With recent deadly heat waves and wild fires ravaging Canada’s west coast and large-scale flooding in the east, who can ignore the growing risk of extreme weather?

Irrespective of efforts to reduce greenhouse gas emissions, extreme weather events, driven by climate change, are projected to increase in frequency, intensity and duration through the 21st century, giving rise to significant threat and the likelihood of greater costs — financial and social — to society. Growing costs are already reflected in escalating catastrophic losses for Canada’s property and casualty sector, where claims have risen almost 350 per cent in the decade from 2011 to 2020 compared to the previous decade.

Read: OSFI launching consultation on climate change risks to pensions, financial institutions

From the perspective of business operations, extreme weather events can be disruptive by damaging a company’s physical property and infrastructure, interrupting supply chains and adversely affecting the health, well-being and livelihoods of employees. These disruptions can affect long-term cash flow and financial performance, underscoring the fact that extreme weather-related risks are financially material and should therefore be disclosed to investors by issuers.

For portfolio managers, this means physical climate risks and adaptation responses should be recognized and integrated into investment management decisions. To aid portfolio managers, we showcase a practical framework (described below) to factor physical climate risk into portfolio management. But up to now, the path for incorporating this risk has been challenging.

First, not all corporations consistently and reliably report climate-related risk information, despite existing regulations requiring disclosure of material climate risk for publicly-traded companies. Compounding this, securities commissions may have limited knowledge of which climate risks are material, thus limiting their capacity to enforce their disclosure mandate.

Read: Pension fund managers calling for stronger ESG disclosure

Second, while an increasing number of international frameworks are available to guide climate-related risk disclosure — such as the task force on climate-related financial disclosure, the Sustainability Accounting Standards Board, the Climate Disclosure Standards Board, the Global Reporting Initiative, etc. — their criteria differ, which in turn can make it confusing for both issuers and investors as to what protocol to follow.

Also, disclosing and contextualizing physical climate risk information requires in-depth technical and industry-specific knowledge of potential impacts, often outside the realm of the investment industry. However, steps are being made, with the International Sustainability Standards Board opening a North American hub in Montreal — to support its main office in Frankfurt, Germany — to establish the standards of environmental, social and governance information shared by companies and disseminate them on an international level.

Lastly, there’s no standardized, practical guidance on how physical climate risk should be included in institutional portfolio management. This challenge was captured by Canada’s expert panel on sustainable finance as follows: “Institutional investors are dissatisfied with the state of climate-related reporting in Canada, noting a general inability to determine whether non-disclosure by corporations reflects legitimate immateriality or a lack of internal focus.”

Read: COP26 highlighting importance of ESG, disclosure for institutional investors

The 2021 United Nations Climate Change Conference, known as COP26, brought much needed attention to climate adaptation through several initiatives, including the global resilience index, which provides insights into the vulnerabilities and opportunities that economies face regarding climate change and natural hazard risk. The tool can guide governments, businesses, communities and individuals in factoring adaptation responses into decision-making. While global adaptation initiatives like these advance policy and knowledge regarding climate risk, the financial sector will still require local interpretation and development of readily deployable, industry-specific adaptation solutions.

To overcome gaps and challenges, a practical framework has been developed by the Intact Centre on Climate Change Adaption in the form of climate risk matrices to guide institutional investors in factoring physical climate risk into their portfolio management (see Table 1 below). These matrices identify the top physical climate risks considered to be the most material for financial performance of companies within a particular industry sector, while presenting actions (mitigation measures) that, if taken, could reduce impacts.

It also provides key questions that portfolio managers can ask a company to determine the issuer’s level of risk-awareness, followed by what would be considered ‘good’ or ‘excellent’ responses to mitigate risks. The matrices are user-friendly, scientifically well-informed and can be updated on five-year intervals to reflect a changing climate and extreme weather impacts. They can also be used by portfolio managers with no special training required, which would, in turn, meet fiduciary obligations.

