The Desjardins Group pension plan faced a reckoning following the 2008/09 financial crisis: its assets were down 40 per cent and it was watching other defined benefit plans transitioning to defined contribution arrangements.

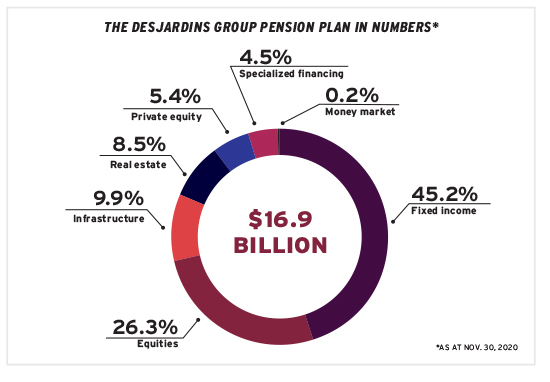

However, with executive director Sylvain Gareau at the helm, it set a new course. Today, it has $16.9 billion in total assets and still offers a defined benefit to members. The path back to health began with a 10-step action plan that included strategies to reduce costs and increase employee contributions. Importantly, the plan also remodelled its investment policy to favour investments that better aligned with its goals.

Read: Pension regulators step up amid turmoil

“A good example is infrastructure,” he says. “We had nothing in infrastructure [back then], but when you buy a toll road, when you buy a solar plant, when you buy a wind farm, these assets have a lot in common with what we’re trying to accomplish.”

Specifically, he notes infrastructure investments have the right risk profile for a pension fund and provide protection from inflation. Critically, they also generate steady cash flow to help the plan make its payments to pensioners.

To get its infrastructure program rolling, the plan teamed up with managers that could provide it with access to direct investments. Today, the plan manages $3.4 billion in infrastructure investments, making up 9.9 per cent of its total portfolio.

Big questions

The Desjardins Group pension plan’s focus has also shifted away from merely achieving the best returns, says Gareau.

“It’s a big shift. In the past, before 2008, if you had first-quartile returns, you were the best in class. Today, when I present to the board, nobody asks me, ‘How do we compare to the others?’ I don’t even get that question anymore. How are our three ratios? Is the plan fully funded? Do we have enough money to meet our obligations? Those are the questions I get.”

In particular, the plan is focused on its solvency, going-concern and accounting ratios, which are all calculated differently and use different metrics. Keeping them in balance is complex, but he says it’s absolutely essential to protect the plan, the organization and members.

Read: DB pensions’ funding positions recovering, but major risks ahead: reports

“Our approach is to find a compromise. Long term, we need to make enough returns to have a [going-concern] ratio above 100 per cent. We need to make sure that when the corporate [interest] rate moves, it doesn’t affect the accounting ratio, so therefore, we will need to invest more in corporate bonds. And then, for the solvency ratio, we need to find [derivative products] to make sure we cover that ratio.”

Getting to know Sylvain Gareau

Job title:

Executive vice-president, Desjardins Group pension plan

Joined Desjardins:

2008

Previous roles:

Executive vice-president of the private equity group at the Caisse de dépôt et placement du Québec

What keeps him up at night:

Making sure the plan meets its obligations to all plan members, while also protecting the plan sponsor

Outside of the office he can be found:

On long walks with his two setters at his property north of Montreal

To support the financial engineering necessary to maintain an equilibrium among the three ratios, Gareau created a specialized 10-person quantitative team, which is responsible for simulating and calculating the effects of different scenarios on returns, liquidity and the three ratios. “What gets measured gets managed.”

Looking toward the future, he says the biggest challenge will be managing the growth of the plan’s assets, which are projected to rise from just under $17 billion in 2020 to $25 billion by 2023. He recently presented a new 10-step action plan to the board that will make sure the organization is ready, with appropriate human, logistic and financial resources in place. In terms of assets, he’s also eyeing private equity and real estate for further exploration.

Overall, Gareau urges other plan sponsors to understand their objectives, constraints and concerns and then develop a strategy in response. “If you do that, the plan is going to stay alive.”

Alison MacAlpine is a freelance journalist.