Nearly nine in 10 (88 per cent) Canadian small- and medium-sized employers say they’re experiencing challenges finding skilled talent, according to a new survey by Robert Half Canada. The survey, which polled more than 400 Canadian SMEs, found their top concerns were retaining top talent (82 per cent), finding talent quickly (77 per cent), finding […]

Canada’s life and health insurers paid out a record $128 billion in health and retirement benefits last year, up from $114 billion in 2022, according to the Canadian Life and Health Insurance Association’s annual fact book. “The benefits that life and health insurers provide through workplace plans and individual policies contributed significantly to Canadians’ health […]

Sales of U.S. workplace supplemental health products totalled nearly US$1.3 billion in new annualized premiums in the first quarter of 2024 ― a three per cent increase year over year, according to a new report by LIMRA. It found major product lines of accident, critical illness and hospital indemnity insurance combined grew four per cent from […]

The Canadian Life and Health Insurance Association has released a critical illness insurance guide to help Canadians better understand the benefits of critical illness insurance and how it works. Critical illness insurance is less well known than other types of insurance, so the guide helps to fill in the blanks for Canadians who may have […]

Hub International Ltd. is acquiring Oakville, Ont.-based Mitchell Sandham Inc., an independently owned insurance brokerage company that provides commercial and personal insurance and employee benefits services. The merger will provide Mitchell Sandham’s clients with enhanced resources and expertise, including a broader geographical reach across Canada and the U.S., said Mitchell Sandham’s chief executive officer, Aaron […]

Canada’s life and health insurers paid out a record $114 billion in health and retirement benefits last year, up $11 billion since before the coronavirus pandemic and up 60 per cent from a decade ago, according to the Canadian Life and Health Insurance Association’s annual fact book. “During a year when many households faced higher […]

An article on the Ontario Court of Appeal upholding its decision in the Brewers Retail Inc. pension case was the most-read story on BenefitsCanada.com over the last week. Here are the five most popular news stories of the week: 1. Court of Appeal upholds decision in Brewers Retail pension case 2. Are insurers updating their benefits policies to include […]

Last year, a benefits plan member in British Columbia was shocked when his insurance provider rejected an orthotics claim because the prescriber was a nurse practitioner rather than a “physician.” In the story, reported by the Victoria, B.C.-based Times Colonist, the chief executive officer of Nurses and Nurse Practitioners of B.C. said it wasn’t the […]

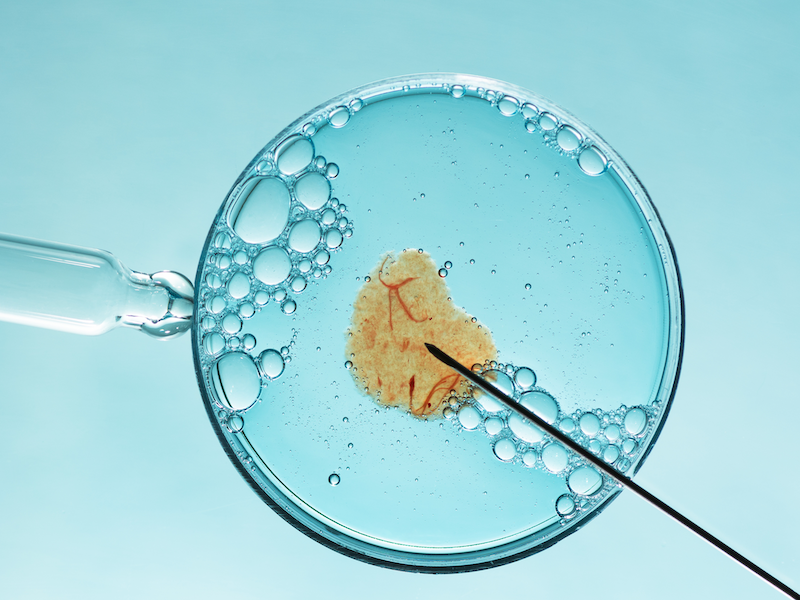

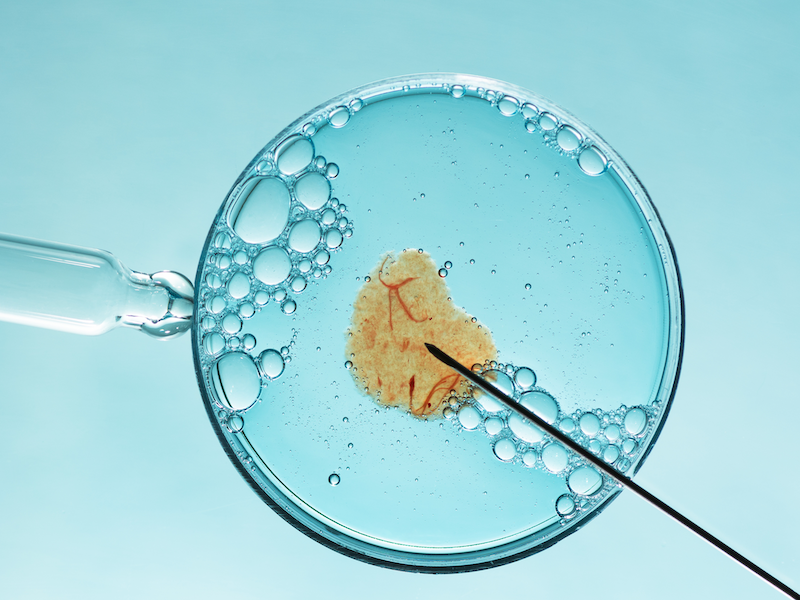

Jessica Tincopa may leave the photography business she spent 14 years building for one reason — to find coverage for fertility treatment. After six miscarriages, Tincopa and her husband started saving for in vitro fertilization, which can cost more than US$20,000. But the coronavirus pandemic wiped out their savings and they can’t find coverage for IVF in their state’s health insurance marketplace. So the California couple is saving again and […]

Although a majority (83 per cent) of U.S. employers say their employees are satisfied with their current benefits offerings, fewer than two-thirds (61 per cent) of workers agree, according to a new survey by MetLife Inc. The survey, which polled more than 2,800 employers and more than 2,800 full-time employees, found the No. 1 reason […]