Before Alison Loat joined the OPSEU Pension Trust as its first managing director of sustainable investing and innovation in 2019, her experience with sustainability investing had only been peripheral.

“Although I did not come from the responsible investing world, I could see the tides were starting to turn. It was clear that a lot more attention was being paid to responsible investing initiatives.”

One of Loat’s first actions was to establish a team of internal investment specialists to build a more systematic approach to undertaking environmental, social and governance due diligence in externally managed investments. When completed, the team created its responsible investment partner evaluation.

Read: OPTrust highlights green bonds, sustainable investment team in latest responsible investing report

“OPTrust has had a dedicated responsible investing team since 2008,” says Loat. “Lots of pieces were in place and we’re working to build on that by establishing more systematic and data-driven approaches. RIPE is one tool we use to do that.”

To develop RIPE, the team assessed external frameworks and approaches, including those of the United Nations’ principles for responsible investment. RIPE, which became mandatory in 2021, allows the OPTrust to assess whether external managers’ investment approaches are aligned with the plan.

In addition, the new sustainable investing and innovation team has three central mandates. First is continuing to facilitate responsible investing throughout the portfolio. The second is implementing a new capital allocation program tied to responsible investing. The approach was particularly appealing to Loat, who was aware of some of the key challenges facing responsible investment teams at other institutional investors. “Too often, responsible investment functions are put to the side. Investors will do all the work and the responsible investment team will either ignore them or check the box and move on. The opportunity to fuse our work with capital was really compelling.”

Read: OPTrust’s sustainable investing evolution

Getting to know

Alison Loat

Job title:

Managing director of sustainable investing and innovation, the OPTrust

Joined the OPTrust:

December 2019

Previous roles:

Senior managing director, FCLT Global

What keeps her up at night:

“Environmental and climate-related issues — they are complex, multifaceted and global in nature.”

Outside the office she can be found:

“Cooking, curling, [keeping up with] politics and reading — both fiction and non-fiction.”

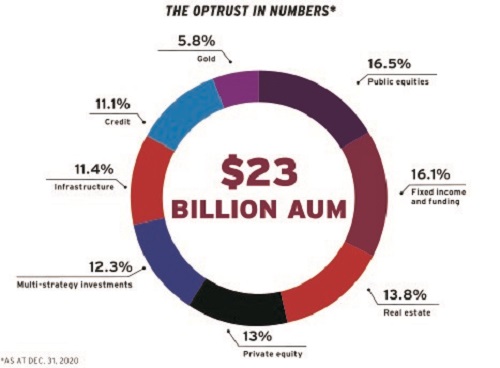

Tasked with investing at the intersection of sustainability and innovation, the team is particularly mindful to focus its efforts in areas that are complimentary to the OPTrust’s existing investments, which include a sizable renewables portfolio, sustainable private equity and green bonds.

Loat didn’t want her teams’ approach to overlap with these other investments. “It had to be additive. The upshot was that we spent a fair amount of time working to define what sustainability and innovation meant in a way that was distinct from how it was being understood by other teams.”

The third mandate is renewing the OPTrust’s climate change strategy. While a climate action plan was released in 2018, Loat’s team was tasked with modernizing the strategy to respond to the rapidly changing views of plan members.

“We are seeing a lot of shifting sands around consumer demands and expectations. Our plan members and stakeholders are expecting us to provide a lot more clarity about how we are managing our assets with respect to climate. We started with an honest assessment of where we were as a fund and identified areas where we could improve. We also set about identifying people across the organization who could help work on putting a foundation in place to address those gaps.”

Read: Earth Day: Strong support for sustainable investing coming from plan members

As a result, the team developed a series of workstreams designed to continually improve the OPTrust’s approach to climate. For example, the scenario analysis was updated to account for climate risks and each asset class team developed bottom-up assessments of their portfolios’ climate risks.

One recurring issue, however, is a lack of reliable data regarding ESG performance. “We do not have adequate data,” says Loat. “It’s our biggest hassle. We had to pilot a number of different data providers and work with our investment teams to bring providers in line. This is still in progress.”

As the sustainable investing and innovation team continues its work, the top priority is to further cement its climate strategy in its investment, risk and disclosure processes. “Job No. 1 is to centre it in our investment approach and strategy.”

Gideon Scanlon is the editor of the Canadian Investment Review.