With Canadians’ financial priorities shifting alongside a turbulent economic climate, including inflation levels not seen in decades and a never-ending rise in the cost of living, it isn’t surprising capital accumulation plan members’ commitment to retirement savings is taking a hit.

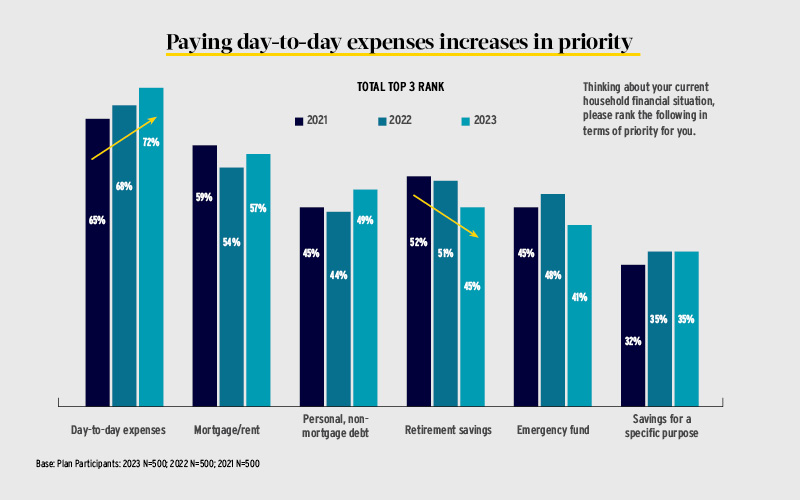

Benefits Canada’s 2023 CAP Member Survey found just 41 per cent of respondents rated their current financial situation as excellent or very good, a decrease from 47 per cent in both 2022 and 2021 and settling at the same percentage as in 2020. In terms of their top financial priorities, 72 per cent of survey respondents ranked paying day-to-day expenses compared to just 45 per cent that ranked retirement savings.

“We see that people are adjusting to this new economic environment by trying to maintain their standard of living and this comes at the expense of other financial goals, like saving for retirement or saving for a rainy day,” said Dean Newell, vice-president at Actuarial Solutions Inc., during a panel discussion on the survey results at Benefits Canada’s 2023 Benefits & Pension Summit. “With this, I guess it’s inevitable that we’ll see people experiencing increasing anxiety levels about their ability to adequately save for retirement.”

Read: Head to head: Should employees be saving for retirement or focusing on other financial priorities?

CAP sponsors looking to assist their plan members with these shifting financial priorities can review the products they offer to see if changes can be made and whether members are using them effectively, said Kenrick Hopkinson, director of plan wellness and education for group benefits and retirement solutions at iA Financial Group.

He also suggested employers consider how they’re matching employee contributions to the CAP. Traditionally, plan sponsors have only provided matches for contributions to a registered pension plan, but they’re now becoming more flexible, he added. “If employers . . . incorporate a match [for contributions to tax-free savings accounts] in some capacity based on a member’s contributions, I think we’ll see more people participating in those programs.”

Employers can also facilitate savings through automatic features, such as auto-enrolment, said Hopkinson. “When members are forced to join the plan right away, that money is deducted from source and the members don’t really see it — you can’t really miss what you didn’t have.”

Pension participation is mandatory at Air Canada, which sponsors several different pensions, including defined contribution plans, hybrid plans with both a DC and defined benefit component, closed DB plans and some multi-employer plans, according to Nathalie Henderson, the airline’s senior director of pensions.

For Air Canada’s DC plans, that means everyone joins on their first day of employment at a minimum contribution rate and then they can choose to raise their contributions, with a match from the employer.

“Employees can select their contribution rate and about 50 per cent do not contribute the maximum rate currently, probably . . . because they need the money for other obligations. I think some of them are not paying attention because it’s so far in the future,” she said, noting the average age of employees is 37, with 12,000 of Air Canada’s 35,000 employees hired in the past three years.

