Plan sponsors are leaning into how they can continue to focus their contributions to long-term savings and offer ancillary services that support broader financial wellness.”

For the first time, the survey asked respondents how much of their savings they expect to have left to leave to family and/or friends. Two-fifths (41 per cent) said they expect to leave between one and 25 per cent of their retirement savings, followed by between 26 and 50 per cent (25 per cent), between 51 and 75 per cent (14 per cent). Only one in 10 said they expect to leave between 76 and 99 per cent, just one per cent said they plan to leave all of their savings and nine per cent said they won’t leave any of their savings to their loved ones.

Read: Flexible savings plans, employer matching allowing employees to retire earlier than planned: survey

“[These plan members] are underspending in retirement, not only because they’re worried about outliving their money, which is a very real worry, but we’re also seeing they want to help their kids,” said Vary. “Research has shown the baby boomers recognize how lucky they’ve been throughout their careers and their jobs and the great investment environment they’ve been so fortunate to be part of. . . . Some of them are purposely underspending and are sharing some of their good fortune with their kids and, more importantly, the grandkids, [who will] probably need it more.”

Learning curve

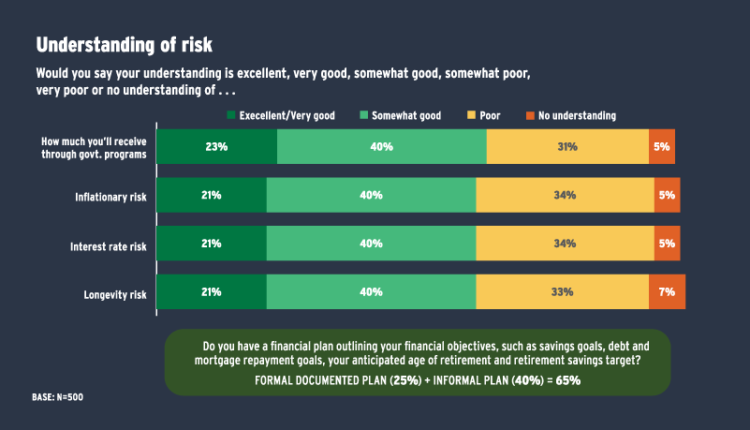

When it comes to employees’ understanding of key retirement concepts, there’s room for improvement.

While two-fifths (40 per cent) of plan members said they have a somewhat good understanding of how much money they’ll receive from government pension programs, as well as the impact of risk factors including longevity, interest rates and inflation on their retirement savings, only a fifth said they have an excellent or very good understanding of these concepts, while roughly a third said they have a very or somewhat poor grasp of these topics.

Despite these findings, Carbonneau said plan members can protect themselves from these risks by maintaining contributions to their retirement savings and delaying the age at which they take their Canada or Quebec Pension Plan benefits.

Read: 46% of Canadian employees prioritizing spending over retirement savings: survey

“Unless you have very bad health, most of us are better off postponing [CPP/QPP benefits] — those programs can protect us against longevity [risk] as well as inflation. . . . We can tell people what the odds are and what are the best [financial] behaviours, but most of the time it comes down to how much you save. This is the biggest impact on people’s retirement income. The easier we make the other decisions, the more they can focus on their budget and their finances.”

Key takeaways

• While retirement remains the No. 1 goal for Canadians’ workplace savings plans, they’re also prioritizing emergency savings and personal endeavours such as sabbaticals and travel.

• To support these shifting financial goals, plan sponsors are increasingly offering additional workplace savings accounts — such as group RESPs and TFSAs — beyond group retirement plans.

• When it comes to Canadians’ understanding of CPP/QPP benefits and risk factors such as longevity, interest rates and inflation, there’s room for improvement and employers can help by educating employees on these topics.

LifeLabs is taking a targeted approach to educating employees about financial wellness and long-term financial planning, said Arnold, including the use of data to determine how members are engaging with the company’s savings plans. “[Previously], we were more focused on industry trends and more broad-brush campaigns to get people’s attention and then just encouraging them to reflect on their own situation and take the next steps from there. But now we’re digging more deeply into the member data . . . to identify opportunities for education in certain areas, based on what our member behaviour is really telling us.”

When it comes to communicating workplace savings plans, more than half (57 per cent) of survey respondents cited email as the most effective method their employer can use, while the second-most common choice was the provider’s website, at 22 per cent. Despite these preferences, Arnold said the format poses several challenges for LifeLabs, where many employees work in customer-facing roles at multiple sites spread across Canada.

“What we found works very well is equipping and leveraging our people leaders as much as possible to share and inform employees on all of the information we’re promoting in terms of our savings plans, while also attending either in-person or virtual meetings, where we find we get a lot more bang for our buck in terms of employees actively listening and really participating.”

Read: Half of Canadian employees behind in retirement savings: survey

Lending a hand

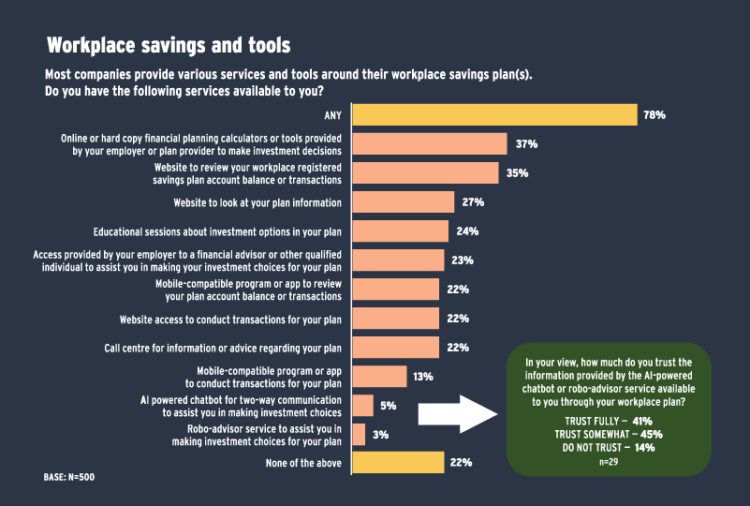

Regarding the services and tools employers provide to assist members with their workplace savings plans, 37 per cent of employees said their employer offers online or hard copy financial planning calculators or tools and 35 per cent said their employer provides a website that allows them to view their account balance and transactions.

Roughly a quarter said their employer provides a website containing information on their savings plan (27 per cent), educational sessions on investment options (24 per cent) and access to a financial advisor for investment help (23 per cent). Fewer than a tenth said their employer provides a chatbot (five per cent) or robo-advisor (three per cent) to assist with investment decisions. And among respondents who have access to these services, nearly half (45 per cent) said they trusted them somewhat and 41 per cent said they trust them fully.

In addition to these forms of artificial intelligence, Nazar highlighted the potential use of agentic AI — a technology designed to achieve specific goals with minimal supervision — within the group retirement space. “One application that’s emerging is the concept of autonomous participant guidance, [such as] a digital retirement coach that’s guiding [plan members] through complex decisions like choosing between investment options, adjusting contributions levels and planning decumulation strategies without human intervention.

“There’s obviously an ethical question about accountability and transparency and there needs to be a regulatory environment to allow for that, but that’s the art of the possible when it comes to agentic AI.”

Blake Wolfe is the managing editor of Benefits Canada and the Canadian Investment Review.