It isn’t an easy time to be a fixed income investor.

After a volatile year that included a severe liquidity squeeze in the spring of 2020, Sandra Lau, executive vice-president of fixed income at the Alberta Investment Management Corp., says many different measures now suggest the bull market for fixed income is officially over and her team is bracing for low or negative returns, with interest rates likely to rise in the coming years.

Lau and her team delivered benchmark-beating fixed income returns in both 2019 and 2020, an achievement she attributes to a two-pronged investment philosophy she brought to the AIMCo more than two decades ago: stay ahead of the curve and be nimble and flexible.

Read: Managing fixed income liquidity issues caused by the coronavirus crash

“Staying ahead of the curve means constant innovation [because] the constant search for new and best ideas is a never-ending process. Personally, I strongly believe the best investment premiums come from first mover advantages or being early, so that’s really critical.”

Nimble flexibility comes into play because “some of the best investments may not fit neatly into a predefined category,” she adds. “As such, creative financial ideas and even flexible product structure can give us superior risk-adjusted returns.”

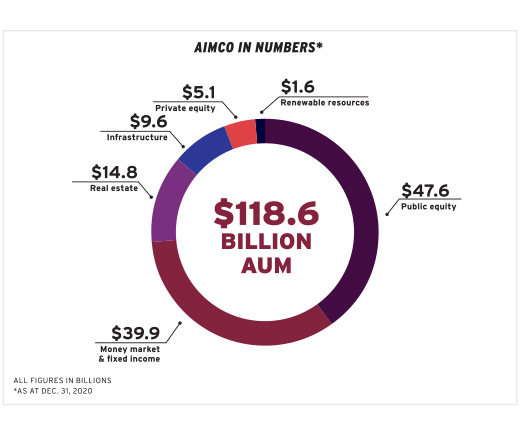

The AIMCo, whose $118.6 billion in assets under management make it one of Canada’s largest institutional investment managers, was an early Canadian adopter of credit derivatives, as well as in-house private credit and loans.

Read: Expert roundtable: Making fixed income work harder

She positioned the AIMCo’s fixed income portfolio defensively for the late-cycle market starting in 2018. However, she and her team were quick to recognize the opportunity offered by the sell-off in the first and second quarters of 2020 and rapidly shifted gears from defence to deployment.

“There were simply a lot of good quality assets trading at extremely less than their intrinsic value. That created a very wonderful risk-adjusted return.”

Getting to know

Sandra Lau

Job title:

Executive vice-president, fixed income, the AIMCo.

Joined the AIMCo:

June 1999

Previous role:

Actuary and investment analyst, Workers’ Compensation Board — Alberta

What keeps her up at night:

The coronavirus pandemic, an increasingly divided world and society and the potential for policy mistakes in handling these challenges

Outside the office she can be found:

With her loved ones, on a golf course, on a tennis court or at home working on her paintings

Lau also believes good environmental, social and governance practices offer solid potential to improve performance. She sits on the AIMCo’s responsible investment committee and her team integrates ESG factors into the due diligence processes for both public and private credit. Just as importantly, she says, the team participates in advocacy and influence.

“Through our responsible investment team, we’ve been constantly and proactively reaching out to a lot of issuers in my fixed income portfolio and engaging with them on ESG topics such as climate strategy and disclosure, diversity and inclusion and even cybersecurity risk. We are a believer of voice over exit. We prefer to work with the issuer [to] help the company improve. . . . Divesting doesn’t involve a company and doesn’t solve the problem. You have to work alongside a company and make sure they move along this ESG journey.”

Read: Considerations for integrating ESG into fixed income

In 2020, the AIMCo was one of the founding signatories of the Canadian Investor Statement on Diversity and Inclusion and, since 2010, has been a signatory of the United Nations’ principles for responsible investment, a voluntary set of investment principles that offer a menu of possible actions for incorporating ESG issues into investment practice. Last year, Lau’s team earned PRI survey scores of A+ in three out of four fixed income categories, with an A in the fourth.

“Building a strong, sustainable investment company is a triangle,” she says. “It’s the AIMCo structural benefit that we have, the culture and philosophy of staying ahead of the curve and a team of great talent.”

Alison MacAlpine is a freelance journalist.