This year, the survey asked respondents to rank their registered savings plans in terms of importance, with personal registered retirement savings plans (72 per cent) and personal tax-free savings accounts (64 per cent) ranking higher than group RRSPs (59 per cent), DC plans (53 per cent) and group TFSAs (29 per cent).

Read: Canadians still not knowledgeable about RRSPs, TFSAs: survey

Despite the obvious benefits of group plans, including lower investment fees and immediate tax savings, Hopkinson chalks this preference up to people’s long-standing relationships with their banks. “As a record keeper, I believe we need to continue to explain the company programs. It won’t be a battle we’ll win right away. We just need to make sure people have all of the information they need in order to make the right choices.”

Retirement readiness takes a hit

Every year, the CAP Member Survey asks respondents about their perceived retirement readiness, including their expected standard of living in retirement, how much they think they need to save for retirement, at what age they expect to retire and what’s impacting that expected retirement age.

This year, the percentage of CAP members who are worried they won’t have saved enough funds in order to retire continued to rise, with 50 per cent agreeing that, if they’re careful, they should be able to live independently and pay their bills. In addition, the average estimated amount CAP members think they’ll need to save by the time they retire was $1.4 million, up more than $400,000 compared to last year.

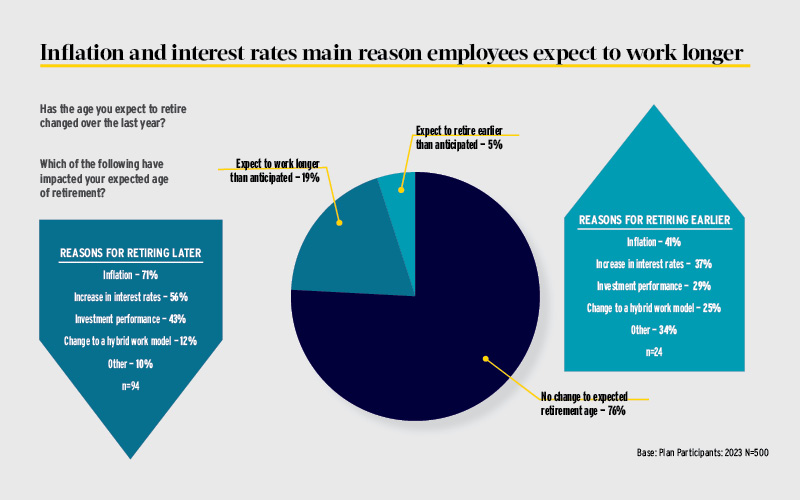

On average, respondents expect to retire at age 62.3, the same as a decade ago, but down almost a year compared to 2020 and about half a year compared to 2022. While 76 per cent of respondents said their expected retirement age hasn’t changed in the past year, 19 per cent said they expect to work longer. Among this group, the overwhelming reason for working longer was inflation (71 per cent), followed by interest rate increases (56 per cent) and poor investment performance (43 per cent).

Read: B.C. court dismisses appeal, upholds pension plan’s decision to increase retirement age

“I’m not sure folks really understand the concepts of interest rates and inflation and how it impacts their retirement savings,” said Newell. “But in fairness, we haven’t experienced both higher interest rates and higher inflation at the same time for a long, long time.”

While higher interest rates can be beneficial to savers, they can also decrease the value of accumulated savings, which is what’s been seen in 2022, he noted, with both equity and bond markets experiencing negative returns. “For people looking at their retirement account balances over the past year and seeing the decline, it might be hard for them to get excited or even know about the prospect of generating higher returns in the future.”

In contrast, higher inflation is easier to understand, said Newell, noting it erodes the value of a person’s savings. “Looking forward, it’s hard to predict whether the current environment of higher inflation and higher interest rates will persist or if we’re going to return to the pre-COVID environment of secular stagnation known for its low inflation and low interest rates.”

