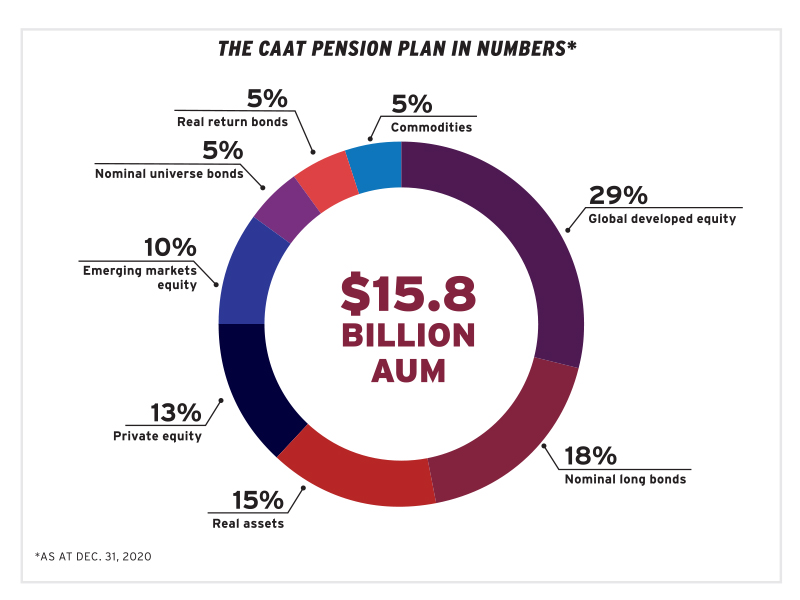

At the end of 2020, a year of exceptionally volatile and unpredictable markets due to the coronavirus pandemic, the Colleges of Applied Arts and Technology pension plan was 119 per cent funded with $3.3 billion in funding reserves and its assets had grown to $15.8 billion from $13.5 billion on Jan. 1, 2020.

“In the heart of the pandemic, we were down maybe one per cent from a funded ratio perspective,” says Derek Dobson, chief executive officer and plan manager at the CAAT. “By the end of the year, we grew our reserves by more than 10 per cent . . . and that’s even more remarkable because we lowered our discount rate [to 4.95 per cent from 5.15 per cent]. It was a banner year from a pension plan health perspective.”

Read: CAAT posts 11.1% return for 2020

The plan delivered an annual return of 11.1 per cent in 2020, outperforming its policy benchmark by 0.4 per cent, which nudged its 10-year net return up to 9.9 per cent. Over those 10 years, the plan provided cumulative added value of $1.7 billion relative to the benchmark. “Everything we do is for the long term, so even though we’re very happy about our 2020 results, our chief investment officer and I talk about our 10-year numbers more than we talk about our one-year numbers.”

One reason is the plan’s strong focus on strategic risk management. Its investment team works with the board to systematically build in risk management levers — essentially a toolkit of risk management strategies that are ready to use when required.

Getting to know

Derek Dobson

Job title:

CEO and plan manager, the CAAT pension plan

Joined the CAAT:

April 2009

Previous roles:

VP, the Healthcare of Ontario Pension Plan; executive administrator, Toronto Electrical Industry Benefit Administration Services

What keeps him up at night:

Decisions made every week to convert DB plans to less valuable, more risky pension arrangements without awareness of better opportunities

Outside the office he can be found:

Hiking, camping or curling

The plan’s liquidity management strategy also made a concerning year less stressful, says Dobson. “We went into the pandemic with a lot of focus on liquidity, so we never got into the yellow zone. We were in the green zone the whole time.”

On May 1, 2021, the plan transitioned from retiring CIO Julie Cays to incoming CIO Asif Haque, who’s been with the CAAT for 11 years. His history with the organization means he’s deeply familiar with both the investment team’s approach and the organization’s growth program, which centres around DBplus, a fixed-cost plan that was launched in 2019 to allow employers to join a defined benefit plan.

Read: CAAT appointing Asif Haque chief investment officer

“He has strategic vision, skills, experience and the right mindset in that he knows the investment program is built to deliver the pensions,” says Dobson of Haque. “One of my most important goals for 2021 is to ensure his transition is as smooth as possible.”

Haque will take responsibility for deploying the assets that flow in through DBplus, which, as of July 2021, was serving more than 125 employers and just over 70,000 members. Those additional assets enhance the plan’s long-term sustainability, says Dobson, and also allow the plan to write bigger cheques.

“[That] might be the difference between . . . being able to partner on a co-investment because they’re looking for somebody who can write a $100 million cheque instead of a $15 million cheque,” says Dobson. “Growth in assets has allowed us to get more seats at more tables and participate for the benefit of our whole membership.”

Read: CAAT sees funded status rise slightly, lowers discount rate

Ultimately, he believes it’s critical to address the factors that have deterred organizations from offering DB pensions, including changing accounting standards that made the plans a volatile expense on the balance sheet and the risks associated with running a plan as a single employer. It’s also essential to future-proof pensions by designing DB plans that look decades ahead and take into account evolving industries, work structures, salary models and regulatory requirements, he adds.

“If our success [with DBplus] leads to other innovations from other groups, I’m happy as well. Our goal is not to be the biggest. . . . It’s about making the whole system better.”

Alison MacAlpine is a freelance journalist.