Despite the prevalence of farming in its home province, the Alberta Investment Management Corp.’s agricultural portfolio is just 13 years old, the product of a 2010 investment in converted farmland held by Australian timber producer Great Southern Group.

The properties proved too arid for tree growth and were converted back to croplands for canola, wheat and barley, planting the seed that would grow into the AIMCo’s agriculture investment mandate in 2016.

“I think one of the biggest things we realized is, when we buy land investments, we don’t necessarily need to restrict ourselves to either just doing trees or just doing crops,” says Jonathan Braams, manager of the organization’s infrastructure and renewable resources portfolio.

Read: AIMCo investing in Australian agriculture firm, CPPIB in cloud-based storage developer

Agriculture by the numbers

• 70% — The increase in global food prices between March 2020 and March 2022

• 18.4% — Total global carbon dioxide emissions from agriculture, forestry and land use in 2016

• 0.21 — The amount of global cropland per capita, by hectare, as of 2016

Source:The U.N.’s food and agriculture organization and intergovernmental panel on climate change

“We saw the benefit of total landscape management — you plant what’s most suitable based on the soil types [and] the topography of the area, the climate zones and even the microclimates within some of these larger properties that we bought.

“We found that agriculture had a lot of the same characteristics of timberland, but was a little bit different at the same time — we love timberland because we found that big land-based holdings had very good inflation protection.”

With both inflation and global temperatures climbing, agriculture is set to play a larger role in institutional investors’ portfolios in the future.

A growing concern

Since 2016, the AIMCo has continued to expand its agricultural focus to domestic investments, such as those made through farmland manager Bonnefield Inc.

The investment organization also continues to invest in Australian agriculture: in 2021, it became a co-owner of Lawson Grains — which produces more than 200,000 tonnes of cereals and vegetable oils per year — through a partnership with investment management firm New Forests Ltd.

The AIMCo’s agriculture investments in Western Australia and New South Wales have provided substantial diversification, says Braams, noting the two regions represent different markets and purposes. “Western Australia is primarily an export-oriented market for grants and then New South Wales is primarily domestic customers. [These properties are also] within five different climatic zones with different rainfall patterns, so there was diversification because of the significant geographic spread.”

Read: OMERS buying U.S. bio-manufacturing facility, Ontario Teachers’ acquiring Australian produce seller

Other Canadian institutional investors have made similar investments in recent years. In 2020, the Caisse de dépôt et placement du Québec and a partner launched a co-investment to support ventures that aim to make the food and agriculture industry more sustainable and climate friendly. Last year, the Public Sector Pension Investment Board entered a strategic alliance with Spanish produce vendor Citri & Co. and also acquired a portfolio of 35 Australian vineyards, including associated water entitlements, crops and equipment. And in March 2023, the Australian agricultural arm of the Ontario Teachers’ Pension Plan purchased a majority stake in Mitolo Family Farms Ltd., which grows, harvests and packages onions and potatoes.

As global markets make stronger-than-expected recoveries from the economic impact of the coronavirus pandemic, the spectre of rising inflation remains ever present. In July, the Bank of Canada increased its benchmark interest rate by 25 basis points to five per cent following the exact same increase the previous month. And while the U.S. Federal Reserve held its rate at five per cent to 5.25 per cent, it remains the highest in 16 years.

Over the last year, agriculture’s inflation hedging qualities have helped the AIMCo weather economic turbulence due to land price appreciation of properties in its portfolio, says Braams, adding institutional investors’ increasing demand for agricultural lands — particularly those owned by farmers seeking to expand operations — is driving up prices and partially offsetting some of the upward pressure of interest rates.

“We have not seen significant compression in valuations — we’ve actually seen the opposite. You would expect discount rates would tick up on assets globally and that would bring down valuations, but that certainly hasn’t been the case.”

Read: 2023 DC Plan Summit: Eight billion reasons why capital investment matters again

By investing in agriculture assets beyond the land itself — such as agricultural services and fertilizer or chemical companies — institutional investors can also access operational leverage and make their investments outperform amid rising inflation, says Chris Faulkner-MacDonagh, co-portfolio manager of T. Rowe Price’s real assets fund. “What we’ve found is particularly helpful for our [institutional investor] clients is that high elasticity. You want a highly volatile sector that responds quite positively on the upside when inflation comes.”

