Over the past 25 years, Canada’s retirement system has evolved significantly through new funding frameworks and federal and provincial reforms to facilitate innovation in plan design. And with Canadians living and working longer and investment returns predicted to soften, it’s no surprise the pension industry is calling for an update to the Income Tax Act to bring it in line with societal trends.

A subcommittee of the national policy committee of the Association of Canadian Pension Management has taken on the task of identifying the necessary changes. “We went for consultation across the country as part of our national sessions,” says Susan Nickerson, a partner in the pensions and employment practice at Torys LLP in Toronto and a member of the subcommittee. “We had a lot of plan administrators show up for these and we had very active dialogue across the country.”

So what tax changes would the pension industry like to see?

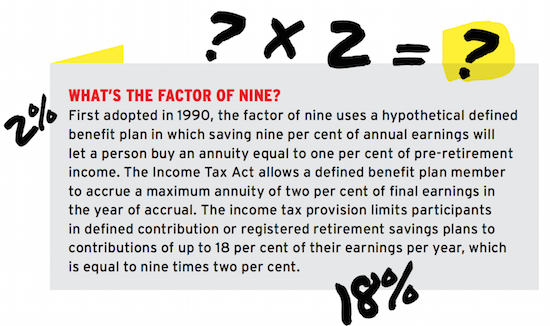

Updating the factor of nine

On the accumulation side, many industry players agree that the pension adjustment calculation using the factor-of-nine equivalency test is out of date. A key element of how the tax system works for registered savings plans, the government introduced the provision in the early 1990s to create a level playing field between defined benefit pensions and capital accumulation plans in terms of the tax-deferral impact, says Nickerson. “What we understand as the factor of nine was meant to equate approximately to the aggregate contributions needed over a full career to provide a pension benefit comparable to an ideal plan,” she says, noting that multiplying the maximum two per cent benefit accrual by nine reflected a capital accumulation plan contribution ceiling of 18 per cent of annual earnings.

Read: Report suggests raising DC, RRSP contribution limit to 30%

Initially, that value reflected the discount rate, inflation and life expectancy, but those factors have all changed dramatically in the past 25 years. While the ACPM views the factor of nine as out of date and overly simplistic, Nickerson believes it’s important not to move to something that’s too complex.

“We think it should be somewhere in the range of 12 to 15, but it’s figuring out what’s the best way to do that,” she says.

“You could consider doing it based on key features of the design of the plan or you could look at it in terms of the age of the member, having the factor increasing as you age — potentially over decades.”

“So if you updated the factor of nine for current circumstances, the RRSP limit expressed in terms of annual income would be 40 per cent, not 18,” he adds. “And if you benchmarked it to the comprehensive plan, it would be 50 per cent. So much, much, much higher.”

Read: Chronicling the Canadian pension system’s constant state of crisis

Dominique Roelants, the executive officer of British Columbia’s college, public service and teachers’ pension boards, says the problem with the factor of nine is more than just the number. In his view, it raises a significant issue for people who aren’t saving for retirement until later in life. “We’ve got lots of people who have nothing in their RRSPs at 45 years old, but they have huge RRSP room,” he says. “And that RRSP room is never adjusted for inflation or for potential investment returns. So that’s the problem that needs to be addressed.”

If the government indexed RRSP room, late savers would be able to accumulate tax-free savings in the same way as someone who started saving much earlier, says Roelants. “Let’s imagine I’m 20 years old and I earn $30,000. I have 18 per cent of that, so I’m able to save $5,400. But I want to go to Hawaii for holiday or buy a boat or pay off my house, so you have that $5,400 in RRSP room. Well, 25 years later, if you haven’t contributed to an RRSP, you still have that $5,400 of RRSP room from 25 years ago, and it’s still $5,400, even though inflation in that time period means that $5,400 is probably worth about $2,000 in current dollars.

“At the very least, I would say the government ought to be looking at adjusting people’s RRSP room by inflation or, alternatively, by some proxy of investment returns,” he adds. “So it could be 10-year government of Canada bond yields. That’s probably the safest one.”

Raising the maximum age to withdraw registered pension savings

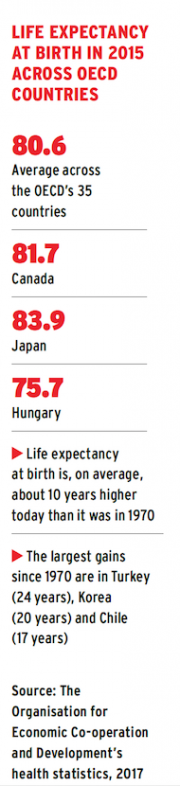

On the decumulation side, the Income Tax Act forces Canadians to start withdrawing from their registered retirement plans no later than the end of the calendar year in which they turn 71. But given current longevity projections and an environment of softening investment returns and interest rates, the government should raise the age limit to provide more flexibility around Canadians’ retirement savings, says Nickerson, who suggests increasing it to 73 or 75.

Read: Report recommends raising trigger age for withdrawal of registered retirement savings

The latest census data from Statistics Canada found about a fifth of Canadians older than age 65 worked at some point in 2015. Cara Bourdeau, senior human resources consultant at Western University, has noticed that trend as the school’s professors look to push out their retirement dates. “Many academics would like to continue working, not just beyond 65 but beyond 71, and some of them do,” she says. “But they then find themselves in a challenging position around having to draw pension income in addition to their regular income.”

