When Tye McAllister was in middle school, he received a life-changing gift from his father — The Wealthy Barber, a practical guide to financial planning by Canadian investor David Chilton.

“Investing became a passion,” says McAllister, senior analyst of pension investments and treasury at ATCO Group of Companies. “I was always trying to pull together money to invest by working on my grandparents’ farms and shovelling snow for our neighbours.”

Following high school, he decided to to remedy the disjunction between his investment ambitions and his bank account. While studying business administration at Calgary’s Mount Royal University, McAllister — who was born into a family with deep roots in Alberta’s fossil fuel sector — found work drilling oil and gas wells throughout his home province and Saskatchewan during his breaks.

Read: Navigating the complexities of investing in agriculture

After graduation, he became an agricultural commodities trader, fulfilling contracts between North American forage and grain farmers and Chinese, Japanese and South Korean dairy farmers. “It was humbling. Despite the geographic, linguistic and cultural differences, the buyers and sellers were all salt-of-the-earth farmers. They worked hard and I wanted to work hard for them.”

Getting to know

Tye McAllister

Job title:

Senior analyst, pension investments and treasury, ATCO Group of Companies

Joined ATCO:

2017

Other role:

Agriculture commodities trader, Barr-AG

What keeps him up at night:

Interest rates, inflation and the search for safe investment havens during recessionary periods

Outside the office he can be found:

Exploring the great outdoors with his wife and two golden retrievers

After a couple of years, McAllister began looking for a more finance-related position. In 2017, he found one working as an analyst at ATCO. “The company epitomizes Alberta’s entrepreneurial spirit — it was founded as a trailer rental business supplying Alberta’s oil sector in the 1940s. Decades later, it acquired Canadian Utilities and it’s been steadily expanding since then. Its companies now operate throughout the Americas and Australia and are involved in natural gas and electricity transportation and distribution, workforce housing, ports and logistics, as well as a growing portfolio of clean energy generation assets.”

During one project, in Puerto Rico, McAllister gained considerable experience working with ATCO’s onsite employees. “It was an absolute privilege. They had a tremendous degree of integrity and taught me so much.”

Read: CBC Pension Plan stays the course with liability-driven investment model

On his return, he was offered a role in shepherding the investment and treasury functions of ATCO’s two defined benefit pensions and one defined contribution plan.

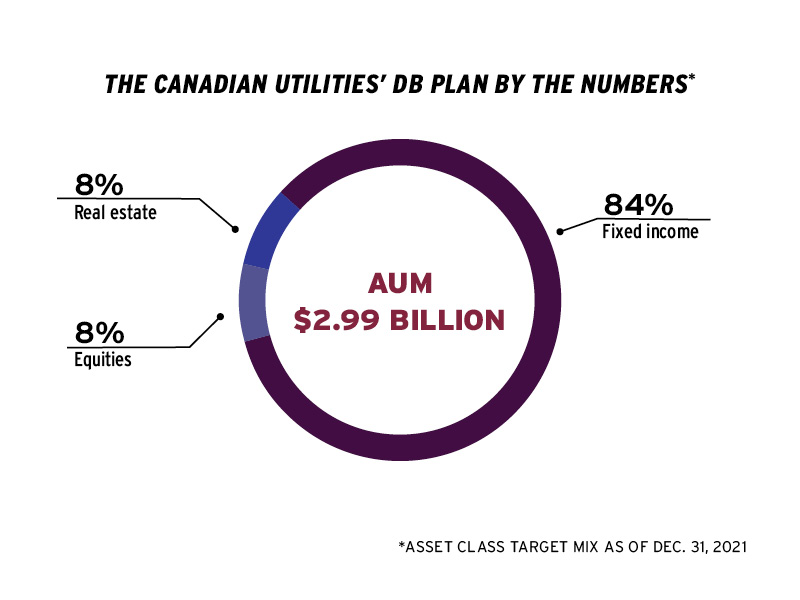

Canadian Utilities Ltd.’s $2.99 billion plan, ATCO’s largest DB pension, was closed to new entrants in 1997. To ensure prudent management of the plan’s obligations, it adopted a liability-driven investment strategy in 2012. As it matured and progressed along the de-risking glide path, the LDI bucket increased in size as the overall return-seeking portfolio decreased. Today, it’s about 75 per cent LDI and 25 per cent growth-seeking.

“My predecessors did a great job establishing the LDI strategy,” says McAllister. “In large part, we’ve only needed to make modest adjustments to the glide path over the years.”

One of the adjustments under his tenure was a revamp of the two DB plans’ portfolio styles. In 2021, ATCO brought in two additional asset managers to neutralize the style of equity allocations. It also adjusted the duration of the plans’ fixed income portfolios to improve the interest rate hedge ratio. And, in response to concerns about rising inflation, it tuned up the portfolios’ alternative investment strategies. “We changed our allocation to real estate, maintaining it at a higher level than before,” he says.

Read: 2022 Top 40 Money Managers Report: The risks for DB, DC plan sponsors around alternative investments

The moves proved fortuitous in 2022. “We haven’t been immune to the volatile markets, but de-risking certainly helped us weather them — our funded status has been quite stable, given the market environment.”

Despite the challenging economic conditions, the year also saw a return to once-normal business practices. “We recently returned to onsite due diligence meetings with our asset managers,” says McAllister. “Keeping open communication with them is important and valuable to us.”

Indeed, he sees these meetings as an opportunity to learn from experienced investors, as well as the people working at investee companies. “There’s so much to be learned in the pension investment space. When I arrived, a great foundation was laid. I continue to have great support from my leaders.”

The other group of people McAllister is always delighted to connect with is ATCO’s plan members. “They’ve dedicated their careers to the company. Managing the investment of their pensions is an honour.”

Gideon Scanlon is the editor of the Canadian Investment Review.