A defined benefit pension plan leader rarely gets to work with a “blank canvas,” but Chuck Bruce has taken that unique opportunity and drawn a new way forward for more than 56,000 DB plan members in Newfoundland and Labrador.

In late 2014, the province and its five largest unions established Provident10 to administer and oversee the public service pension plan’s investment management and administration, amid what the government called “unfunded liability concerns.”

Bruce was tapped as the first employee of Provident10 in early 2016 and, in his first 15 months as chief executive officer, he built a team and prepared the organization to open its doors with a new brand, organizational structure, office space, systems infrastructure and recruitment and retention plan. In that time, Provident10 also digitized plan member files comprising a staggering three million pieces of paper.

Read: What will coronavirus mean for pension investors in the long term?

“Pension reform didn’t establish rigid execution to create the organization and transition from government administration to a non-profit, private sector organization,” says Bruce. “This provided the ability to create an organization from a blank canvas, consider how the industry and peers have evolved and evolve at a pace agreed upon with the board of directors — a true advantage, with good governance as a foundation balanced with minimal bureaucracy.”

Two of Bruce’s top concerns in the current market environment are high valuations and the potential for higher inflation. To help manage the risk that high valuations will drive a market downturn, Provident10 relies on a portfolio construction process that strategically mixes manager styles to improve the chances of performing well under various market scenarios.

“When we put our managers together in a portfolio, we spend a great deal of time assessing the market capture of all managers. Our goal is to have a series of managers who, in a market downturn, would perform better than the market. Over the past 12 months, we have increased our exposure to low-volume-type managers, which has proven to be a positive change.”

Getting to know Chuck Bruce

Job title:

CEO, Provident10

Joined Provident10:

January 2016

Previous role:

CEO of an employee health trust

What keeps him up at night:

Inflation pressures and the effects of the coronavirus pandemic on the mental health of employees and society as a whole

Outside the office he can be found:

Serving as chair of the board at the Mental Health Commission of Canada, playing with a new recipe, driving along the coast and spending time with family

With inflation, Bruce says the question is always “how much?” The real concern for stocks and bonds is when inflation moves beyond five per cent, he says, and to brace for that scenario the portfolio holds a portion of the portfolio in private debt structured on a floating-rate basis. Private debt has the added advantage of offering potentially higher returns than either traditional fixed income or hedge funds, as well as downside protection thanks to its low correlation with equities. Real estate and infrastructure investments can also offer protection against inflation, he adds, and the portfolio recently increased its weighting to infrastructure.

Sketching out an ESG-factor strategy

Environmental, social and governance factors are also key risks the portfolio considers. While Bruce describes Provident10’s ESG journey as “still early stages,” he says the organization is undertaking a corporate-level strategic review that he expects will evolve its approach to and integration of ESG factors. He emphasizes that ESG issues aren’t all or nothing — not every investment will have a perfect score and some will have better scores in one area than others, but he believes in an approach in which managers favour businesses that are continuously improving their ESG performance.

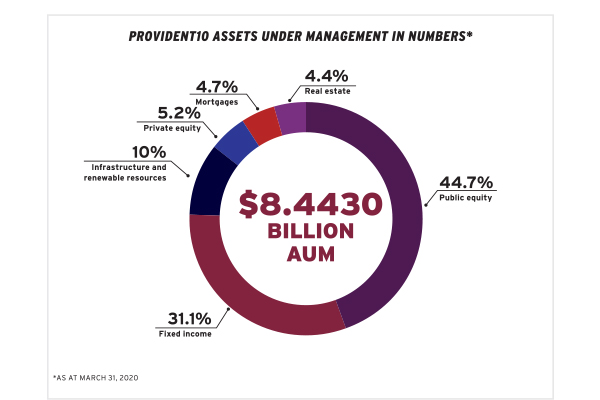

Bruce says risk management is woven into the fabric of the plan that represents one in nine people living on the Rock, oversees $10 billion in plan assets, has annual contributions of $366 million and annual pension benefit payments of $452 million. “Every member of our team is accountable to our stakeholders to protect the assets under our authority, ensure we are compliant within our policies, and play an ongoing role in continuous improvement.”

Alison MacAlpine is a freelance journalist.