Robson agrees, comparing the additional investment risks some people take in retirement to a few extra years of employer-assisted saving. “You think about your return on investment or the certainty of getting a benefit of shifting to a much riskier asset class with your investment, as opposed to delaying retirement for a few months,” he says. “The former is risky. . . . The latter, it works. . . . A small delay in retirement could do so much for you, by comparison with desperately trying to get a few more basis points of return. It’s basically in the bag, if you work a little longer, as compared to the different risks people are taking.”

But Robson doesn’t believe the government should set the number in stone, suggesting that moving it to age 73 would be a good start. Some Scandinavian countries are now linking the number to changes in longevity, he adds. “So you can make it a thing that moves over time as we get new information about how long people are living.”

Maximum transfer values, target-benefit plans

If the government updates the factor of nine and the maximum age at which people must draw down registered savings, there will be a domino effect on maximum transfer values as they’ll automatically increase as well. “But looking at each one in isolation, which is what we’ve done at this point, we’re coming to the view that should be repealed,” says Nickerson. “The argument for it would be that plan members who decide to exercise portability rights shouldn’t be disadvantaged in comparison to those who decide to leave their pension entitlements in the plan.”

Read: How can Canada’s retirement system better address pension portability?

And with target-benefit plans now on the pension scene, should the government tax them like a defined benefit or a defined contribution plan? The Canada Revenue Agency has indicated it sees them as defined benefit plans, according to Nickerson, although she notes the Department of Finance will ultimately determine any changes.

The ACPM believes administrators of target-benefit plans should have the choice of which tax rules to adopt. “It would be based on their individual sustainability levers and circumstances,” says Nickerson, noting if the plan focuses more on benefits, the defined benefit tax rules would be better. On the other hand, if the plan emphasizes maintaining contributions, the defined contribution tax rules would be more appropriate. “It really would depend,” she says. “Each plan would make that determination at the outset.”

Greg Hurst, a Vancouver pension consultant, says multi-employer pension plans, which use the defined contribution tax treatment, are akin to target-benefit plans. “So there’s a reasonable argument that, if you’re going to use target-benefit plans . . . maybe you can treat it more like a DC plan, since you’ve got fixed contribution levels coming from members and employers.”

Tax changes for CAPs

The ACPM’s consultation process also includes a number of tax issues dealing specifically with capital accumulation plans. One of them is pension income splitting. “Right now, defined benefit plan members can claim pension income deduction and split payments with a spouse immediately on retirement, but DC plan members have to wait until they reach age 65,” says Nickerson.

“So that’s just because they didn’t include variable benefit payments under the definition of qualified pension income for that purpose. We think that should be adjusted. The feedback we’ve gotten on that, too, is that we should apply that to other capital accumulation plans.”

Read: Variable annuities touted as a ‘good third option’ for DC decumulation

Many in the industry also believe the tax system should permit self-annuitization arrangements for capital accumulation plans. Adam Kehler, manager of pension and benefits at Farm Credit Canada in Regina, says he’s concerned about the lack of options available for defined contribution plan members when it comes to converting their retirement savings into income in a way that protects against longevity.

The company has a closed defined benefit plan and an open defined contribution arrangement, the latter of which tends to include considerably younger employees. “Where we start to see career employees retire through that DC plan, that’s just very different for us than what it’s been so far with DB,” he says. “It’s really through that lens that we’re saying pretty much any of the tax change proposals that are focused on that would provide our DC plan members with more flexibility and more tax-effective ways to use their retirement savings.”

The ACPM’s consultation also addresses reforms related to contribution errors. Nickerson would like to see the Income Tax Act amended to permit retroactive catch-up contributions, up to the member’s pension adjustment limit for the relevant year. “Right now, if we discover an error with an under contribution, we can only make the contributions to make up for that error on a go-forward [basis] . . . versus going back.”

One example of that would be catching up for lost contributions during maternity leave. While new parents typically aren’t making contributions while on leave, they would have the option, when returning to work, to contribute for some of that period, says Kehler.

Read: Bridging the pension gender gap

“If someone goes away and comes back early in the next calendar year, we’re kind of restricted in what we can allow them to contribute in for that time of leave, whereas in the DB world, they can buy back that service regardless of the calendar timing. So it’s really just to keep it similar to what we were used to on the DB side and give at least the option for employees to put that money in if they want to.”

Ultimately, Nickerson believes the tax system should do more to consider the evolution of socioeconomic factors affecting Canadians today.

“The revisions to those underlying factors should be approached consistently throughout the act,” she says. “It would be good to have some type of automatic review period, like every five years, that would ensure those assumptions remain appropriate.”

While he notes the value of the discussions, Hurst suggests a lot of the issues have come up in the past.

“There’s nothing wrong with raising it,” he says. “It’s reasonable and appropriate to do so and it’s good to have this kind of dialogue and discussion, but I’m not sure what kind of appetite the government has for changing these things right now.”

Jennifer Paterson is the managing editor of Benefits Canada.