Read: Institutional investors unsatisfied with public companies’ climate disclosures: survey

Table 1: Climate risk matrix — Electricity transmission and distribution sector (material bolded below reflects prioritized areas of focus applied to portfolio management)

| Flood | Fire | Wind storm | Ice and snow loading | Thawing permafrost | |

| Key climate risk impacts | Flood-induced high water levels result in inadequate electrical clearances below lines that are hazardous to the public | Fire along transmission corridors can cause outages if corridors are note adequately cleared of brush Vegetation/tree contacts with transmission lines can cause arcing, fires and outages | Vegetation/tree branches can fall onto T&D lines causing outages T&D lines can be brought down by wind forces | T&D lines and structures can collapse under heavy ice loading | Thawing/ discontinuous permafrost can displace transmission tower foundations, causing structural collapses and outages |

| Mitigation measures | Ensure structures are tall enough for safe clearance under foreseeable flood levels, or lines are installed underground | Conduct patrols (visual inspection of utility equipment and structures) in fire prone areas Clear vegetation along transmission corridors | Clear vegetation along transmission corridors Install anti-galloping devices on conductors and ensure structures are designed to withstand winds | Install visual monitors to detect ice loading. Before ice loads build, boost current to melt ice (i.e., short the line) | Modify structure/designs to readily permit adjustment of towers when line patrols identify permafrost thaw displacement |

| Key questions to determine readiness to mitigate climate risk | What percentage of T&D lines in flood-prone areas have sufficient clearance to safely accommodate a 1:200-year flood without de-energizing the line? | What percentage of total length of overhead transmission lines in wildfire-possible areas are closer than 10 metres horizontally to tree branches? | What percentage of total length overhead transmission lines in treed areas are closer than 10 metres horizontally to tree branches that are higher than the conductors? | Are overhead lines that are susceptible to icing monitored by cameras that observe icing on the conductors? | Are your transmission structures, in discontinuous permafrost areas, of a design where the structured footings can be adjusted without de-energizing the line? |

| Excellent answer | > 75% | None | < 5% | Yes | Yes |

| Good answer | 50% or higher | < 10% | < 25% | Yes, the most recent ones |

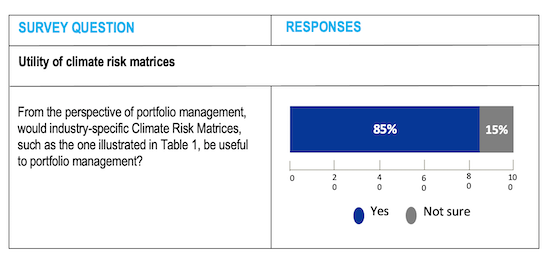

A 2020 international survey, conducted by the Intact Centre on Climate Adaptation, the Stanford Global Projects Center and the Global Risk Institute, assessed institutional investors’ views regarding the practical utility of climate risk matrices. It found 85 per cent of respondents found these matrices to be of value in portfolio management. They can also provide value for securities commissions (material climate risk disclosure), credit rating agencies (borrowers’ ability to repay loans/mortgages may affected by extreme weather events) and boards of directors (relevant climate risk questions for management).

Table 2: Survey results — Integrating climate risk into institutional portfolio management

To scale this work in Canada, industry and standards associations, such as the Canadian Standards Association, could lead the way in assembling technical committees/working groups to continue developing and updating climate risk matrices for all sectors/sub-sectors of a major stock exchange like the Toronto Stock Exchange. In the future, these matrices could be made available on computer software systems that provide financial data, such as a Bloomberg terminal. The goal of the matrices is to provide a practical tool that can support transformation and sustainable investment, while building resilience within industry sectors.

Read: More standards required for pension funds using ESG data, indices and scores

Recognizing that climate change is irreversible — and that extreme weather will only get more extreme — portfolio managers must integrate physical climate risk into portfolio management — and they must do so rapidly.

Caroline Metz is the managing director of economics and resiliency at the Intact Centre on Climate Adaptation at the University of Waterloo. Kathryn Bakos is the director of climate finance and science at the Intact Centre on Climate Adaptation at the University of Waterloo.