Turning up the heat

According to a 2023 report by the United Nations’ intergovernmental panel on climate change, the global temperature currently sits at 1.1 degrees Celsius above pre-industrial levels and continues to climb towards 1.5 degrees, the target temperature of the 2015 Paris Agreement.

While the report found there are still measures that could be taken to slow or halt rising temperatures, the impacts of climate change are increasing in the form of catastrophic weather events — such as the wild fires raging across Canada — and record heat.

One reason institutional investors may consider agriculture is that the increased severity of climactic events is putting additional pressure on cost curves for agriculture companies and enhancing their ability to generate outsized profits, says Faulkner-MacDonagh. However, he notes climate change is also increasing the volatility and uncertainty of economic shocks.

Timeline of the AIMCo’s agriculture investment mandate

2010

The AIMCo invests in converted farmland held by Australian timber producer Great Southern Group

2016

The agriculture investment mandate is officially launched

2017

The first domestic agriculture investment is made though farmland manager Bonnefield

2021

The AIMCo becomes a co-owner of Australia’s Lawson Grains with investment management firm New Forests

In addition to inflation and climate change, rising geopolitical tensions are also impacting agriculture investments, he adds, pointing to Russia’s invasion of Ukraine in February 2022 when global wheat prices skyrocketed. “[Agricultural investments] provide a steady stream of real income because they’re tied to agricultural prices and farmland income.”

Read: PSP entering strategic alliance with produce company, Ontario Teachers’ investing in online retailer

While the world’s growing population will put finite resources under increasing pressures, the need for a global food supply will always remain, making agriculture an attractive asset class to institutional investors seeking to grow plan members’ money over the long term while exacerbating the threat of climate change, says John Cook, Mackenzie Investments’ senior vice-president, portfolio manager and co-lead of the Greenchip team.

“We’ve got a very crowded planet. And currently, a lot of that population is eating a developing market diet and they’re striving for a middle class or Western diet, which requires more [energy] input and is more carbon intensive.”

However, the challenges posed by an expanding populace and climate change also provide opportunities for investors to innovate. For example, as farmlands are at the increased environmental risk of a warming planet, investments in products such as herbicides, fungicides and insecticides are becoming increasingly attractive, says Cook, as are fertilizers that are less carbon-intensive such as those made from blue and green ammonia.

Technology that limits water usage — such as drip irrigation and tractors outfitted with cameras that allow farmers to direct water to crops and away from weeds — also provides lucrative investment opportunities while preserving resources, he adds. “All of these technologies are coming together to really reduce the amount of energy needed to make farmland productive — and it’s a really, really rich investment space.”

