Capital accumulation plan members continued to see an uptick in their plan outcome for the second quarter of 2024, as gross income replacement ratios remained at multi-year highs, according to a new report by Eckler Ltd. The consultancy’s latest CAP income tracker found a typical male member retiring at the end of June 2024 achieved […]

Alberta’s finance and treasury board warned against releasing the official results from a government survey evaluating the interest in a new potential pension plan, according to a report by the Edmonton Journal. The survey, launched on Sept. 21, 2023, coincided with the release of a report by LifeWorks Inc. (now part of Telus Health) that argued […]

An article on the nuances of Quebec’s pension laws was the most-read story on BenefitsCanada.com this past week. Here are the top five human resources, benefits, pension and investment stories of the last week: 1. What should employers know about Quebec’s pension legislation? 2. Ontario’s new regulations for publicly advertised jobs providing transparency for job-seekers: expert 3. Canadian […]

Working grandparents who are providing financial support to children and/or grandchildren are risking their own plans for retirement, says Craig Bannon, director of financial planning centre of expertise at the Royal Bank of Canada. “[They might need to] delay their retirement to extend their earning years or continue to work on a part-time basis in […]

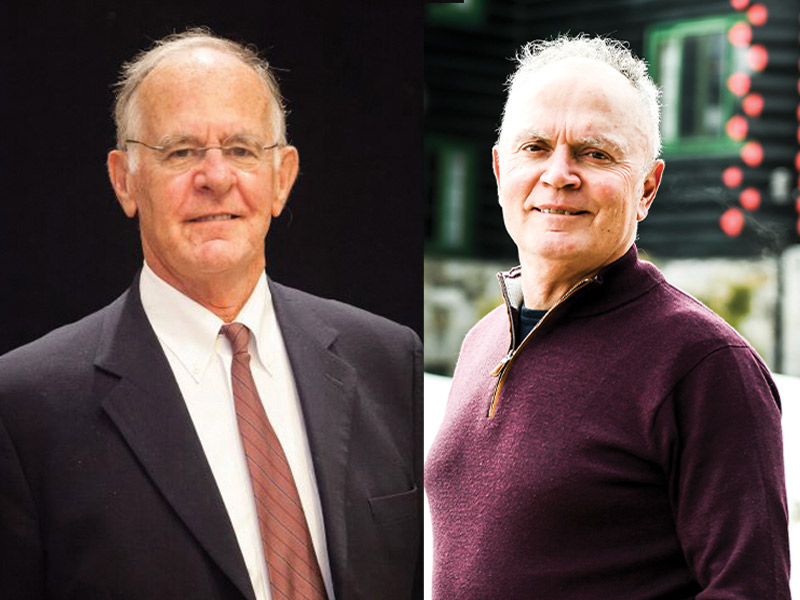

One actuary says social and technological factors are changing the concept of retirement, while another notes the fundamentals remain the same. Michel St-Germain, retired actuary, fellow and past president of the Canadian Institute of Actuaries Yogi Berra once said: “The future ain’t what it used to be.” Millennials will be retiring in 25 years, but not […]

Half (51 per cent) of U.S. pre-retirees and retirees say they’re considering either delaying or coming out of retirement, according to a new survey from F&G Annuities & Life Inc. The survey, which polled more than 2,000 adults aged 50 and older and who have more than US$100,000 in financial products/savings, found among respondents who […]

An article detailing how Canada’s exemplary pension regulatory system is helping to safeguard plans from mismanagement was the most-read story on BenefitsCanada.com this week. Here are the top five human resources, benefits, pension and investment stories of the past week: 1. Culture of compliance prevents mismanagement, conflict at Canadian pension funds: expert 2. OPB making key appointments […]

Seven in 10 U.S. workers between the ages of 40 and 80 with at least $100,000 in investable assets say they’d be “very” or “somewhat” likely to select an in-plan annuity option if it were available within their employer-sponsored retirement savings plan, according to a new report by LIMRA. It also found younger plan participants […]

Nearly two-thirds (64 per cent) of Americans say they wish they’d started saving for retirement when they were younger than age 25, according to a new survey by Voya Financial Inc. The survey, which polled more than 1,000 Americans adults, found more than half said they started saving for retirement when they were between ages 18 […]

Half (51 per cent) of women in the U.S. aged 65 who are entering their peak retirement years have less than $100,000 saved, with the percentage rising (67 per cent) among single women, according to a new survey by Artemis Strategy Group on behalf of non-profit the Alliance for Lifetime Income. The survey, which polled more than 2,500 consumers between […]