Canadian employers are investing in innovative financial, physical and mental-health benefits to drive their attraction and retention efforts, according to a new survey by Mercer. The survey, which polled more than 300 employers, found 59 per cent said they’ve invested in employee discount programs, followed by budgeting and other financial wellness education and supports (51 […]

OVERVIEW AGENDA SPEAKERS LOCATION POST EVENT COVERAGE Speaker Pat Leo, vice-president, institutional investments, Longevity Retirement Solutions In Pat Leo’s current role as vice-president of Longevity Retirement Solutions with Purpose Investments, he focuses on delivering innovative retirement solutions, thought leadership and dedicated service to institutional clients across Canada. He has more than 20 years of experience […]

The Canada Post Corp. pension plan is appointing Thavanesan Naidoo as director of pension fund investments and external equities. Naidoo, who has more than 30 years of experience in pension and investment management, joins the Canada Post plan from the CIBC pension plan where he was director of pension investment strategy. In the new role, […]

Canadian defined benefit pension plans’ median solvency ratio increased in the second quarter of 2023, according to a new report by Mercer. The report, which looked at the performance of more than 500 Canadian DB plans in its database, found a rise from 116 per cent to 119 per cent during the quarter. Meanwhile, a similar report […]

At the beginning of April, the OPSEU Pension Trust made a change to a definition in its plan text that will have meaningful implications for plan members with disabled children who need to continue to rely on their parents into adulthood. The organization expanded the definition of a child eligible for survivor benefits to include […]

The Colleges of Applied Arts and Technology pension plan is appointing Karen Lockridge as director of responsible investing. In the new role, she’ll be responsible for developing and refining the CAAT’s responsible investing strategy, including research, analysis and reporting on the pension plan’s environmental, social and governance activities. Lockridge will also provide guidance to the […]

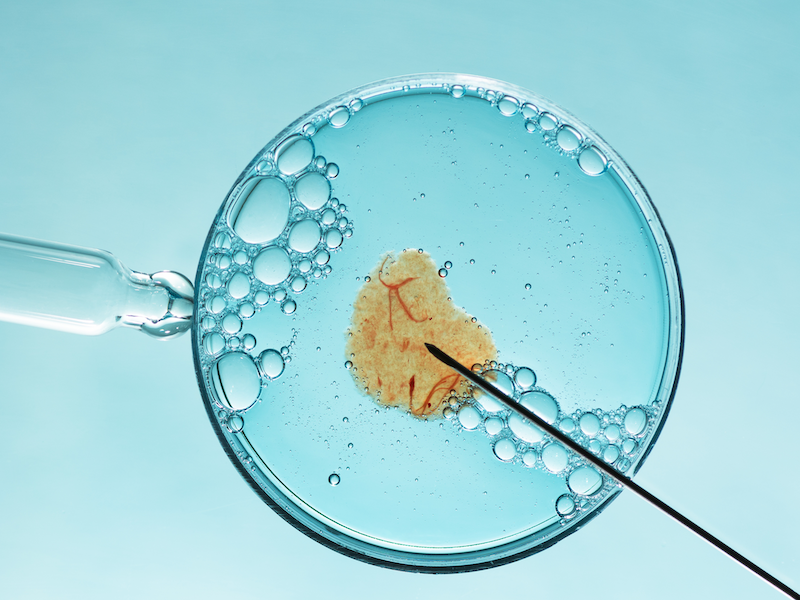

Jessica Tincopa may leave the photography business she spent 14 years building for one reason — to find coverage for fertility treatment. After six miscarriages, Tincopa and her husband started saving for in vitro fertilization, which can cost more than US$20,000. But the coronavirus pandemic wiped out their savings and they can’t find coverage for IVF in their state’s health insurance marketplace. So the California couple is saving again and […]

With Yukon implementing a transitioning policy on April 3 to expand the use of biosimilar medicines in its public drug plan, it’s important for benefits plan sponsors that create a similar policy for their workplace plans to be clear in their communication and education with employees. “It’s never easy to switch a medication, especially when […]

Millennial workers who rent for their entire careers must save 50 per cent more than homeowners in order to have a sufficient monthly income in retirement, according to a new report by Mercer Canada. The report, which analyzed findings from Mercer’s database, found millennials who rent need to save eight-times their annual salaries to retire […]

The median solvency ratio of Canadian defined benefit pension plans rose during the first quarter of 2023, from 113 per cent at the beginning of the year to 116 per cent at the end of March, according to Mercer’s latest pension health pulse. The measure, which tracks the median solvency ratio of the DB plans […]