Since last March, the coronavirus pandemic has derailed the best-laid plans of many organizations, including the Toronto Transit Commission.

With so many white-collar employees working from home, and worries about public health, it’s no secret the TTC’s ridership and revenue have been hit hard. Between the first and last weeks in March 2020, for example, lockdown measures contributed to a 75 per cent decline in weekly revenue. Cost-saving measures included temporary layoffs and a pause in salary increases for non-unionized employees.

Despite these stark challenges, the TTC Pension Fund Society didn’t experience either contribution reductions or a retirement spike.

Read: TTC pension plan focusing on liquidity amid coronavirus pandemic

“We have a very stable contribution regime, being a jointly sponsored pension plan, so there really hasn’t been much in the way of contribution volatility [and] we actually saw retirements go down this year versus the previous year. . . . That was interesting to us [and] perhaps not totally expected,” says chief executive officer Sean Hewitt.

In July 2020, the plan felt confident enough to announce an ad hoc cost of living increase of 1.96 per cent, effective as of January 1, 2020, for pensioners who retired in 2019 or earlier. “That speaks to two things: one, how well we’ve performed through this pandemic period, and, two, our stable contribution regime and long-term focus,” Hewitt says, adding, “We entered into the pandemic in perhaps the best financial position that we had been in our history as a result of very strong returns over the last 10-plus years. That also helped.”

Getting to know Sean Hewitt

Job title:

CEO, TTC Pension und Society

Joined TTC Pension Fund:

2016

What keeps him up at night:

Maintaining strong employee connections amid the coronavirus pandemic and finding well-priced opportunities in an environment of high valuations

Outside of the office he can be found:

Spending time with his family, including his two young children

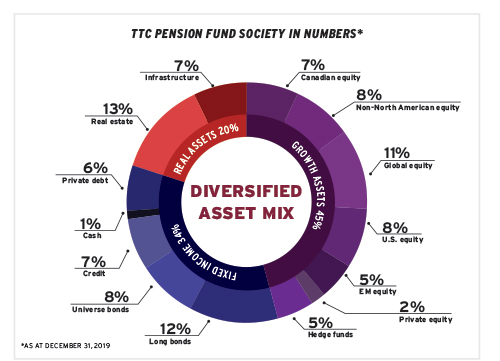

Making inroads in private debt, equity Hewitt attributes the plan’s robust performance to a diversified portfolio, with exposure to alternatives (especially real estate) stretching back several decades. In addition, the plan has historically been fully invested so it was able to benefit from the past decade’s strong returns. The road ahead looks tougher, however.

“[In 2020], we exceeded our targets for financial performance, but that comes with the caveat that our future return expectations are muted and getting lower. In our view, achieving our desired rate of return going forward will be harder . . . but we have strategies to help combat that,” Hewitt says.

Read: A look at the TTC pension plan’s move to more illiquid assets

Because fixed-income yields are low and getting lower, Hewitt says the plan can’t rely on meaningful returns from its substantial allocation to Government of Canada and provincial bonds. As a result, it has started pivoting towards private debt and private equity. “It’s a several-year program. We’re going slowly but methodically into those investments,” he says. However, he cautions, “There are liquidity challenges that come with that, so on an annual basis we review our liquidity needs and stress test for all sorts of different circumstances.”

The stress testing looks at factors ranging from contribution volatility on a year-by-year basis to mark-to-market settlements on hedges and capital-call requirements, and then calculates how four times the worst results in the past 10 years would affect them.

“We build a maximum budget for illiquidity based on those factors . . . and then we build in an additional cushion so that we can be a provider of liquidity and invest opportunistically into very stressed markets.”

The pandemic added a new threat for the TTC to build into its stress tests and also generated volatility that made it difficult to rebalance speedily. That’s prompted Hewitt to look at synthetic rebalancing tools utilizing derivatives that would enable the plan to quickly take advantage of opportunities when they present themselves.

Read: A look at the TTC pension plan’s move to more illiquid assets

Hewitt’s main concern these days is that market valuations are very high across multiple asset classes, which makes it harder to deploy capital. But, he says, “by maintaining a long-term focus, I think we’ll be in excellent shape going forward, despite, perhaps, some short-term volatility.”

Alison MacAlpine is a freelance journalist.