In its 2025 budget, the federal government announced several initiatives to incentivize institutional investors to back domestic infrastructure and business ventures. The budget proposed $1 billion on a cash basis over three years, starting in 2026, for the Business Development Bank of Canada to launch a venture and growth capital catalyst initiative, a fund-of-funds that […]

The pursuit of reduced energy emissions portfolios from institutional investors is putting pressure on the efficiency of energy transition plans from investee companies. Despite a growing uncertainty caused by pushback against an environmental, social and governance driven investment lens, companies and investors need to think about environmental causes with a long-term risk perspective, says Sagar […]

Doubts about the demand for electric vehicles in the U.S. is creating new questions around the development of the Canadian lithium-ion battery industry, says Jon Wojnicki, a partner at EY Canada. “The Canadian battery landscape has sort of gone soft. People have made the announcements, they say they’re moving forward, but I’ve got to believe […]

While community bonds, an investment asset offered by not-for-profits looking to raise capital for socially conscious projects, are growing in Canada, they don’t match the investment needs of institutional investors, says Rod Lohin, executive director at the Lee-Chin Institute for Corporate Citizenship at the University of Toronto’s Rotman School of Management. “[Community bonds are] just […]

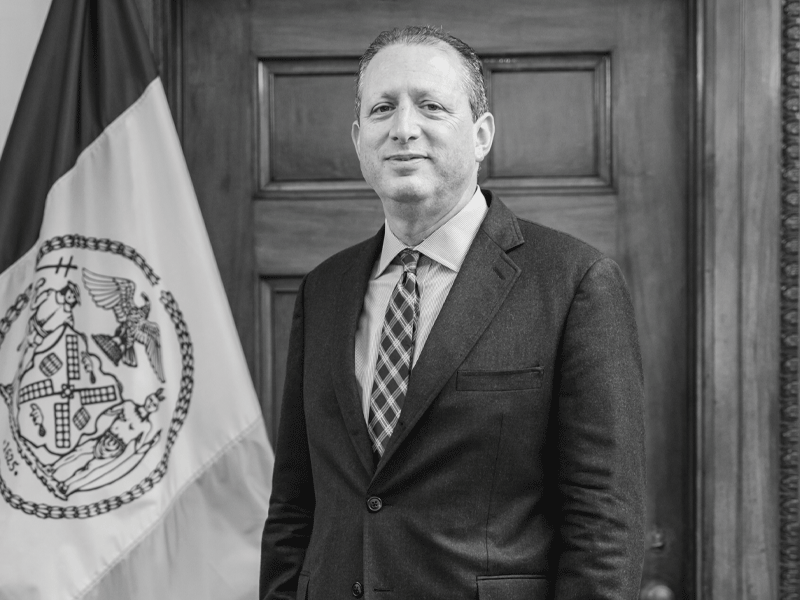

Brad Lander is advocating for public pension funds to enforce their responsible investment mandates even if that pits them against their partners. As New York City comptroller and chief financial officer, he’s the investment advisor and custodian for the city’s five public pension funds. In the role, he oversees the investment guidelines and allocations strategy […]

The Caisse de dépôt et placement du Québec is investing $35 million in a new energy transition fund from Quebec-based equity firm MacKinnon Bennett & Co. The investment is part of a larger $145 million commitment alongside the Canada Growth Fund, Investissement Québec and BDC Capital. The fund will target growth-stage businesses commercializing emission reduction […]

To reach 2050 net-zero targets, investment volume in U.S. and European clean power markets has to be scaled on an annualized basis from now until 2030, said Daniel Sausmikat, partner of origination and execution at InfraRed Capital Partners, during the Canadian Investment Review‘s 2024 Global Investment Conference held in April. However, progress isn’t going to […]

The Caisse de dépôt et placement du Québec and Gildan Activewear Inc. have reached an agreement that will see the Montreal-based apparel manufacturer issue $200 million in senior unsecured notes on a private placement basis to the investment organization. Gildan will issue notes with an annual interest rate of six per cent and will mature […]

The New York City Employees’ Retirement System, Teachers’ Retirement System and Board of Education Retirement System signed an agreement with the Royal Bank of Canada to publicly disclose its financing ratio of low-carbon energy to fossil fuels. The investment organizations are mandating RBC, as well as Citigroup Inc. and JPMorgan Chase & Co., to adhere […]

The Caisse de dépôt et placement du Québec is selling 1.3 per cent of the issued and outstanding common shares it holds of insurance provider Intact Financial Corp. The investment organization will sell about 2.3 million shares at a price of $227.10 per share, resulting in gross proceeds of approximately $525 million. Once the transaction […]