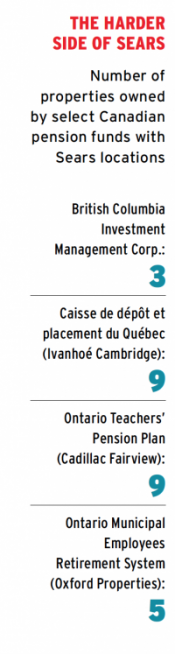

When Sears Canada Inc. announced it was going to liquidate its stores in 2017, the chain’s demise was a big concern for pension plan members worried about a big deficit in the company’s defined benefit plan. But also among the parties affected were some of Canada’s largest pension funds, which own more than two dozen shopping centres that just lost a big tenant.

“It’s a challenge globally, what’s going on in retailing,” says David Paine, global co-head of real estate at Aberdeen Standard Investments.

Cadillac Fairview Corp. Ltd. and Ivanhoé Cambridge, the real estate investment arms of the Ontario Teachers’ Pension Plan and the Caisse de dépôt et placement du Québec, respectively, felt the sting particularly harshly, with nine instances of exposure to a closing Sears location each.

Read: Sears liquidation a vindication for pensioners’ move to force DB windup

The steady income a rental property like a mall represents is hypothetically ideal for a pension plan, as long as the conditions are right, says Joe Cerullo, senior consultant at Segal Rogerscasey Canada.

“Sounds positive, but we all saw what happened to Target, where they didn’t execute properly,” he says of another retail failure that left a large number of empty spaces for the country’s malls to try and fill.

The dance to accommodate the latest big-box failure is becoming all too familiar, says Brendan George, a partner at George & Bell Consulting. “This isn’t the first time this has happened,” he says, noting the fall of Future Shop and the current worries surrounding Toys “R” Us Inc.

At the same time, the immediate situation isn’t necessarily dire for mall owners. Even in the case of Target Canada Co., if the right covenant was in place — which in many situations was the case — the retailer still had to make good on its two-year leases, says Cerullo.

Read: How e-commerce upswing is disrupting REITS

And while shopping centres are under pressure, it appears some pension funds are still considering them as options for investment. Even amid the gloomy predictions for smaller shopping centres in secondary markets, just last month, a New Brunswick-based real estate investment trust, Plaza Retail REIT, announced a deal to co-own two plazas in the Moncton, N.B., area with an unnamed Canadian pension fund.

It’s clear, however, that many malls will be looking to reconfigure their properties to adapt to the evolving retail environment. But what are those new uses to be? And for those pension plans that don’t own malls outright, what should they be thinking about when it comes to their investments in commercial real estate?

Divide and conquer

“Do I think the department store in its current form is going to be around? I suspect not,” says Paine.

Owners and managers, however, are still eager to find a traditional tenant willing to take on the space, says George. “They’re looking to ideally re-lease it to a big tenant, but if that doesn’t work, they have to renovate,” he says. If they’re able to find a new occupant, a silver lining is that Sears was likely paying lower rents than current market rates, he says, noting that finding a new tenant able to pay more could absorb some of the sting of having to make a change.

Slicing up the space might be a better option in the long run, says George. “I think you have the same risk, whether it’s Nordstrom or Holt Renfrew or whatever it ends up being. If you’re going to replace Sears with another big department store, you have very similar risks.”

Read: What do Golf Town’s troubles say about retail investment prospects?

One Cadillac Fairview property most Canadians know by name dealt with the closure of a Sears location before the chain went bust. In its place, the Toronto Eaton Centre brought in Nordstrom Inc., a more upscale department store that now fills only a fraction of the space Sears once took up. Originally about 75,000 square metres, a large portion of it became office space and, until recently, served as Sears Canada’s corporate headquarters. In early March, the Bank of Montreal announced a plan to build a large new complex in the space vacated by Sears.

As for Nordstrom, it occupies about 20,000 square metres, with Uniqlo Co. Ltd., a recently arrived Japanese clothier, taking up about 2,600 square metres. H&M took another 1,900 square metres as part of its latest renovation, and a two-level Samsung flagship store moved in at the end of 2017 to take up a similar amount. The remaining space is now a common atrium area and hallway.

