Environmental, social and governance issues are key for many Canadian pension plans, but taking meaningful action is easier said than done, especially at small and mid-sized organizations.

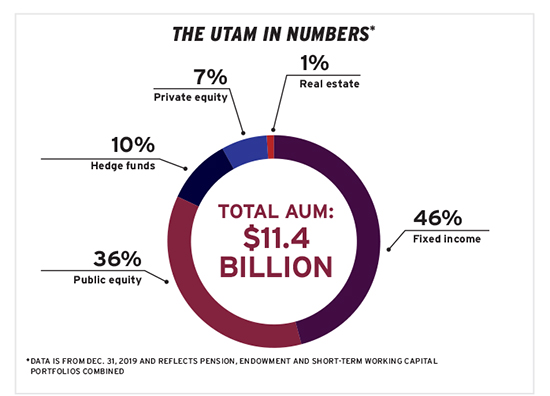

With a team of about 30 people, the University of Toronto Asset Management Corp. managed more than $11 billion of the university’s endowment, pension plan and short-term working capital assets as of the end of 2019.

When the UTAM first looked at responsible investing, it considered what it wanted to accomplish and how to do that, given its small team and the fact that it predominantly invests through funds and not directly, says Daren Smith, the organization’s president and chief investment officer. “How are we going to integrate these considerations as part of our manager selection and monitoring process?”

Read: Considerations for integrating ESG into fixed income

The UTAM decided to embed responsible investing across the organization and has implemented a comprehensive approach to evaluating managers, which includes a relevant section in its investment due diligence memos. “Of course, we’re going to continue looking at performance, people, process and philosophy, but now we’ve added this additional lens, which is how managers do responsible investing.”

However, Smith notes it can be difficult to look under the hood at a manager’s approach. “The reality is there’s a lot of marketing spin on responsible investing and you really have to get into the weeds many times just to figure out what a manager is actually doing.”

To overcome the challenge on the public equity side, the UTAM is using an existing third-party system that analyzes position-level data to evaluate a manager on ESG metrics based on an ESG data feed from MSCI Inc. It does so by collecting manager holdings at each month-end going back five to 10 years, depending on the length of the track record, and uploading the data into the system.

Read: Short selling could impact company ESG behaviour: study

The system allows the organization to look at a manager’s portfolio characteristics on the environmental, social and governance sides, he says, and then the UTAM uses the data along with other qualitative and quantitative information to evaluate that manager.

“Then we’re also looking for names where there are some perceived issues coming out of the ratings from MSCI,” says Smith, noting the organization tries to be thoughtful about how it talks to managers about these names, particularly where it looks like there are potential ESG considerations.

When it comes to ESG, the UTAM also considers the investment holding period. “Many of the ESG concerns are more long term. So we think that for private equity, ESG considerations would almost always be very relevant. And there are some other strategies that are perhaps more short term in nature; for example, on the hedge fund side, we have some shorter frequency strategies where the holding period might be just a few months as opposed to multiple years, where we think it’s less relevant.”

Getting to know

Daren Smith

Job title: President and chief investment officer

Joined UTAM: 2008

Previous role: Partner and director of manager research at Keel Capital, which at the time managed investments for what’s now the Nova Scotia Health Employees’ Pension Plan

What keeps him up at night: Employee mental health and engagement amid the coronavirus crisis

Outside of the office he can be found: Spending time with his children, travelling and playing golf

The organization’s approach for public equity doesn’t work on the private side because it uses data from a provider that doesn’t have the same information available for private assets. For these assets, the UTAM relies on a series of questionnaires and conversations with managers.

Read: U of T Asset Management’s pension portfolio returns negative 1.6% in 2018

“We don’t have a system like we do on the public side for privates, but to some extent, those portfolios tend to be very concentrated and it’s easier to take that one-off approach where you look at individual holdings from prior funds.”

Overall, Smith’s advice for small or mid-sized plan sponsors investing through funds is to start slowly and have good discussions with their boards and investment committees to develop objectives and a game plan. “It could be a multi-year game plan, but it is important to start and to make progress. Things evolve and there is a lot that organizations of our size can do, but it does take time and effort and you do need buy-in from the board or the investment committee.”

Yaelle Gang is editor of the Canadian Investment Review.