CPPIB cuts 10% of staff in Hong Kong office: report

The Canada Pension Plan Investment Board is cutting roughly a dozen employees at its Hong Kong office, according to a report by Bloomberg. It said…

- By: Staff

- March 7, 2024 March 6, 2024

- 11:00

The Canada Pension Plan Investment Board is cutting roughly a dozen employees at its Hong Kong office, according to a report by Bloomberg. It said…

The Financial Services Regulatory Authority of Ontario is implementing a framework with core principals to help defined benefit pension plans avoid inappropriate risk-modelling strategies, said James…

The Ontario Teachers’ Pension Plan is making three key appointments to its executive team, effective immediately. Its appointing Bernard Grzinic as executive managing director of…

Eastman Kodak Co. is disbanding a team that manages the firm’s US$1.6 trillion of pension investments and moving its management to Boston-based investment consulting firm…

An article detailing Ford of Canada’s transfer of $923 million in pension plan liabilities through a group annuity buyout was the most-read story on BenefitsCanada.com. Here…

The Caisse de dépôt et placement du Québec is selling 1.3 per cent of the issued and outstanding common shares it holds of insurance provider…

The Ontario Municipal Employees’ Retirement System returned 4.6 per cent in 2023, or $5.6 billion, in investment income in 2023, according to its latest year-end…

Information technology risk has become a more prevalent concern in recent years, so it comes as no surprise that Canadian pension regulators are focused on…

To mark Black History Month, the Alberta Investment Management Corp. is giving employees a chance to reflect on the history of groups dedicated to the…

The Colleges of Applied Arts and Technology pension plan is promoting Sabeen Purewall (pictured left) to vice-president of solutions and partnerships and Graham Stone (pictured…

The issues that lay at the root of the social justice unrest of 2020 haven’t dissipated and four years later, many investment organizations are focusing…

The Canada Pension Plan Investment Board earned 3.4 per cent during the third quarter of fiscal 2024, according to its latest quarterly report. By Dec.…

The Caisse de dépôt et placement du Québec is acquiring an 80 per cent stake in a Japanese solar power generation plant alongside its portfolio company…

Guardian Capital Group Ltd. is acquiring U.S.-based asset manager Sterling Capital Management from Truist Financial Corp. The financial terms of the transaction include a payment…

The estimated cost to transfer retiree pension risk to an insurer in a competitive bidding process decreased from 101.8 per cent of a plan’s accounting…

Three of Canada’s largest pension plans are among the top 10 pension funds that generated the largest compound annualized returns between 2013 and 2022, according…

A majority (91 per cent) of Canadian institutional investors say climate change is a leading concern within the environmental, social and governance space, according to…

Vestcor Inc. is appointing Sean Hewitt as president and chief executive officer, effective mid-April. He’ll succeed John Sinclair, who announced his retirement last November after…

Well hello there! We may have met during one of Benefits Canada’s and the Canadian Investment Review’s many events throughout the year, but if we…

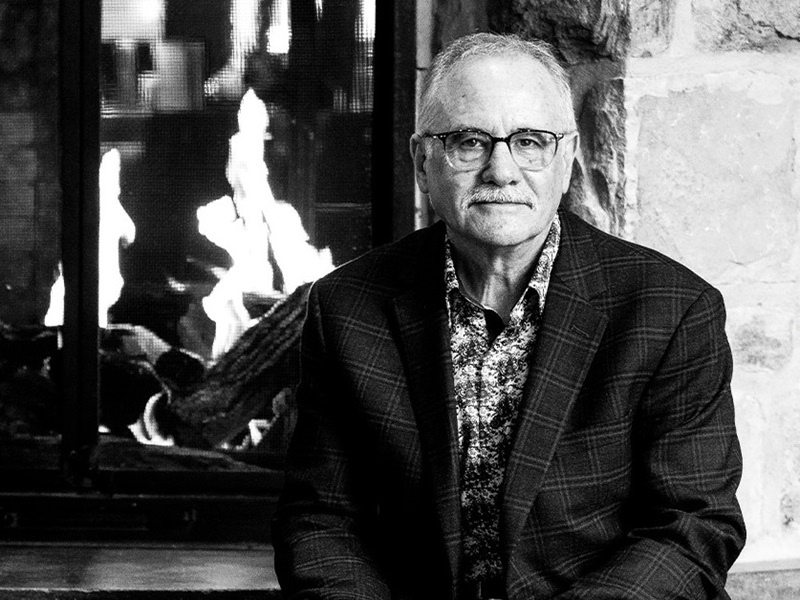

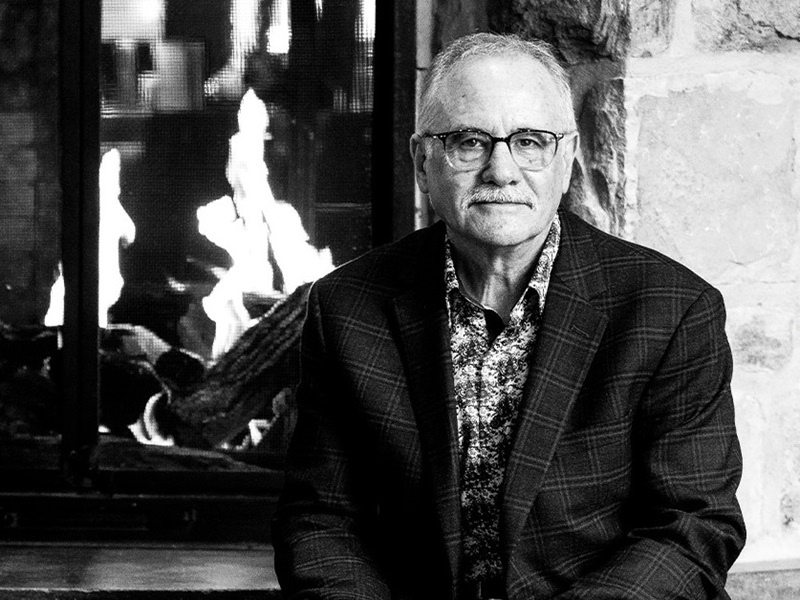

While Blair Richards understands why the industry is moving away from defined benefit pension plans, he worries about what may be lost in the process.…

The average Canadian defined benefit pension plan generated a median return of 8.4 per cent for the fourth quarter of 2023, according to a report…

Two New York City pension funds are pushing the Royal Bank of Canada to disclose more details on its clean energy funding. The shareholder resolution…

The Ontario Municipal Employees’ Retirement System is appointing Celine Chiovitti as chief pension officer, effective Feb. 6, 2024. In the new role, she’ll continue to…

The Canada Pension Plan Investment Board and Oxford Properties Group Inc., the real estate arm of the Ontario Municipal Employees’ Retirement System, are selling two…