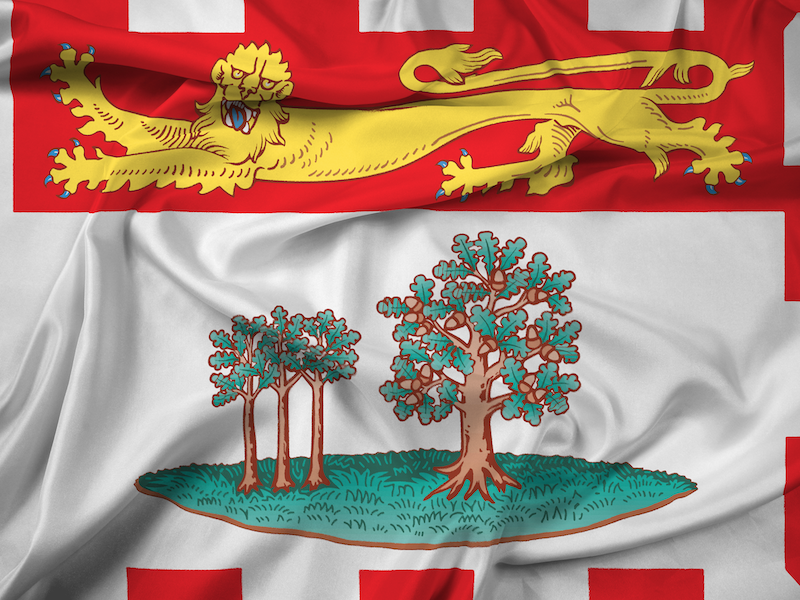

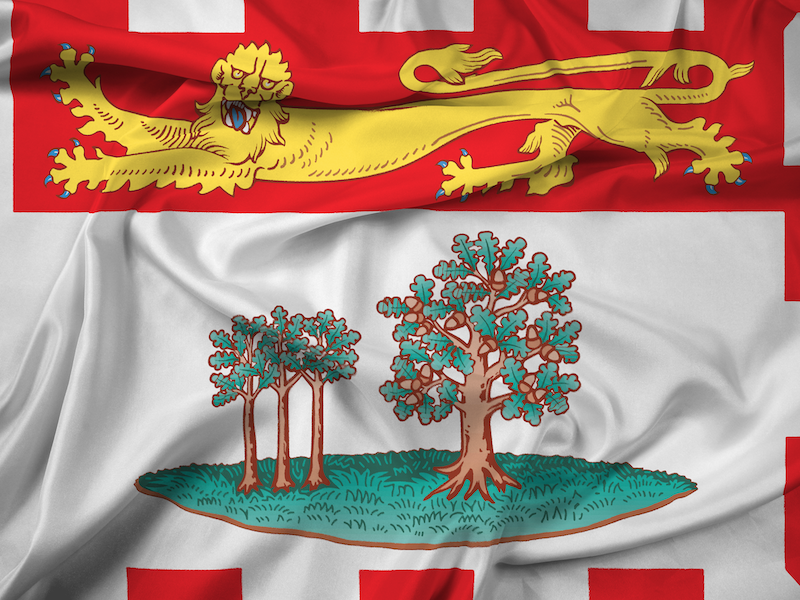

The Association of Canadian Pension Management is calling on Prince Edward Island’s pension regulator to amend the Employment Standards Act to facilitate auto-enrolment and auto-escalation features in workplace pension and savings plans.

The current legislation includes language that would prohibit pension plan administrators from introducing automatic features in workplace plans, including capital accumulation plans such as defined contribution pensions, group registered retirement savings plans and group tax-free savings account. Specifically, the Employment Standards Act requires employee consent to automatic deductions from payroll.

“Making these changes would signal to pension plan administrators that the government supports automatic features in workplace pension and savings plans,” wrote Ric Marrero, chief executive officer at the ACPM, in a letter.

Read: The case for incorporating automatic features into DC pension plans

The shift from defined benefit plans to CAPs over the last generation has highlighted that many employees don’t understand how much money they’ll need to retire comfortably, said the letter, noting pension plans that included employee contributions and an employer matching component were primarily designed with voluntary member participation with the default being that employees would have zero contributions.

“This leads to many plans having low employee participation and, for those who made the decision to contribute, many are not making the level of contribution needed to receive the maximum match from their employer.”

While many employers have amended their CAP design to automatically enroll new hires in the plan, the ACPM pointed out that P.E.I’.s Employment Standards Act restricts employers from enabling auto-enrolment or auto-escalating contributions for current employees due to the requirement that an employee give explicit consent for employers to make deductions from their wages.

“For these features to be adopted by employers, they need to be easily implemented and applicable to all CAP members.”

Read: Automatic features in DC pension plans may benefit members: FSRA

As well, P.E.I. doesn’t have a Pension Benefits Act or corresponding regulations like other jurisdictions across the country. As a result, noted the letter, the province’s pension plan members don’t have the same level of protections that are available to other Canadians.

“This is something that we feel should be considered if government does, in fact, make any changes to the ESA in your province. We would strongly recommend that plan sponsors assess their plan provisions and determine whether amendments need to be made and if member communication is appropriate prior to implementing any auto-enrolment or auto-escalation features.”

The ACPM has long called for automatic features in CAPs. Indeed, the organization urged the Ontario government to consider the related amendments to the Employment Standards Act and the Pension Benefits Act in July 2020.

In recent years, regulators in British Columbia, Alberta, Saskatchewan and Quebec have updated their respective pension and employment standards to permit employers to deduct pension contributions from employee wages without requiring explicit consent from the employees.

“We are encouraged that some provinces have taken these important steps but other provinces, including Prince Edward Island, have not yet made changes to enable these auto features,” said the letter. “We are asking that serious consideration is given to making these changes to the legislation in Canada today. These changes are as important as ever or even more critical.

Read: ACPM calling for CAP automatic enrolment, escalation features

“During these difficult times, employees who are participating in their employer CAP, and may have been contributing an amount to maximize the employer match, may have had to make the difficult decision to lower their contributions due to other financial needs, even if they would not have under normal circumstances. . . . Allowing employers to amend their pension plans to include auto-enrolment and auto-escalation features will assist employers in helping employees get back on target for a secure retirement.”