In light of all of these findings, Henderson said employers can do much better at educating their employees. Air Canada, for example, has a lot of materials available, but it’s a matter of getting plan members interested in what’s available. “So whether it’s upon hire or during their career or when they get closer to retirement or even after retirement, we can still be there to help them.”

Again, she referred to the airline’s younger generation, noting they likely don’t really understand the benefit that’s offered to them. “We have a good plan, but many of them don’t understand it and don’t understand that they have to play an active role if they want to have a good retirement. And honestly, I don’t blame them because it’s scary to hear about a pension plan when you’re 25 years old.”

One of Air Canada’s strategies around educating employees is through its wellness program, which covers physical, mental and financial wellness. It features articles and videos on finances in general, but Henderson notes it’s challenging to educate all employees at the same time because of the variety of different pension plans.

Over the next two years, the airline is planning to add shorter videos to its education program to grab plan members’ attention. Topics will include the importance of contributing the maximum amount to the plan, the impact of economic factors on pensions and the importance of preparing for retirement early in a career.

“We’re a travel company and our employees spend lots of time preparing for their holidays,” said Henderson. “We want to get their attention and say, ‘If you spend as much time to prepare your long holiday, which is your retirement, you’d be happier you have taken the time earlier in your career.’”

Carrying on the theme of ongoing education, Hopkinson noted it’s important for plan sponsors to keep record keepers accountable in how they educate members. “From a plan sponsor perspective, there has to be a way for them to check in to make sure their members are engaged. . . But at the end of the day, plan sponsors need to be advocates and promoters of the service. And if they aren’t, it won’t work, no matter what you do.”

Talking about decumulation

While it’s important for CAP sponsors and record keepers to promote workplace savings plans and educate employees in the accumulation phase, Canada’s relatively young DC industry has been struggling with tackling the decumulation challenge.

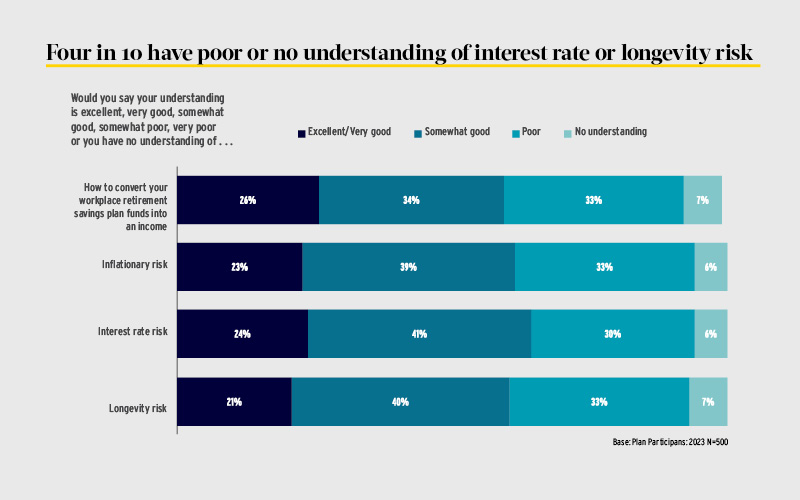

In terms of decumulation, just 26 per cent of survey respondents reported an excellent or very good understanding of how to convert their funds into an income stream. This year, the survey went deeper on this point, asking which decumulation options members would use if they were made available. Two in five (43 per cent) said they’d transfer their funds into a retirement income fund or a life income fund, while just a quarter (26 per cent) said they’d keep their funds in their current workplace plan and just 21 per cent said they’d purchase an annuity.

Read: 2023 DC Plan Summit: A look at McGill University’s search for a comprehensive decumulation solution

“For younger members who are in the accumulation phase, I’m not sure talking too much about decumulation is going to be that relevant at that stage in their career,” said Newell. “[Plan sponsors’] focus needs to be on the retirement readiness discussion, which is, ‘Are you saving enough? Do you understand the value of the plan?,’ to make sure that, when they get to an age where they’re ready to focus on retirement, there’s enough money in the pot for them to be able to afford it.”

