Providing tools to help defined contribution pension plan members make solid financial decisions rather than making the decisions for them was the impetus for Canadian Forest Products Inc.’s multi-year financial wellness program, according to Lisa Weber, the company’s pension and benefits advisor, during a session at Benefits Canada‘s 2022 DC Plan Summit. Since Canfor closed […]

The union representing nearly 800 employees at Calgary and Vancouver airports has ratified a first contract that includes retirement and benefits gains. The contract cements the continuation of the airline’s employee savings plan, which permits contributions to either a cash savings plan, a group registered retirement savings plan or a group tax-free savings account. Employee contributions […]

As the Canadian Association of Pension Supervisory Authorities looks to update its capital accumulation plan guidelines, the amendments must reflect the changes in the industry, said Angela Mazerolle, vice-president of regulation at the Financial Services and Consumer Services Commission of New Brunswick, during a session at the 2022 Canadian Pension and Benefits Institute Forum in […]

As employers increasingly customize their human resources, benefits and pension communications campaigns, how are these methods connecting with employees? Long gone are the days of chunky tomes of group benefits and pension information. Once the norm, those pages and pages of minutiae have gradually been replaced by more personalized and targeted communications. “Direct communication is […]

Earlier this year, I received an email from a Canadian National Railway Co. employee who had recently learned their defined benefit pension plan was winding up and they’d be moved into a defined contribution plan. According to the plan member — who will remain anonymous — CN closed the DB plan to new hires more […]

In 2021, Foresters Financial redesigned its retirement and benefits plans to be more flexible, relevant and competitive, modernizing the plans with the recognition that employees have varying financial priorities. “Overall, we have a very diverse employee base,” says Ken Adams, the financial services company’s vice-president of total rewards. “Someone who is a few years out […]

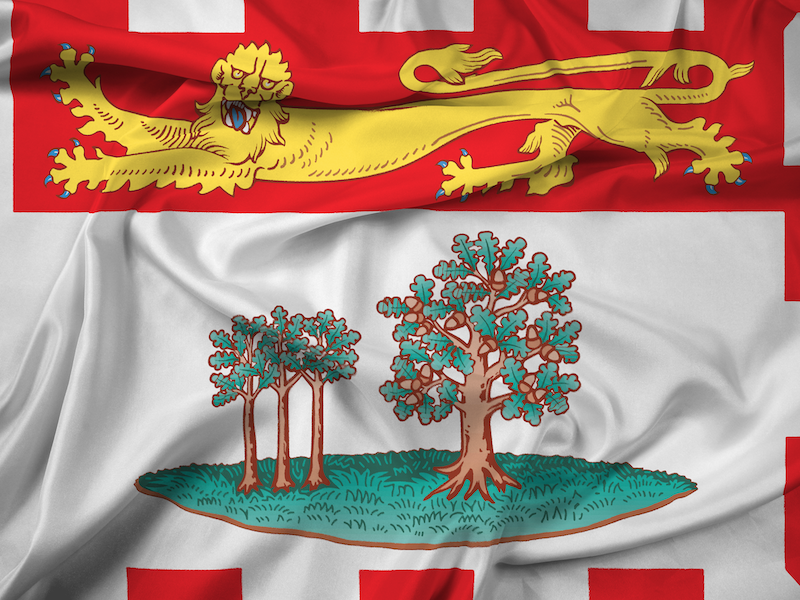

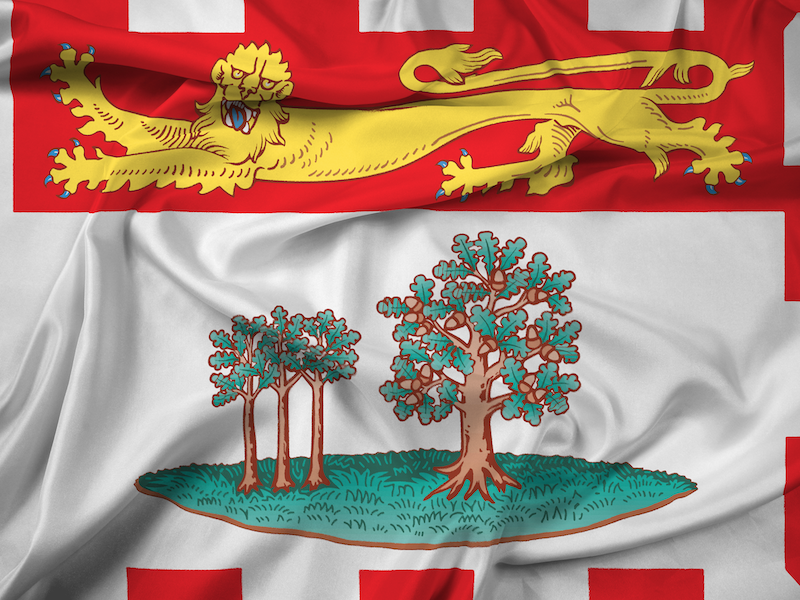

The Association of Canadian Pension Management is calling on Prince Edward Island’s pension regulator to amend the Employment Standards Act to facilitate auto-enrolment and auto-escalation features in workplace pension and savings plans. The current legislation includes language that would prohibit pension plan administrators from introducing automatic features in workplace plans, including capital accumulation plans such […]

Higher investment fees in capital accumulation plans can potentially set an individual’s retirement date back by four years, according to Mercer’s latest retirement readiness barometer. The analysis found a person paying the median retail fee (1.9 per cent) would be retirement ready at age 70. On the other hand, someone paying the median fee available […]

This summer, KPMG in Canada is helping staff refresh and recharge by making every weekend a long weekend. As the country prepares to enter the third year of the coronavirus pandemic, the professional services firm is giving employees in Canada seven additional paid days off in July and August that will fall on weekends that […]

Canadian Forest Products Ltd.’s new financial wellness program may have originated as the brainchild of its defined contribution pension plan committee, but it’s just as applicable to its defined benefit plan members — and the organization chose to roll it out for all employees. When you have broad financial wellness topics, it’s fine, but when […]