Read: Navigating the complexities of investing in agriculture

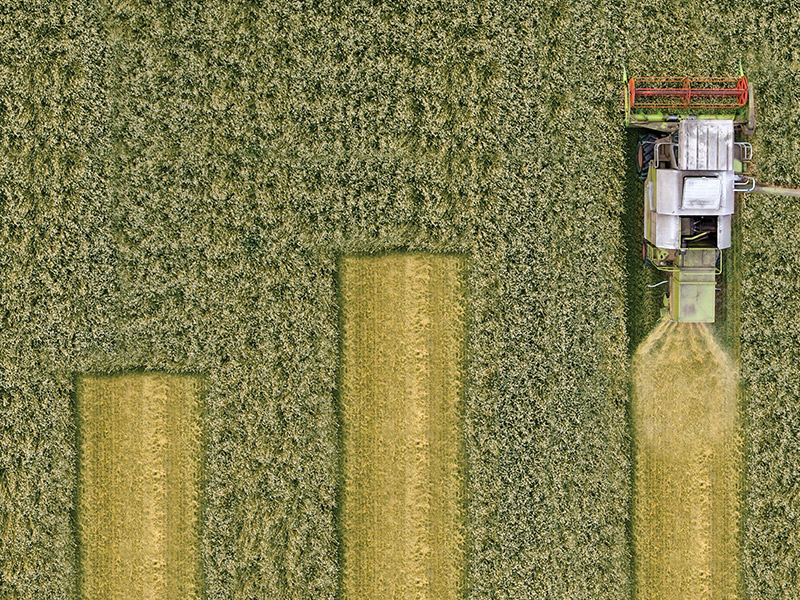

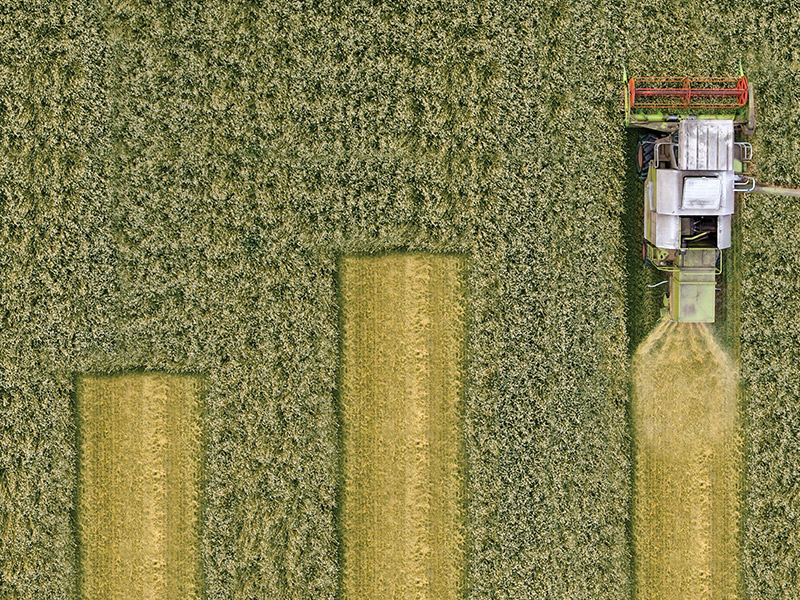

Energy-efficient technology can also help institutional investors extract more value from the farmland they own while reducing their carbon footprints. On the AIMCo’s Australian properties, it uses state-of-the-art farming equipment that allows farmers to monitor fertilizer and chemical levels and apply them in targeted applications instead of blanket spraying entire fields, says Braams.

“We not only save costs, but it’s also more environmentally friendly by putting less inputs on the farm. And that’s been especially important recently with input prices having gone up [during the pandemic].”

Challenges from climate change and inflation are also reshaping investments in livestock, says Sofía Condés, head of investor outreach at the Farm Animal Investment Risk & Return initiative, noting the global food system is highly dependent on a very limited amount of crops for both human and animal consumption, such as corn and soy. In addition, the Russia-Ukraine conflict and lingering supply chain disruptions from the pandemic have similarly impacted the sector. “This has resulted in the production of animal feed to skyrocket in cost and companies that depend on animal feed have been really badly hit.”

Key takeaways

• Agriculture is well-suited to institutional investors seeking long-term investment opportunities.

• Technology provides additional agriculture investment opportunities beyond crops and farmland.

• Amid a warming climate and expanding global population, agriculture represents a growing sector for institutional investors to explore.

Meanwhile, the growing market for alternative proteins from non-animal sources is providing institutional investors with another opportunity to generate higher returns. While this market has grown substantially in recent years, it requires investors to take a long-term view, she says. “This is not the type of [investment] play where, in two years, you’re going to see this company take 50 per cent of the market. Little by little, [alternative protein] market share is growing faster than its traditional meat counterpart.”

ESG considerations

As institutional investors increasingly make commitments to net-zero emissions, agriculture can also play a role in reducing carbon footprints and meeting environmental, social and governance targets.

By maintaining both timberland and cropland investments, the AIMCo is looking to strike a balance, says Braams, adding while forestry investments generally sequester more carbon, the investment organization is also exploring opportunities to sequester more carbon within its agricultural lands through practices such as no-till farming.

Read: Report finds more Canadian pension funds committing to net-zero emissions by 2050

“Generally, forestry investments are sequestering more carbon than we’re emitting [and] we’ll continue to look at those opportunities and decide whether there’s a way for us to potentially offset emissions elsewhere in our portfolio, monetize those credits elsewhere or whether we’d rather just hold the credits — [the latter gives us] the flexibility of whether we want to monetize carbon revenues going forward or sell more logs.

“We’ll have to see how those programs develop through time and also how we can measure the amount of carbon within the soil [of our croplands],” he continues. “That’s one thing that is quite expensive right now. But the price will come down over time and there will be different methods that we can use to measure it going forward.”

Blake Wolfe is the managing editor of Benefits Canada.