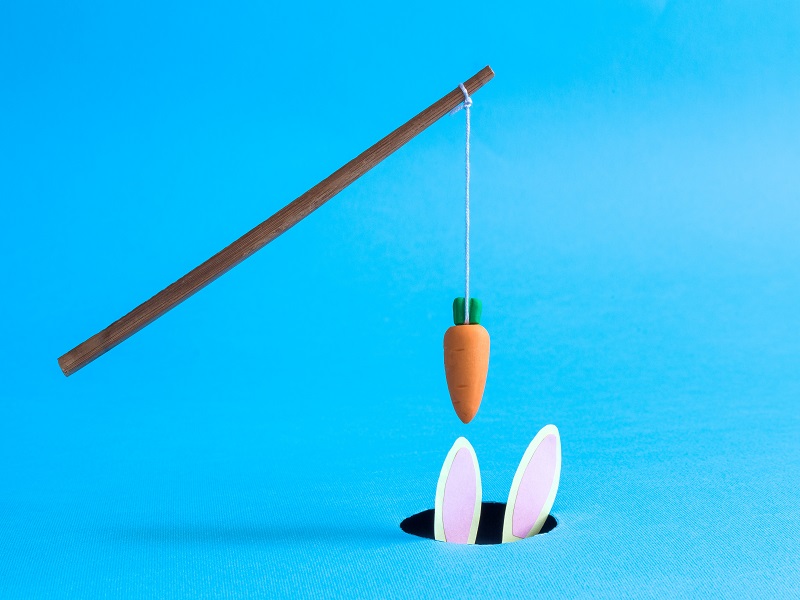

Employers relying on benefits, perks to attract, retain talent in 2026: report

Seven in 10 (71 per cent) employers say they’re concerned about meeting candidates’ salary expectations in 2026 and nearly half (46 per cent) say adding…

- By: Staff

- October 7, 2025 October 7, 2025

- 15:00