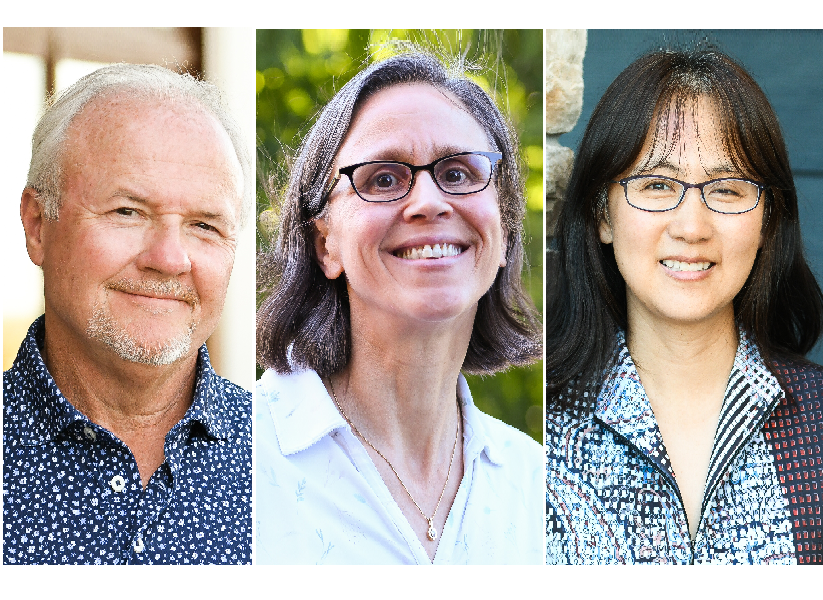

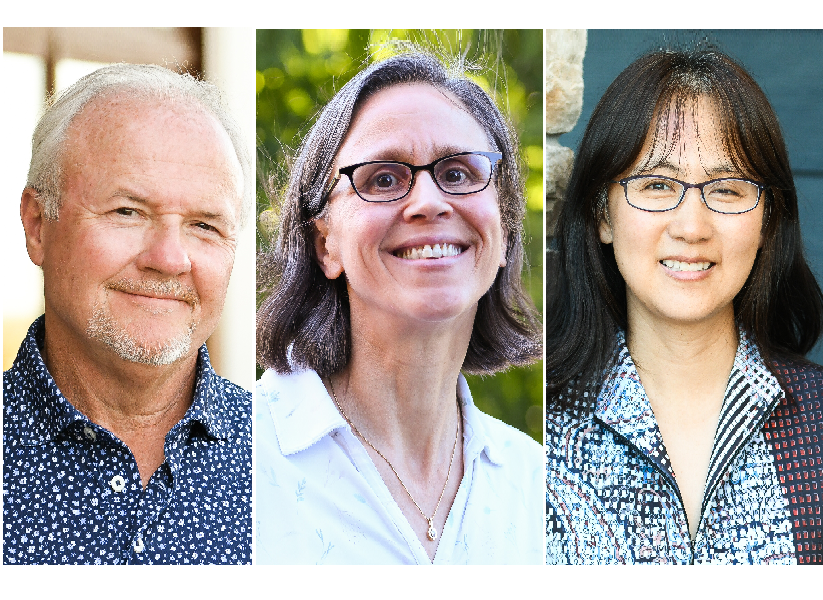

Responsible investing covers a spectrum between simple exclusion practices to environmental, social and governance integration to thematic and impact investing, said Les Marton, managing director of bfinance Canada Inc., while moderating a panel discussion at the Canadian Investment Review‘s 2022 Risk Management Conference.

The two panellists — Karen Lockridge, director of ESG investing at the Canada Post Corp. pension plan, and Dawn Jia, president and chief executive officer at the University of British Columbia Investment Management Trust Inc. — represented organizations with well-established, though different, approaches to responsible investing.

Read: Head to head: Is carbon divestment becoming obligatory for pension plans?

According to its statement on responsible investing, UBC IMANT incorporates ESG considerations into its investing decisions. It also requires external asset managers to provide evidence of ESG incorporation and for them to practice corporate engagement through proxy voting and direct contact.

With the organization managing the UBC’s endowment fund and working capital, as well as its pension fund, its pension plan members have different responsible investing priorities than other stakeholders, said Jia. “I find that pension plan members . . . think of financial security as a higher priority. They want you to fully evaluate ESG risk — that’s all. It’s part of their priority. On the endowment side, we have lots of young students involved. They put lots of pressure [on UBC IMANT] about [fossil fuel] divestment specifically.”

Read: Debate about pension fund’s divesting due to ESG issues heats up in Oregon

Canada Post has a responsible investing philosophy built on four pillars: integration, engagement, advocacy and investment. “I thought we should have three — investment is only the fourth pillar when there’s intentional investing in solutions and I thought we were too early for that, but a board member encouraged it,” said Lockridge. “We still have a way to go to implement [the investment pillar], but I think it’s an important part.”

Like the UBC IMANT, Lockridge’s team assesses asset managers on ESG issues and is involved in corporate engagement, including by supporting shareholder-led proxy votes asking companies to provide climate-related disclosures and emissions targets. The three-person advisory team supports these efforts throughout the organization. “We support the broader team as we integrate ESG and get to some of the specifics about how that impacts our portfolio and the world,” she said.

With Canada Post’s team and external managers doing the direct investing, the team developed a due diligence framework to grade new managers and existing managers. “It has six attributes and impact is one of them,” said Lockridge. “It’s about looking at their intentionality, their research processes and their approaches.”

Read: OMERS committing to net zero, UPP facing divestment calls from university staff

However, the team doesn’t like to describe itself as being involved in impact investing, she added. “While we’re not looking for impact investment strategies now, it’s part of our strategy going forward. We have a lot of work to do first. We need to develop mandates, guardrails and ask ourselves, ‘What, specifically, are we targeting?’”

While the Canada Post pension plan’s team may not be looking for impact investment strategies, it sometimes stumbles into them.“We recently invested in an affordable housing strategy. . . . It was not presented as an impact investment strategy, though everybody knew the manager had intentionality in there. But it met the real estate team’s expectations and our due diligence process.”

Similarly, UBC IMANT’s staff don’t think their work investing for UBC employees qualifies as impact investing. “There’s a grey area between impact investing and an investment philosophy,” said Jia. “When we talk about ESG investing and sustainable investing, we like to say, ‘You don’t have to sacrifice return. If you can keep your return and do something good, why not?’ Whereas impact investing, I feel impact has to be your priority, superseding return.”