After a tough couple of years, Canadians continue to face several challenges against an increasingly turbulent economic landscape. While most coronavirus restrictions were lifted in late spring 2022, the seventh wave of the pandemic arrived in July alongside rising inflation, which is compounding prices from the gas pump to the grocery store.

Though the 2022 CAP Member Survey was conducted in March, many of these impending challenges were gaining momentum and were front of mind for capital accumulation plan members. The survey asked them about their perceptions around their retirement readiness, their satisfaction with their employer-sponsored plans and how the current economic landscape — including the ongoing pandemic — is affecting their financial well-being.

Read: New surveys highlight discrepancies in retirement readiness

More than half (52 per cent) of respondents agreed they feel financially prepared for retirement, compared to 48 per cent in 2020 and 47 per cent in 2021. Additionally, 63 per cent said they’re on target for the amount of money they need to save, up from 59 per cent in 2020 and 60 per cent in 2021.

While these findings are positive, plan sponsors must continue to promote the retirement programs they offer to employees, said Kenrick Hopkinson, manager for education and communication in group benefits and retirement solutions at iA Financial Group, speaking during a panel discussion at Benefits Canada’s 2022 Benefits & Pension Summit. “They can also speak to the record keepers and ask them how they can help out — and when I say help, I’m talking about helping their employees — helping them adjust their savings’ behaviours [and] helping them understand the importance of checking in on themselves and setting goals.”

Also speaking on the panel, Emilie Inakazu, director of benefits and well-being at KPMG in Canada, noted the organization views retirement and savings holistically. It provides employees with four optional savings vehicles — a defined contribution pension plan, a non-registered savings plan, a group registered retirement savings plan and a tax-free savings account.

“Our underlying approach emphasizes flexibility and choice in recognition of the fact that within a multi-generational workforce, savings goals can vary significantly. There really is no one-size-fits-all approach in this space. Our goal is to offer programs and resources that support our employees in achieving whatever their financial goals may be at any given time, whether that’s saving for a large purchase like a car, buying a house, planning for children or saving for retirement — whatever the case may be.”

Read: Editorial: Employers embracing innovation, flexibility in DC plan design

Indeed, employees’ financial priorities change at different stages in their lives, so it’s important that employers consider this when designing their savings programs. “We’re talking to different generations so their goals are different,” said Hopkinson. “I can’t speak to my son about a retirement program because he tunes out, he has no interest in it. But if I talk to him about a savings program . . . his ears perk up.”

Engagement leads to satisfaction

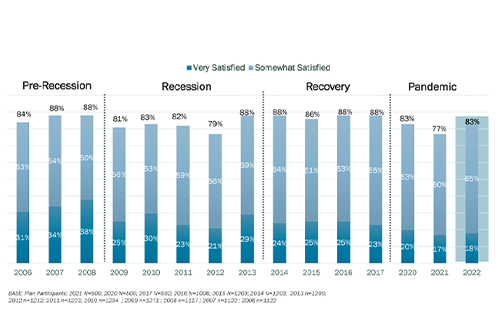

The survey also found 83 per cent of CAP members are satisfied with their employer-sponsored plan, up from 77 per cent in 2021. And when asked whether they expect their savings plan will provide the money they need to meet their financial objectives in retirement, that figure was up to 66 per cent in 2022 compared to 63 per cent in 2021.

To keep members engaged and satisfied with their savings plans, Hopkinson suggested plan sponsors stay alert to the tools that are available to them, but also acknowledges one solution won’t fix all problems.

This year, the survey also asked CAP members if they’d be reluctant to leave their employer because of their workplace retirement savings plan — 60 per cent of respondents agreed, which was down from 66 per cent when the question was last asked in 2017.

During the panel discussion, Jason Vary, president of Actuarial Solutions Inc., said he believes these findings reflect the fact that people are more open to switching jobs as the pandemic has prompted them to revisit their work-life balance and where they work. “I think, in general, loyalty to your employer is dropping and, of course, on the other side, the demand for workers is huge right now at all levels and so we’re seeing lots and lots of movement.”