Along the same lines, he isn’t concerned if a younger plan member doesn’t understand the decumulation options available, but it’s much more important for employees who are five or 10 years from retirement. It comes back to education, he added. “I think it really becomes an education exercise to deal with that generation. . . . Is it special sessions for them? Is it examples? Is it talking to peers in their group and getting their experiences? I think it’s going to be things along those lines that help the CAP industry more. And I think, to a certain extent, more can be done and more will be done in the future.”

The survey also found less than a quarter of respondents have an excellent or very good understanding of inflationary risk (23 per cent), interest rate risk (24 per cent) and longevity risk (21 per cent). For Henderson, these results highlighted that Air Canada isn’t currently doing anything specific in its education programs for DC plan members about longevity risk.

“We are from a DB world at Air Canada. It’s only about 10 years that we’ve been offering DC plans and, until a few years ago, we were still struggling at making our DB plans viable. Now that we’ve settled the issue, we’ve put more focus on our other types of plans and longevity risk will certainly be part of one of our future short videos. . . . [The videos] will be targeted to certain populations, so longevity risk will be important for all employees while decumulation is for those closer to retirement.”

Hopkinson also highlighted the importance of getting the right message to the right group of employees. For example, when it comes to products, plan members older than age 50 are looking at the options available to them as they close in on retirement, but for younger employees, the message is about savings options rather than retirement options.

Read: Financial education offerings may help close pension gender gap

Returning to the survey question about which decumulation options members would use if they were made available, he emphasized the 23 per cent of respondents who didn’t know what they’d choose. “Again, it’s all about education. It tells us, as a record keeper, there’s more work to be done and we can’t stop because we want to see that number decrease over time versus increase.”

Looking at the services and tools available to educate CAP members about their plans, the survey found the most common were websites reviewing account balances or transactions (39 per cent), followed by websites to review plan information (31 per cent), hard copy or online retirement planning calculators (30 per cent), education sessions about investment options (27 per cent) and access to a financial advisor via the plan sponsor (27 per cent).

On the other hand, when CAP members were asked which tools they actually used in the past year, 23 per cent of respondents visited a website to review their account balances or transactions, followed closely by websites to review plan information (22 per cent) and reviewing investment statements (21 per cent).

Key takeaways

• CAP sponsors looking to assist their members with shifting financial priorities can review the plans they offer to see if changes can be made and whether members are using them effectively.

•While CAP members may not understand how interest rates and inflation impact their retirement savings, it’s important that plan sponsors and record keepers educate them about these concepts.

• Looking at the different stages of saving, plan sponsors should target the message to the correct age group, with younger employees learning about accumulating enough and understanding their plans and those closer to retirement learning about decumulation options.

Since the onset of the coronavirus pandemic, plan sponsors and record keepers have been dumping a lot of information on people, taking advantage of the extra time they’re spending on computers and cell phones, said Hopkinson, noting it’s resulted in a screen fatigue. “They’re so tired of looking at stuff that they just stop looking. So what do we do as a record keeper? Do we continue to build or do we say, ‘You know what? Let’s figure out how to get them to use what we’ve already built.’”

There are three types of learners: the visual, auditory and hands-on, he added, so record keepers and plan sponsors must make sure they’re connecting with all of them when designing communication and education strategies. “If you don’t do that, you’re going to lose a group of people.”

Read: Court of appeal decision highlights importance of clear pension communications

Henderson agreed, noting she believes the CAP industry has good tools in place, but plan members may not know they exist or where to find them. “We need better coordination between plan sponsors and DC providers.”

Referring to Newell’s earlier point about plan members talking to their colleagues about their pension experiences, she noted Air Canada is looking to identify employee ambassadors who can educate other employees about the plans. “Employees prefer to talk to their colleagues and someone in their own group than picking up the phone, calling . . . their DC provider or the company. It’s so much easier.”

Jennifer Paterson is the editor of Benefits Canada and the Canadian Investment Review.