Why should defined benefit pension plans invest in Canadian equity markets at all?

It’s a question many DB plan sponsors began asking themselves in the mid-1990s. At that time, the federal government removed foreign content limitations on pension plans and again, later, when it made similar changes for individual registered retirement savings plans.

These regulatory adjustments led to a continuing trend of investors reducing the Canadian equity weight in their portfolios in favour of global equities. With the Canadian equity markets mainly in financial and resource sectors (or banks and rocks), a common rationale for investing abroad was to improve diversification.

Read: Canadian equities buoy DB pension’s Q2 returns: report

While we can see this perspective, we don’t believe it tells the full story. We recently did an analysis of the benefits and pitfalls of investing in Canada versus global stocks and the key findings from the analysis follow below.

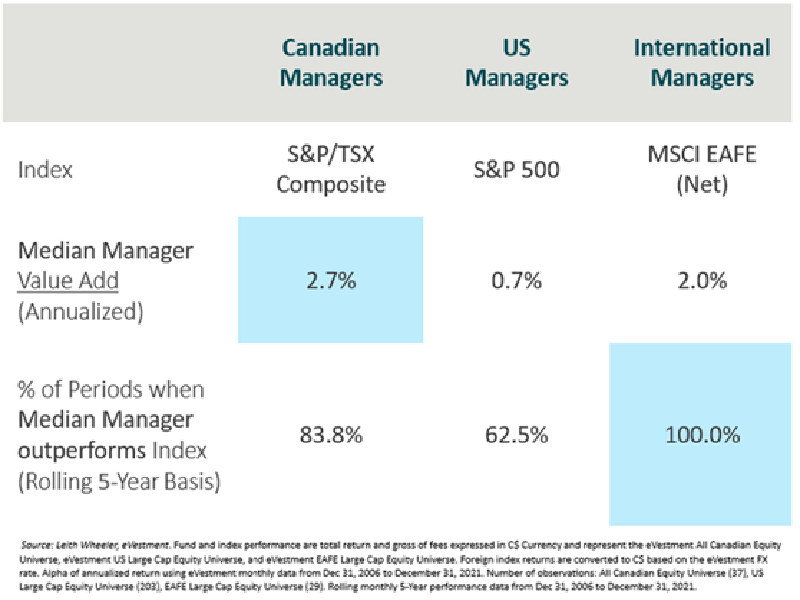

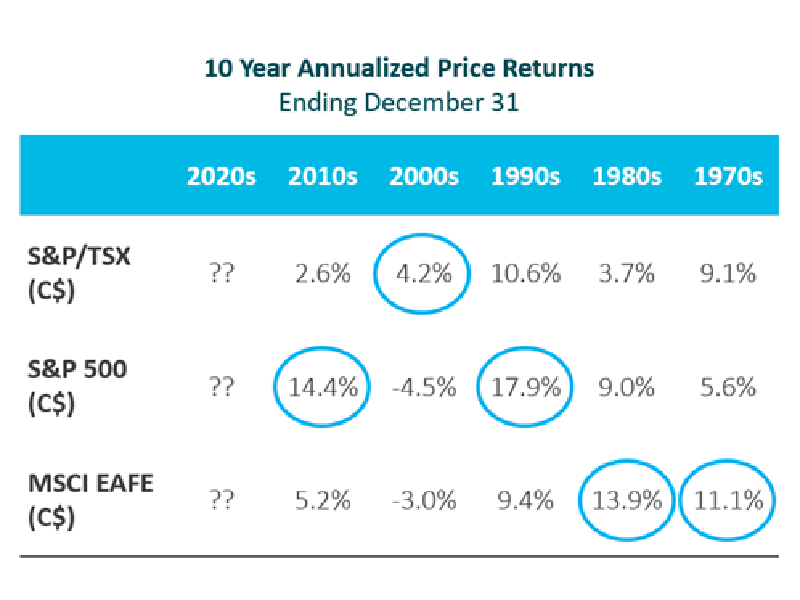

During the 25-year period ending December 2021, the median investment manager in Canada generated more value-add against its benchmark than its peers in Australasia, Europe, the Far East and the U.S. markets. While U.S. equities posted higher returns in the past decade, its market has been difficult to beat by individual managers because of the volume of trading and research on its stocks.

Value-add in the international EAFE market has been similar to Canada’s market and is also the most consistent, with the median investment manager outperforming the index 100 per cent of the time on a rolling five-year basis. However, active management fees for the EAFE market are typically higher for Canadian investors.

Read: Managing fixed income liquidity issues caused by the coronavirus crash

We should note this study captures data through Dec. 31, 2021. In the six months ended June 30, 2022, Canadian markets outperformed U.S. and international markets close to 10 per cent in Canadian dollar terms, so these findings would be further bolstered by this recent period.

Canada also has several world-class businesses that warrant material weightings relative to their foreign comparable. Today, Canadian banks are an opportunity, not a problem. As oligopolistic businesses with pricing power operating in a favourable regulatory environment, Canadian banks’ dominate businesses span banking, insurance, capital markets and wealth management. They can also generate consistently high returns within those businesses while keeping debt in check. As well, they tend to be less expensive and carry higher capital ratios than their U.S. peers.

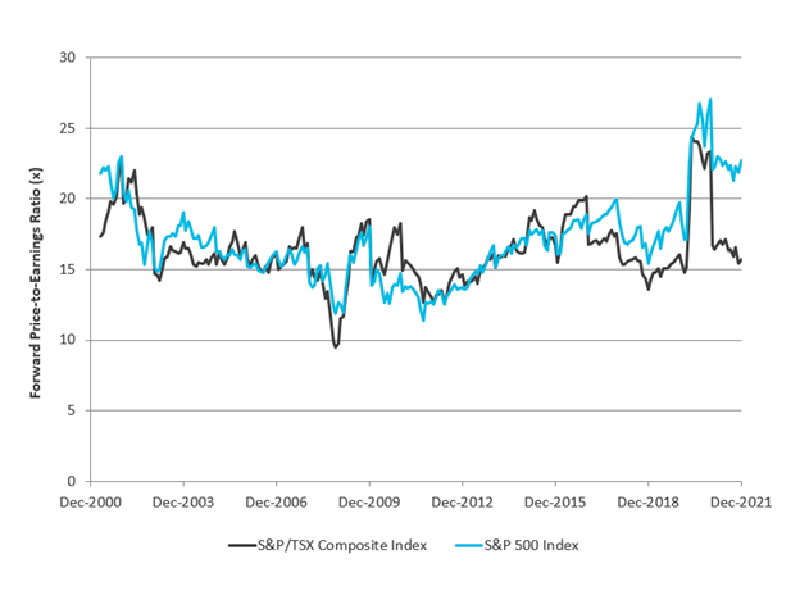

Overall, Canadian stocks are also currently trading at a large discount to U.S. ones. While the two markets have tracked fairly closely for many years, U.S. stocks ended 2021 with a price/earnings ratio of 22-times — or about seven multiple points — higher than Canada. After tumbling more than Canada through June 2022, U.S. stocks remain considerably more expensive at 20-times earnings while Canadian stocks continue trading around their long-term average of about 15-times earnings. The margin of safety in Canada is just much lower in the U.S.

The problem with overpaying for stocks is you sacrifice future potential gains. Despite equity markets being quite correlated, market leaders do change. The Canadian equity market is not one to dismiss. Fads may come and go, but quality and value are what will best serve every portfolio and the Canadian market delivers both.

Read: How should investors interpret the recent rise in interest rates?