Fortunately, CAPs are relatively portable, he added, noting employees can take their CAP funds, transfer them into a locked-in account or replace a CAP at a new employer. “Sometimes CAPs tend to be less generous [than a defined benefit plan], so maybe the employees aren’t valuing the three per cent employer contribution they’re getting [and] they’re like, ‘I can replace that three per cent somewhere else,’ when they start actually doing the math.”

Read: Portable non-employer retirement benefits could fill gap in pension savings: report

The CAPs provided by KPMG in Canada are an important consideration when it comes to attraction and retention, said Inakazu, adding the DC plan allows for increased contributions based on years of service, so employees with longer tenures may be tempted to stay. But she also highlighted the importance of financial education in encouraging members to value their plans.

“We put significant effort into other financial well-being resources and it’s not just the existence of the CAP[s], but rather the holistic support we provide that people find value in and that ultimately becomes a factor in a decision to leave or stay. “At the end of the day, when you’re talking about attraction or retention, the CAP is only one piece of a larger total rewards offering and we do our best . . . to make it clear that it’s just one piece of the puzzle and that there are a lot of different ways that we support people in the financial well-being space.”

External pressures

Considering the uncertain economic landscape, the survey asked CAP members whether pressing financial concerns have affected their ability to save for retirement during the last 12 months. Sixty per cent of respondents said yes, up slightly from 57 per cent last year.

This result highlights the need for flexibility, said Inakazu, noting savings plans that are too rigid may make it difficult for members to take steps to support their financial well-being as both external factors like inflation and personal circumstances change over time. “The flexibility that we offer allows us to actually view those different behaviours and we certainly see a higher tendency to invest in shorter-term savings vehicles like the TFSA versus a longer-term savings vehicle like a pension plan.

Read: Plan sponsor panel: Customizing plan design, communication key for DC members

“As inflation increases, the reality is the portion available for savings decreases and, for some, paying off debt in the short term may actually be the right decision versus others who can afford to continue to contribute to their savings and they have more flexibility serving their month-to-month income levels. Ultimately, I think the question employers really need to be asking themselves is what role they’re looking to play as employers make those decisions and how they can support or offer programs that align with that objective.”

Hopkinson also spoke to the opportunity for flexibility, noting people have different financial goals outside of saving for retirement. While he said the CAP industry has more work to do in this space, awareness is growing and plan sponsors are asking for solutions. “Through those discussions, plans are adding various savings tools like tax-free savings accounts and non-registered accounts to allow that flexibility . . . . Those conversations actually should and need to continue.

“The industry needs to continue to create a space that focuses on helping members move to action and change behaviours,” he added. “We need to help employees understand their options and we need to have the information readily available whenever the member needs it and however they need it. If we do all those things — and add more flexibility — things will head in the right direction.”

The survey also asked CAP members whether they’ve used their savings from a retirement plan for any other reason in the past 12 months, such as repaying personal debts, paying their mortgage or rent or a first home purchase — 33 percent of respondents said they’ve done so, compared to 25 per cent in 2021.

While it’s understandable that people might have drawn down their savings during the pandemic, Vary said he’s surprised this trend has continued. “Using your TFSA or RRSP money to go on a big trip, maybe that’s not the best use of your retirement savings . . . . That’s fine when you’re 25, but when you’re 45, you should probably stop doing that and start focusing on retirement.”

Read: What do rising inflation, interest rates mean for pension de-risking?

Looking at the results around inflation and longevity risks, about a quarter of CAP members said they have an excellent or very good understanding of inflationary risk (24 per cent) and longevity risk (27 per cent). And the majority of respondents said inflation will have a negative impact on their financial situation (63 per cent) and retirement savings (57 per cent).

“High inflation is not the worst thing in the world,” said Vary. “It can lead to higher interest rates which means higher [guaranteed investment certificates] rates and things like that. When you’re saving for retirement and you want a guaranteed interest rate, it means cheaper annuities if you want to do that. Obviously, your purchasing power will be eroded if your benefits aren’t indexed to inflation. But there are some positives actually that come from higher inflation rates.”