Despite the shuffling of the decks and the reduced footprint of the anchor tenant, Cerullo notes the merits of bringing in a higher-end chain like Nordstrom. “Nordstrom was a good decision, because high-end retail in North America is actually very buoyant.”

New experiences

Property owners are also experimenting with creating more experiential reasons for customers to visit and stay once they’re at the mall. Getting that combination right isn’t going to be easy, says Paine.

“From a landlord’s perspective, you’re going to have to invest a lot of energy in selecting the right operator who’s creative enough to morph whatever the mix is,” he says.

There won’t be an immediate solution, he adds, noting successful managers will need to be nimble enough to know when to move on from something that isn’t working as they consider everything from trampoline areas to ping-pong clubs.

Read: Ivanhoé Cambridge to revitalize Quebec City shopping centre

“My experience is, [experienced-based attractions] are viable for a period, but they require a lot more active management,” says Paine, who questions whether the U.S. suburban malls that are having so much trouble staying afloat will be able to shift to those new uses.

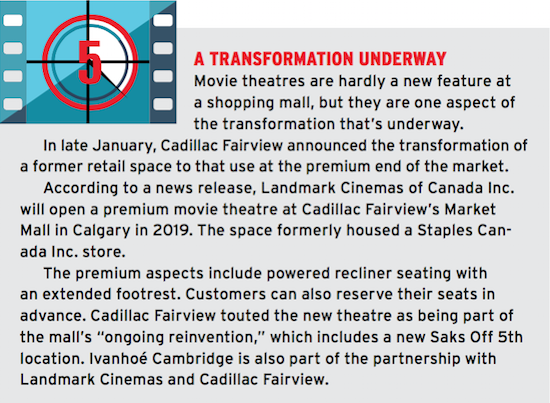

“At Cineplex, we’re right now going through an exercise of diversifying our business, to transform ourselves from what was previously primarily a movie theatre company into more of an entertainment company,” says Sarah Van Lange, director of communications for Cineplex Entertainment. “And as part of that, we’re modifying and adding to our theatre network, as well as opening up different types of businesses that leverage our skills and expertise.”

As part of its new strategy, Cineplex is aiming to draw in and keep customers through a gaming, entertainment and food venue called the Rec Room. It has four locations across the country, with two more opening in 2018.

“They can go for a meal. They can go for live entertainment. Each location has a live performance space. They could be going for a special event. In the case of the [Toronto location], they could be going for a beer before heading to a Jays game. So there’s a number of reasons to go, which brings in a number of different revenue streams,” says Van Lange.

The Rec Room provides options at both ends of the video game spectrum, as it features both cutting-edge virtual reality experiences and nostalgic arcade games.

In Cerullo’s view, Cineplex is trying to be what malls need to become: a place for people to spend money in multiple ways at locations where they naturally gravitate to in their daily lives. The shift that’s underway offers a chance to grow, he says. “For the pension plans, it’s that opportunity. If you get it right, you make good money on it. If you get it wrong, you better find some way to change that.”

Breaking old ground

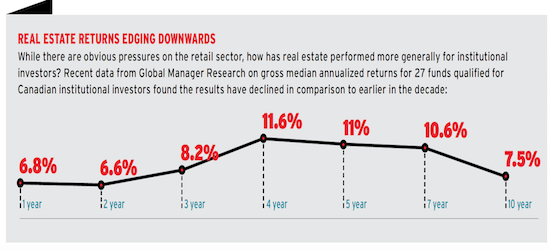

Real estate has generally become a more complicated area for institutional investors over the years, says Paine. While it may have been adequate in the past to tick a box by simply making an allocation to a particular type of space, there are more issues for them to consider today.

“Now, the portfolio is changing quite dramatically,” says Paine. “You’ve got new areas of student accommodation. Residential, rental, a whole raft of hotels [have] become a much more institutionally acceptable choice. So it’s a big change, just from the point of view of an investment manager, [to consider] what do we actually take the exposure to?”

