According to York University’s Arijit Banik, there’s only one way forward for environmental, social and governance standards: it’s time for an evolution.

The treasurer responsible for overseeing the university’s endowment fund wants to go beyond simply investing in wind and solar energies to tick a box. Instead, his investment team has pushed towards sustainable infrastructure by being more critical with its investments.

Thanks to a background in chemical engineering, Banik applies an analytical approach to the endowment fund’s investment strategy. He ensures the team’s approach is matched by consultants when performing due diligence. “That whole questioning and analytical part just informs the way we do things.”

He has taken the scenic route into the institutional investing industry. “Nothing was scripted out for me. This whole area of investments — treasury, asset allocation — is a second career for me.”

Read: 67% of asset owners say ESG factors increasingly material to investment policy: survey

Getting to know Arijit Banik

Job title:

Treasurer, York University

Joined York University:

2018

Previous roles:

Senior manager, pensions and asset liability management, Royal Bank of Canada

What keeps him up at night:

The increasing divisiveness found in the current political climate and the lack of middle ground found between people at opposite ends of the political spectrum

Outside the office he can be found:

Trying his best, little by little to improve his way around a tool box

An uneasiness with Ontario’s manufacturing sector in the late ‘90s pushed Banik towards an exit strategy. In 2001, he went back to school part time to pursue an economics degree at what’s now known as York University’s Schulich School of Business.

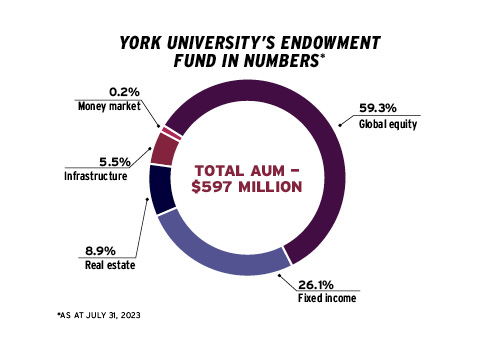

Before joining the university in his current role in July 2018, he was part of a treasury team formed through a joint venture between the Royal Bank of Canada and Dexia Group. In that role, he cut his teeth in preparation for the responsibilities of overseeing York University’s endowment fund, which is designed to finance the university’s faculties, programs, chairs and scholarships through investments totalling $597 million at the end of July 2023.

“That was the first time I was looking at things like solvency ratios, asset allocation from the perspective of an institution [and] getting the mix correct in terms of fixed income versus equities versus others. That was my first foray into it.”

The university also has more than $1 billion in investable operational funds. Forty-four per cent of these are managed professionally, while the rest are overseen internally in order to meet liquidity requirements.

Read: University pension plans engaging investees on climate change risks

Working in the education sector, with a wide assortment of stakeholders, means Banik knows what it’s like to answer to tough critics. One example is when the investment team was asked about completely divesting from one contentious category: fossil fuels. He says the category didn’t register a 0.2 per cent stake in the endowment fund’s investment strategy. “Our current equity investments in fossil fuels isn’t even a rounding error. It’s very, very small.”

However, Banik is opposed to closing off entire categories. “We don’t want to make [an official negative screening] the standard practice because, once you start closing yourself off to one thing, then there’s no argument against never closing yourself off to other things.”

The carbon footprint for the university’s investments has been reduced by 80 per cent since it began tracking this measurement in 2017, he adds.

York University’s investment team is also smaller than what’s typically found in the private sector. “In terms of the actual pure investment side, it’s myself and my analyst. That’s why we run very lean.”

Bryan McGovern is an associate editor at Benefits Canada and the Canadian Investment Review.