Employer support

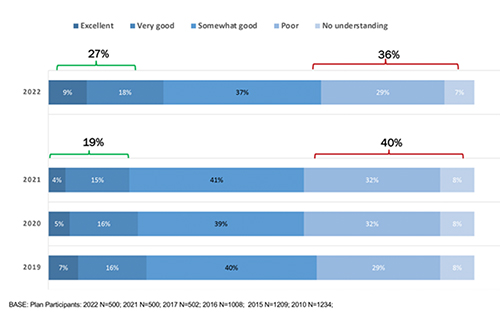

As in previous years, the survey asked CAP members about their understanding of how to convert their retirement savings into an income stream. More than a quarter (27 per cent) said they have an excellent or very good understanding, compared to 21 per cent in 2020 and 19 per cent in 2021.

While the rise in perceived understanding is good news, Vary said there’s still a long way to go. “The industry has been focusing on this for the past number of years, so it’s good to see the needle is moving with all the efforts we’re making focusing on the decumulation problem — as we like to call it — but there’s still lots of work to do.”

The developments in the decumulation space include advanced life deferred annuities and variable payment life annuities, which were both introduced in the federal government’s 2019 budget. ALDAs will be similar to traditional annuities in offering a fixed payout that can be deferred to age 85. And VPLAs will be introduced when federal and provincial legislation lines up and can only be used through pension plans and pooled registered pension plans.

Read: CAPSA developing multi-jurisdictional VPLA framework for DC pension plans

“ALDAs are available, theoretically, the rules are out there,” said Vary. “But as far as I know, no insurance companies are selling them yet, which is a bit of a problem. . . . As far as VPLAs are concerned, we’re still waiting on the final rules from the feds before the provinces and others can start designing those products and then getting them out into the employees’ hands. But I think there’s a lot of opportunity there. And we’re going to keep seeing a lot of activity over the next five to 10 years.”

While decumulation is still a space very much in progress, CAP members expressed interested in other employer supports, including an automatic increase or escalation of contributions to their plans, though the percentage that support the option is on the decline. In 2022, 53 per cent of respondents agreed with this statement, compared to 59 per cent in 2016 and 64 per cent in 2014.

KPMG in Canada has considered this option over the years, said Inakazu, noting automatic features can help drive positive savings outcomes. “At its most simplistic, it’s an easy way to cross something off your employees’ ever-expanding list of things they need to take care of. And that helps them focus on what matters to them both personally and professionally.”

However, for some segments of the employee population that are already engaged with their savings plans, auto-escalation may be disruptive, she noted. “It also makes an assumption that changes to an employee’s income is something they can easily absorb. The truth of that is going to vary by individual.

“Ultimately, even though we’ve considered those features and whether or not we should implement [them], we’ve held off and our focus has been on continuing to provide employees with access to resources to increase their financial literacy,” added Inakazu. “It’s about making sure that, at the point in time they’re thinking about retirement or thinking about their savings goals, they have access to those resources that can support that thought process and enable them to make informed decisions that best suit their own personal needs.”

Read: 2022 DC Plan Summit: Considering flexibility when implementing in-plan decumulation

In addition, when it comes to reviewing retirement savings programs and conducting financial transactions, 73 per cent of survey respondents said they’re comfortable using their record keeper’s online and mobile apps.

“My suggestion for record keepers is for us to ensure that not only are they comfortable, but make sure that they’re using it,” said Hopkinson. “The example I’ll give you is I have a gym membership, but I may not be going to the gym.

“We need to, as record keepers, go in and drill down on some of the stats we collect because we love information,” he added. “So go into that information [and] see what members are doing. We want to make sure the members are taking full advantage of some of those tools that are available to them. The reality is people — more than ever before — are online. We, the record keepers, can’t ignore this medium, we have to continue to take advantage of it.”

Jennifer Paterson is the editor of Benefits Canada.