Read: CPPIB raises stake in U.S. student housing portfolio

As part of the rearrangement, revamping existing spaces to accommodate the expanding physical needs of online retailers could be one option for many malls, says Cerullo.

“Malls can be converted into distribution centres for someone like Amazon,” he says. As well, the parking lots attached to malls, which typically aren’t a big focus, still represent valuable land mall owners could develop into residential space, he adds.

Indeed, with autonomous cars on the horizon, the need for parking lots could disappear to a large extent, says Cerullo.

Some mall owners have already started to work on the transformation to residential uses. In December, a Reuters report noted a number of owners, including Cadillac Fairview and the Ontario Municipal Employees Retirement System’s Oxford Properties, that are planning to add residential units. In Oxford’s case, reduced demand for parking is a factor, the Reuters report noted.

But when it comes to potential industrial uses, not everyone agrees that mall spaces would work for the last-mile delivery logistics operations of online retailers. “Some of it’s pretty idealistic,” says Ed Strapagiel, a Toronto-based retail consultant.

Amazon, he adds, is “quite happy in industrial settings and warehouses that are off the beaten track, where the real estate is far cheaper and the access in terms of trucks, especially, is much better than would be the case at a mall.”

A scenario like Sears highlights the need for plan sponsors to do their homework on major trends that can affect their portfolios, says Janet Rabovsky, a partner at Ellement.

She notes Target’s exit from Canada put money managers on notice and suggests that, as a result, investors weren’t as surprised and were in a better position when Sears suffered its own meltdown.

Read: Ontario pension regulator seeks Sears pension windup

Apart from the troubles some bigger stores are seeing, other parts of the retail sector are quite healthy, says Rabovsky, adding the big push into logistics centres serving online operations is a good example of how to handle real estate in the current environment.

Investors do have a number of issues to consider, however. With the closure of a large number of anchor stores, the United States is experiencing a particularly big contraction in the retail sector, says Paine. “The U.S. has got a lot of floor space per capita, so it’s hitting the wall a bit earlier, because of that, as sales go on,” he says.

And the impact of store closures goes beyond the pension funds that directly own mall properties. The retail contraction could also have an impact on commercial mortgage-backed securities through reduced returns and possible defaults, says George.

“If you’ve loaned money to some of these big malls, when they get into trouble, some of the mortgages start to default, and that’s where you get into trouble,” he says.

George has seen a shift in mortgage funds away from retail properties towards residential and industrial pursuits. “But then, the gain is slow. If you already own a bunch of mortgages on retail, you’re not going to be able to change that quickly,” he says.

“There’s definitely going to be pressure on returns and even default concerns on the mortgage side,” he adds.

For smaller pension funds, however, it’s possible to mitigate the issue while still seeking the diversification real estate investments provide, says Mohamed Karmali, consultant and lead on investment management research at Accompass Inc. Rather than purchasing mortgage-backed securities or real estate investment trusts, he says, “for the smaller funds . . . we generally recommend pooled investment vehicles into direct real estate.”

Read: Options for small plans to invest like the big pension funds

He continues: “These vehicles are generally pretty diversified, so they’ll be invested in several different sectors like commercial, office, retail and multi-residential, and typically there will be a 10 to 15 per cent allocation to the retail sector.” Along with the built-in diversity of such a fund, including a variety of tenants should further diversify even the allocation to retail, he says. That double diversification then cushions investors from taking much of a hit from a closure like Sears in comparison to what they may experience with a commercial mortgage-backed security.

Further, for those plans that include commercial mortgage-backed securities, they would typically make up no more than five per cent of the fixed-income segment of their portfolio and therefore not cause a huge dent, says Karmali.

Even so, because of the uneasiness surrounding them, investors are likely to be more cautious about such investments in the U.S. retail sector, says Steve Jellinek, vice-president of commercial mortgage-backed securities research at Morningstar Credit Ratings.

Traditional mall anchors are now a warning signal to investors, he says. “You do still have a general uneasiness around certain mall tenants that are downsizing and consolidating, like Sears, JCPenny and Macy’s.”

If a mall has more than one of those stores, investors will steer clear, he adds. “They’re looking for more diversity.”

Martha Porado is an associate editor at Benefits Canada.